How ADU Grant Programs Are Changing the Housing Game

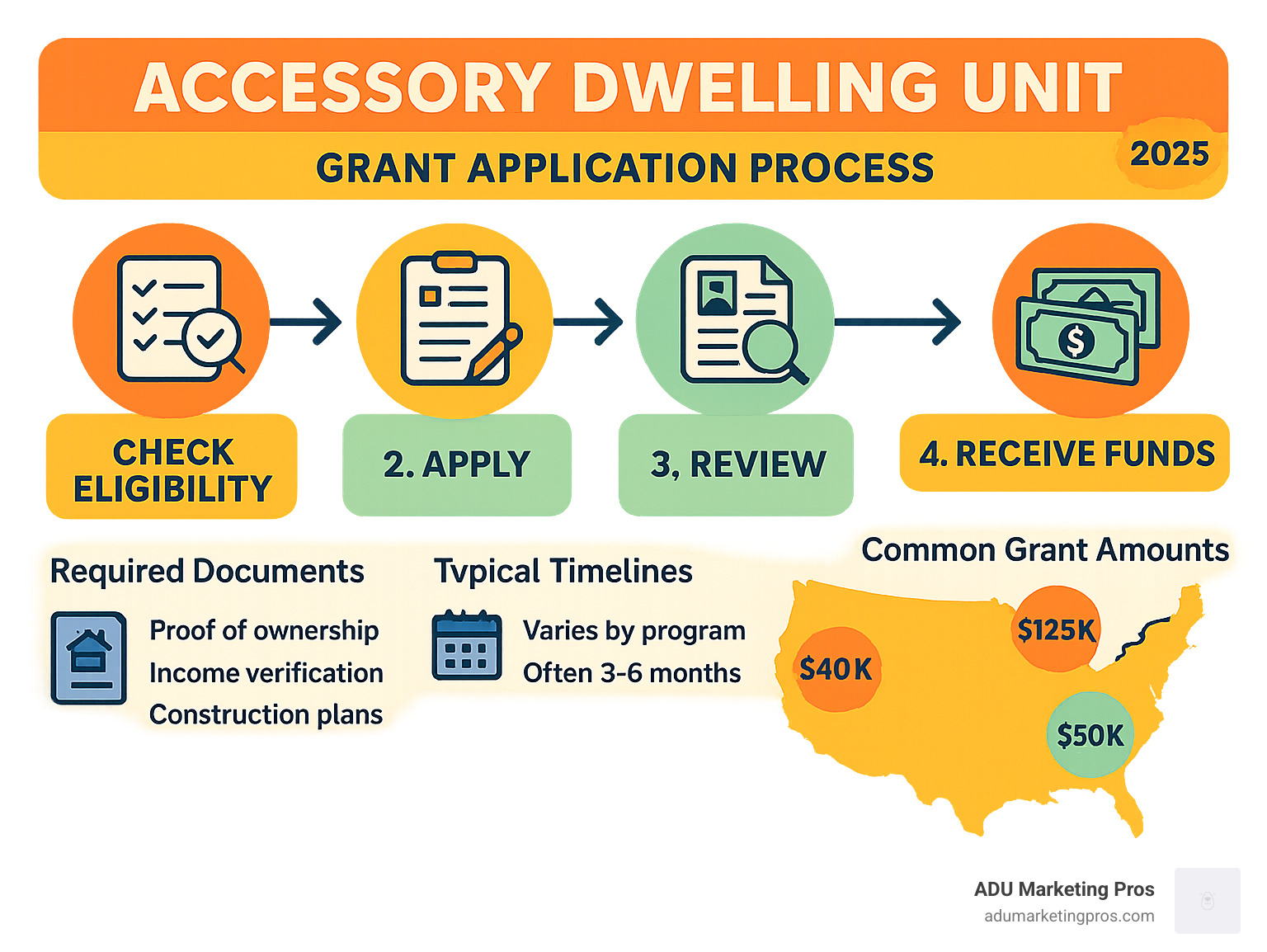

Accessory dwelling unit grant programs are government-funded initiatives that provide financial assistance to homeowners who want to build additional living spaces on their property. These programs offer grants ranging from $8,000 to $125,000 to help cover pre-development costs, permits, and construction expenses for ADUs.

Here’s what you need to know about ADU grant programs:

- California: CalHFA offers up to $40,000 for pre-development costs (currently waitlisted)

- New York: Plus One ADU Program provides up to $125,000 through local partnerships

- Vermont: VHIP-ADU grants up to $50,000 with a 20% homeowner match requirement

- Colorado: ADUG Program offers $1.6 million in funding for local governments

- Local Programs: Cities like Largo, FL ($8,000) and Pasadena, CA offer municipal grants

The housing crisis, intensified by rising construction costs and a persistent shortage of affordable homes, has made ADUs more important than ever. In states like California, housing production continues to lag far behind market demand, while demographic shifts, such as the fact that 66% of Florida households consist of only 1-2 people, highlight the need for smaller, more flexible living options. These small secondary units offer a practical, scalable solution, adding to the housing supply without the need for large, disruptive development projects. They represent a form of “gentle density” that can be integrated into existing neighborhoods seamlessly.

But here’s the catch: funding is extremely competitive. California’s initial $100 million ADU grant allocation was exhausted by December 28, 2023. Even with an additional $25 million added, demand far exceeds supply. This high demand underscores the program’s popularity and the urgent need for financial assistance among homeowners. Prospective applicants must be prepared for a race to submit their paperwork the moment a new funding round is announced, as the funds are often claimed within weeks, or even days.

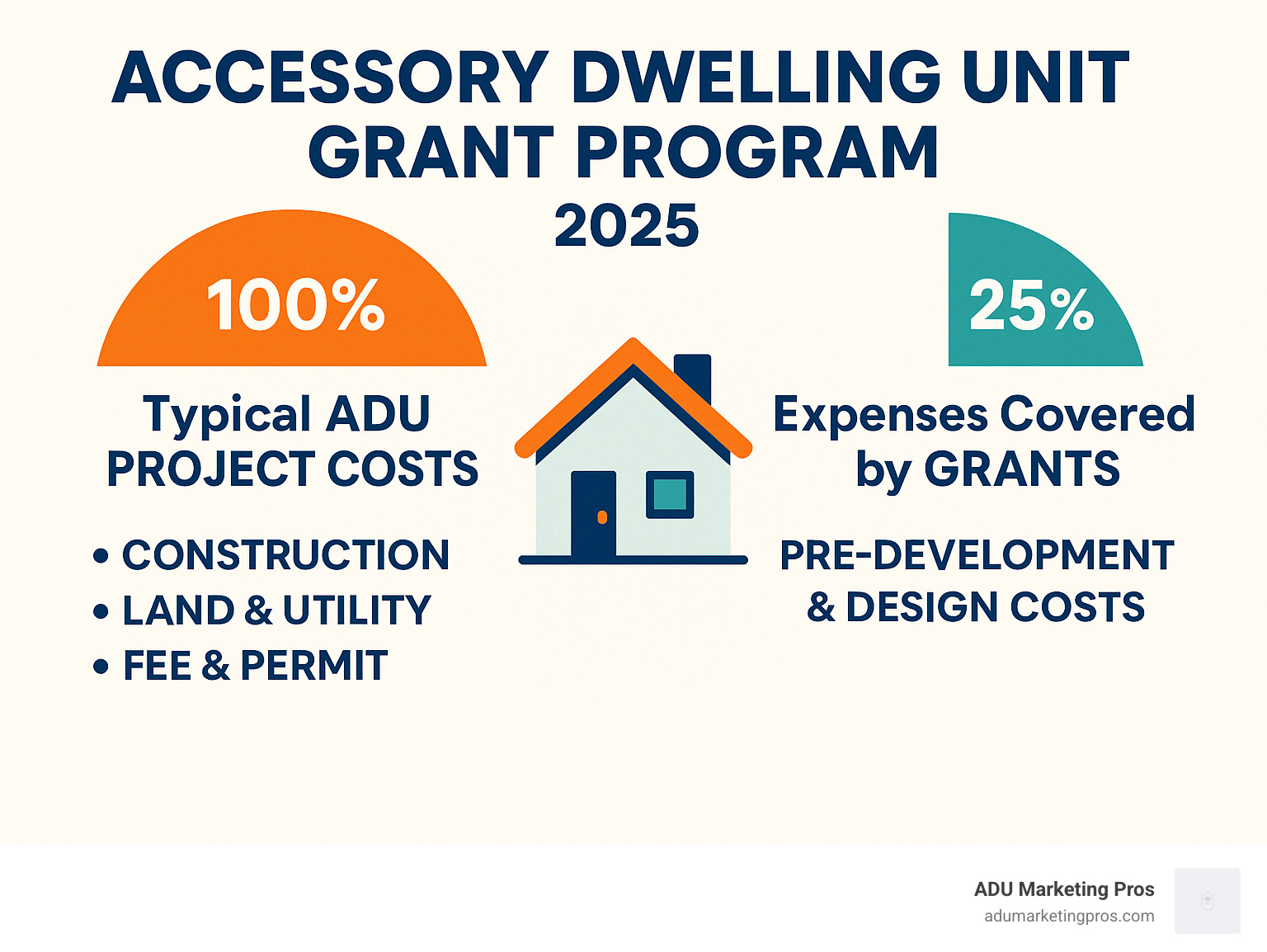

The good news? ADU grants typically cover the most expensive upfront costs – architectural designs, permits, soil tests, impact fees, and property surveys. These pre-development expenses can easily reach $20,000-$40,000 before construction even begins.

Most programs target low-to-moderate income homeowners earning under 100-150% of their area’s median income. You’ll need to own and occupy your property, maintain good credit, and commit to using the ADU for long-term housing (not short-term rentals).

What Are ADUs and Why Are They So Important?

An Accessory Dwelling Unit (ADU) is a self-contained home located on the same lot as a primary residence. Also called granny flats, in-law suites, or backyard cottages, these dwellings include a kitchen, bathroom, and sleeping area—all in a compact footprint.

Why do planners, advocates, and even the U.S. Department of Housing and Urban Development care so much about ADUs? Because they add much-needed housing without bulldozing neighborhoods. In Florida, for example, 64 % of occupied homes are single-family structures, yet average household size keeps shrinking. ADUs introduce what experts call “gentle density”—one extra unit at a time—so streets retain their character while cities gain affordable rentals.

Financially, ADUs can be game-changing. They generate rental income, increase resale value, and give families flexible space for aging parents or returning graduates. Our own ADU Return on Investment analysis shows many California homeowners earn 8–12 % cash-on-cash returns each year. For a broader policy perspective, see the AARP ADU Policy Guide, which outlines best practices for states and municipalities.

The Main ADU Configurations

- Detached new construction – a stand-alone backyard house. Highest privacy and rental potential but also the priciest to build.

- Attached additions – share at least one wall with the primary dwelling; often cheaper because they tap existing utilities.

- Garage or basement conversions – repurpose space you already own, making them the budget favorite. Our ADU Conversion Tips guide breaks down the must-knows.

- Junior ADUs (JADUs) – ultra-compact (≤ 500 sq ft) units that share the main home’s utilities.

Regardless of style, ADUs exploit existing land, shorten approval timelines, and—according to an AARP policy report—rent for 20–30 % less than comparable apartments. That combination of speed, affordability, and neighborhood compatibility explains their growing popularity.

A State-by-State Snapshot of ADU Grant Programs

Grant opportunities change constantly, but three states dominate the conversation:

California – CalHFA ADU Grant (Up to $40 k)

CalHFA pays for “soft costs”—design, engineering, permits, and impact fees—so you can start building sooner. Income must be ≤ 150 % of Area Median Income (AMI) and credit ≥ 640. Funds are first-come, first-served, and past rounds emptied in weeks. This means having your lender, contractor, and plans lined up before the application portal opens is not just an advantage—it’s a necessity. Successful applicants are often those who have done months of prep work. Local boosters include Santa Cruz (forgivable loans) and Pasadena (design & permit assistance). See the full checklist in our California ADU Requirements guide.

New York – Plus One ADU (Up to $125 k)

The country’s richest ADU grant funnels money through nonprofit/municipal partnerships instead of direct homeowner applications. This model ensures that the funds are distributed in alignment with local housing goals and that homeowners receive guidance and support throughout the process. However, it also means homeowners must identify and connect with the specific partner organization in their area, which can add a layer of complexity to the application. In exchange for funding, owners accept a 10-year affordability covenant (no short-term rentals, capped rents). Recent examples include Amherst’s $2 million program and Ulster County’s now-closed RUPCO initiative.

Vermont – VHIP-ADU (Up to $50 k)

Administered by regional Homeownership Centers, VHIP requires a 20 % homeowner match and caps rents at HUD Fair Market levels. The rent cap ensures the new unit contributes to the local affordable housing stock, a key goal of the program. Homeowners should consult the latest HUD Fair Market Rent documentation for their county to understand the potential rental income before committing to the program’s requirements. Vermont simultaneously rewrote zoning rules to guarantee every single-family lot the right to add one ADU, making approvals faster.

A Few Honor-Roll Programs

- Colorado ADUG – Grants to cities that create pre-approved plans or waive fees.

- Florida (Largo) – Up to $8 k reimbursed for impact & permit fees.

- Oregon (Portland) – Citywide fee reductions and express permitting.

The takeaway? State grants can be generous but oversubscribed; local incentives may be smaller yet easier to snag.

How to Qualify—and Apply—Like a Pro

Most programs judge three things:

- Homeowner – You must live on the property, earn under the program’s income cap (usually 100–150 % AMI), hold a 640+ credit score, and be current on taxes & mortgage.

- Property – Typically a single-family lot or duplex with room to meet local setbacks plus utility access.

- Project – A complete dwelling (kitchen, bath, sleeping), 400–1,200 sq ft, no short-term rentals.

Application Fast-Track

- Find the official conduit. CalHFA uses approved lenders; Vermont uses Homeownership Centers; many cities rely on nonprofits. Never apply through an unofficial third party. Always start your search on the official state or municipal housing agency website to find the designated program administrators.

- Pre-qualify early. Get income docs, surveys, and concept drawings ready before a window opens. This includes gathering several years of tax returns, recent pay stubs, bank statements, your property deed, and a preliminary budget from a qualified builder. The more you have prepared, the faster you can complete the final application.

- Submit day-one. Nearly all grants are first-come, first-served.

- Answer follow-ups immediately. Silence can bump you to the back of the line.

- Plan for reimbursement. Most programs pay after final inspection, so arrange bridge financing or savings. A bridge loan is a short-term loan that covers the gap between your construction expenses and the grant disbursement. Alternatively, a HELOC or personal savings can be used. Discuss these options with your financial advisor to ensure you have the liquidity to complete the project without interruption.

Common strings attached include 5–10 year affordability covenants, annual proof of occupancy, and strict bans on Airbnb-style rentals. Know the long-term rules before you sign.

What Do ADU Grants Actually Pay For?

Grants target soft costs—the pricey preliminaries that stop many projects in their tracks:

- Architectural & engineering plans (≈ $5 k–$15 k)

- Site surveys, soils tests, energy reports (≈ $2 k–$8 k)

- Permit, planning, and impact fees (can top $30 k in coastal California)

- Loan origination or title costs if you’re financing construction

They rarely fund framing, roofing, or finishes—that’s on you. For a line-item budget, see our full Accessory Dwelling Unit Costs breakdown.

No Grant? No Problem—3 Solid Financing Paths

-

Construction/Reno Loans. Borrow against the future value of your home + ADU. Interest-only during the build; converts to a fixed mortgage at completion. See our Construction Loans for ADU primer.

-

Tap Home Equity. A HELOC, cash-out refi, or home-equity loan lets you pull 80–90 % of your property’s current value. Flexible, fast, and often cheaper than personal loans.

-

Count Future Rent. Both Fannie Mae and Freddie Mac allow lenders to use 75 % of projected ADU rent for qualification. Details in our Fannie Mae ADU Rental Income and Freddie Mac ADU Rental Income guides.

These options are always open—no competitive deadlines, no 10-year covenants—so you can break ground whenever you’re ready.

Conclusion: Your Next Step Toward an ADU

Securing an ADU grant can significantly reduce the financial barrier to building a backyard home, potentially knocking $40,000–$125,000 off your upfront costs. However, as we’ve seen, this funding is highly competitive and disappears fast. Success hinges on preparation: homeowners who win these grants are those who prepare months in advance, line up their documents, and are ready to submit their application the moment a new funding cycle opens.

If you miss a funding window or don’t qualify, don’t be discouraged. A variety of robust financing options, including construction loans, home equity lines of credit, and innovative underwriting that counts future rental income, can keep your project moving forward. These paths often provide more flexibility and can move faster than state-administered programs.

For ADU Builders and Architects:

Educated clients are the best clients. An informed homeowner who understands the grant and financing landscape is better prepared to begin their project, making the entire process smoother for your team. At ADU Marketing Pros, we specialize in creating content like this that establishes your firm as an authority and attracts high-quality, project-ready leads. If you’re a professional in the ADU space looking to connect with more homeowners and stand out in a crowded market, we can help you build a marketing strategy that drives growth. Learn how ADU Marketing Pros can lift your business.