The Truth About Bay Area ADU Costs in 2025

Bay Area ADU cost ranges between $150,000 and $475,000, with an average cost per square foot of $300-$500 depending on the type, size, and finish quality. Here’s what you can expect to pay:

- Detached ADUs: $200,000-$400,000

- Attached ADUs: $150,000-$300,000

- Garage Conversions: $80,000-$200,000

- Junior ADUs: $60,000-$150,000

An Accessory Dwelling Unit (ADU) represents one of the smartest investments for Bay Area property owners in 2025. As housing prices continue to soar across San Francisco, San Jose, and surrounding communities, these self-contained living spaces built on existing residential properties offer practical solutions to the region’s housing crisis.

“An accessory dwelling unit can be a deeply personal thing. Every property, home, and homeowner is different and your needs, tastes, and site will be different from those of your neighbor,” notes one ADU design professional.

The Bay Area’s unique market conditions – high labor costs (25-50% above other California regions), strict building codes, and complex permitting processes – create a challenging but potentially rewarding landscape for ADU construction. Whether you’re looking to generate rental income (typically $2,000-$3,000/month), create space for family members, or increase your property value (by approximately 20-30%), understanding the true costs is essential before breaking ground.

Bay Area homeowners face unique cost challenges compared to other California regions, with labor rates, material availability, and regulatory requirements all contributing to higher overall expenses. Yet despite these costs, ADU construction permits represented 21% of all building permits in California during 2023 – a testament to their growing popularity and value.

Easy Bay Area ADU cost glossary:

– ADU cost per square foot

– Cost to build ADU

Bay Area ADU Cost Breakdown for 2025

Let’s talk real numbers for your ADU project. The Bay Area ADU cost varies dramatically depending on whether you’re dreaming of a standalone backyard cottage, adding onto your home, or changing that rarely-used garage into a stylish living space.

Good news for 2025: construction costs have finally stabilized a bit after those wild post-pandemic swings. That said, we’re still in the Bay Area, where everything comes with that special “location premium.” Labor costs here run 25-50% higher than other parts of California – skilled tradespeople don’t come cheap in one of the nation’s most expensive housing markets!

Here’s what you can expect for different approaches:

| ADU Type | Average Cost Range | Typical Timeline | Best For |

|---|---|---|---|

| Stick-Built Custom | $150,000-$475,000 | 8-12 months | Maximum customization, complex sites |

| Prefab/Modular | $100,000-$300,000 | 3-6 months | Speed, predictable costs |

| Garage Conversion | $80,000-$200,000 | 4-8 months | Budget-conscious, utilizing existing structure |

Looking ahead, expect modest annual increases of 3-5% in construction costs. If you’re serious about adding an ADU, sooner is typically cheaper than later.

Average Bay Area ADU Cost by Type and Size (Bay Area ADU cost)

Let’s break down what your Bay Area ADU cost might look like based on the type you choose:

Detached ADUs run $200,000-$400,000 and offer the most privacy and creative freedom. A typical 650-square-foot detached cottage in San Francisco or Palo Alto will set you back around $350,000, while going bigger (near the 1,200 sq ft maximum allowed in most jurisdictions) with high-end finishes can push beyond $400,000.

Attached ADUs cost less at $150,000-$300,000 because they piggyback on your existing home. Sharing walls, foundation, and potentially roofing with your main house creates significant savings – especially when utility connections are nearby.

Garage Conversions represent the budget-friendly champion at $80,000-$200,000. You’re working with an existing structure and foundation, which cuts costs substantially. Just be prepared for potential surprises – older garages might need seismic upgrades or structural reinforcement that can add to your bottom line.

Junior ADUs (JADUs) are the most affordable option at $60,000-$150,000. These space-efficient units (maximum 500 square feet) are created within your existing home’s footprint. They require an efficiency kitchen but can share a bathroom with the main house.

One piece of wisdom every Bay Area homeowner should accept: set aside a 10-20% contingency fund. Between challenging hillside lots, stringent building requirements, and the occasional surprise inside your walls, having financial breathing room is essential.

According to scientific research on average ADU costs, the median California ADU costs approximately $150,000 – but Bay Area projects typically run 30-50% higher due to our unique regional factors.

Cost per Square Foot for Bay Area ADUs (Bay Area ADU cost)

When it comes to Bay Area ADU cost per square foot, expect to pay between $300-$500 – significantly higher than the statewide average of about $250. This premium isn’t surprising when you consider our region’s higher labor costs, stricter building codes, and more expensive permits.

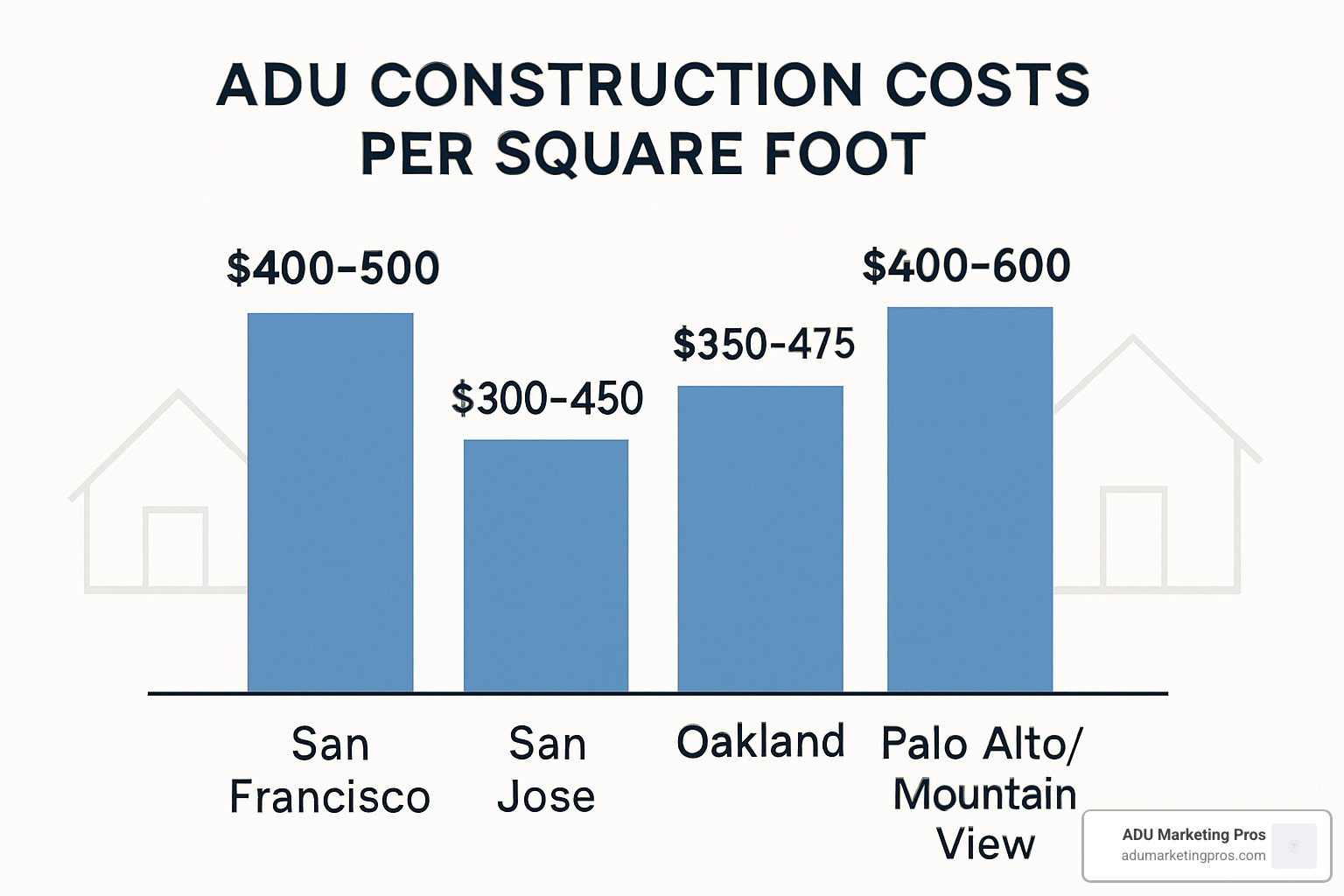

The numbers vary considerably depending on where you live:

- San Francisco tops the charts at $350-$800 per square foot

- San Jose comes in at $300-$450 per square foot

- Oakland ranges from $300-$500 per square foot

- Palo Alto/Mountain View command $350-$600 per square foot

Your choice of finishes dramatically impacts these numbers. Basic finishes might keep you in the $300-$350 range, while mid-range options typically land at $350-$450 per square foot. For those dreaming of high-end materials and luxury fixtures, prepare for $450-$800+ per square foot.

Here’s a counterintuitive fact many homeowners don’t realize: smaller ADUs often cost more per square foot than larger ones. This happens because certain fixed costs (permits, utility connections, kitchens, bathrooms) get spread across fewer square feet. For example, a cozy 350-square-foot ADU at $225,000 costs about $643 per square foot, while a more spacious 650-square-foot unit at $350,000 runs approximately $538 per square foot.

This “economy of scale” principle is worth considering as you plan your ideal space. Sometimes going a bit larger can actually represent a better value, even if the total price is higher.

For more detailed information about construction costs and what goes into them, check out our comprehensive guide on ADU Construction Cost.

Major Factors Influencing ADU Budgets

Building an ADU in the Bay Area isn’t just about square footage and design preferences—it’s about navigating a complex landscape of variables that can dramatically impact your bottom line. Let’s explore what really drives the Bay Area ADU cost beyond the basics.

Your property’s unique characteristics play a huge role in your budget. That gentle slope you barely notice? It could add $10,000-$50,000 for retaining walls and foundation work. I recently spoke with a homeowner in Oakland whose sloping-site ADU estimate came in at $510,000—a full $160,000 more than similar projects on flat lots. Poor soil conditions might require deeper foundations or remediation work, potentially adding another $5,000-$30,000 to your project. And if your backyard is a challenge to access? Expect a 10-15% premium as contractors wrestle with equipment access and manual labor requirements.

Bringing utilities to your ADU often surprises homeowners with its expense. Running new water, sewer, and electrical lines through your yard can quickly add $10,000-$30,000, especially if you’re dealing with mature landscaping or hardscaping. Your main home’s electrical panel might need an upgrade to handle the additional load ($2,500-$8,000), and in older neighborhoods of San Francisco, sewer connections alone can run $5,000-$20,000.

Design choices make a significant difference too. Those beautiful architectural features you’ve been dreaming about? They’ll add 15-30% to your base costs. Energy efficiency requirements are mandatory under Title 24, but going beyond with solar panels ($10,000-$25,000) or advanced insulation systems increases upfront costs while reducing long-term operating expenses. Smart home technology adds $5,000-$15,000 but can make your unit more attractive to potential renters.

The Bay Area’s hot construction market continues to influence costs. Labor rates here run 25-50% higher than other parts of California, and while material costs have somewhat stabilized, they remain unpredictable for certain items. The best contractors command premium rates due to high demand—and trust me, this isn’t where you want to cut corners.

Regulatory factors can throw unexpected curveballs into your budget. Building codes evolve, sometimes mid-project, requiring costly design revisions. Inspection delays extend timelines and increase carrying costs. Being prepared for these possibilities with a healthy contingency fund is essential.

For more detailed information on size and lot requirements that affect costs, check out our guides on ADU Size Restrictions and ADU Minimum Lot Size.

Permit & Impact Fees by Bay Area City

Permit fees are the unsung budget-busters of ADU projects, varying dramatically depending on which Bay Area city you call home. Your Bay Area ADU cost can fluctuate by tens of thousands just based on your zip code.

San Francisco residents face some of the steepest fees, typically running 6-9% of construction costs. For a $350,000 ADU, that translates to $21,000-$31,500 just in permits—enough to furnish your entire unit lavishly. San Jose offers a bit more relief with permit fees between $8,000-$17,000, and they’ve wisely waived impact fees for smaller ADUs under 750 square feet.

Oakland stands out with some of the most progressive ADU policies in the region. They’ve eliminated impact fees for units under 750 square feet and offer pre-approved plans that can save you time and money. Redwood City provides a straightforward ADU checklist and typically charges around $6,000 in permit fees, while Palo Alto fees can exceed $20,000 (though recent policy changes have reduced some costs). Mountain View falls in the middle range with permit fees averaging $10,000-$15,000.

The good news is that many Bay Area jurisdictions have reduced or eliminated certain impact fees for smaller ADUs following state legislation. However, larger units may still trigger impact fees exceeding $10,000. Beyond the fees themselves, don’t forget to budget for carrying costs associated with permit delays, which can add thousands to your project.

The permitting process is often more marathon than sprint. For a comprehensive guide to navigating the permit landscape, visit our detailed resource on ADU Permits California.

Design & Engineering Line Items

The professionals who bring your ADU vision to life represent a significant slice of your Bay Area ADU cost, but they’re also your best defense against expensive mistakes and delays.

Architectural design typically consumes 8-12% of construction costs ($12,000-$40,000), covering everything from initial concepts to detailed construction documents, material specifications, and interior design elements. Engineering services add another 1-5% ($1,000-$5,000) for structural calculations, foundation design, and critically important seismic considerations—a must-have in earthquake country.

Don’t forget additional professional services that often fly under the radar: energy calculations for Title 24 compliance ($500-$1,500), boundary surveys ($1,500-$3,000), soils reports if required ($2,000-$5,000), and project management (5-15% of total project cost).

While these numbers might make you wince, experienced professionals familiar with local codes can actually save you thousands by preventing expensive design revisions, permit delays, and construction headaches. As one San Jose homeowner told me, “I tried to save on design fees and ended up with three months of permit revisions that cost twice what I’d saved.”

There are ways to be smart about design and engineering costs without cutting corners. Consider stock plans or pre-approved designs where available. In conversion projects, reuse existing walls and foundations whenever possible. Keep exterior shapes simple—those complex rooflines and angles might look stunning but will inflate your budget. Standardizing window and door sizes and optimizing your layout to minimize plumbing runs can also yield significant savings.

Good design isn’t just about aesthetics—it’s about creating a space that functions beautifully while navigating the complex regulatory landscape of Bay Area construction.

Prefab vs Stick-Built vs Conversion: Which Saves You the Most?

Choosing the right construction method for your ADU can make a dramatic difference in both your wallet and timeline. When it comes to Bay Area ADU cost, your choice between prefab, traditional construction, or conversion will shape your entire project experience.

Prefabricated or modular ADUs ($100,000-$300,000) offer a compelling combination of efficiency and predictability. These units are built in climate-controlled factories, then delivered to your property in sections and assembled on-site – sometimes in as little as 2-3 days once your foundation is ready. The entire process typically wraps up in 3-6 months from contract signing to move-in day, significantly faster than other methods. Many Bay Area homeowners appreciate knowing exactly what they’re getting, with fewer surprises along the way.

Traditional stick-built ADUs ($150,000-$475,000) remain the gold standard for customization. Built entirely on-site using conventional construction methods, these units offer unlimited design possibilities to match your exact vision. The trade-off comes in timeline – expect 8-12 months from initial design to completion – and potentially higher costs. However, for unique lots or specific design requirements, the flexibility of stick-built construction can be worth the wait and extra investment.

Conversion ADUs ($80,000-$200,000) represent the budget-friendly champion, changing existing structures like garages, basements, or portions of your main house into livable spaces. By leveraging existing foundations, walls, and roof structures, you’ll typically save significant money compared to building from scratch. The timeline generally falls in the middle range at 4-8 months. Just be prepared for potential surprises when opening up walls in older structures – what looks simple from the outside can sometimes reveal costly complications.

From a property value perspective, all three methods can boost your home’s worth by 20-30% in the competitive Bay Area market. That said, appraisers tend to give a slight edge to well-executed stick-built ADUs that seamlessly match the main home’s architectural character and quality.

For deeper insights into the modular approach, our page on ADU Modular Homes offers a wealth of additional information.

Pros & Cons of Prefab ADUs

Prefabricated ADUs have captured the imagination of many Bay Area homeowners seeking faster, more predictable projects. But are they right for your situation? Let’s explore what makes them attractive – and where they might fall short in the Bay Area ADU cost equation.

The speed advantage of prefab is undeniable. Once permits are in hand and site prep is complete, your ADU can materialize in days rather than months of traditional construction. This rapid timeline means less disruption to your property and potentially lower carrying costs during construction.

Cost predictability represents another significant benefit. Since most components are built in controlled factory environments, you’ll face fewer of the surprise expenses and change orders that plague traditional construction. The production-line approach also helps maintain consistent quality standards across every element of your ADU.

Perhaps most appealing in our region’s expensive labor market is the reduced on-site work. With much of the construction happening off-site, you’ll need fewer hours from high-priced Bay Area contractors. Some jurisdictions have even created streamlined permitting pathways for pre-approved prefab designs, potentially saving both time and money.

But prefab isn’t perfect for every situation. Design flexibility is more limited compared to custom building, with modifications often increasing costs substantially. Getting these units delivered can be genuinely challenging in neighborhoods with narrow streets, steep inclines, or difficult access – a common issue throughout the Bay Area’s hillside communities.

Don’t forget that prefab still requires significant site preparation, including foundation work, utility connections, and final finishing. These site-specific costs can sometimes surprise homeowners who focus only on the module price. Transportation limitations may restrict the maximum size of your unit or require multiple modules, and many installations need a crane, adding $1,500-$5,000 to your budget.

Bay Area prefab suppliers typically offer units ranging from $100,000 to $300,000, with costs averaging $250-$400 per square foot. While this can represent savings compared to custom construction, the all-in project cost including site work, permits, and utilities sometimes approaches traditional building costs in certain scenarios.

Garage & Basement Conversions on a Budget

For budget-conscious homeowners, garage and basement conversions offer the most economical path to creating an ADU. With Bay Area ADU costs typically ranging from $80,000 to $200,000, these changes can save you significant money while still creating beautiful, functional living spaces.

The biggest financial advantage comes from leveraging what you already have. Using the existing shell – foundation, walls, and roof – can save you $50,000-$100,000 compared to new construction. Site work is minimal since you’re working with an already-developed footprint, and many jurisdictions have created streamlined permitting processes specifically for these conversion projects.

Proximity to existing utilities represents another major benefit. Your garage or basement likely already has electrical service nearby and may be close to water and sewer lines, potentially reducing connection costs that can run into the tens of thousands for detached new construction.

That said, garage conversions come with their own set of considerations. Most garages weren’t built to residential standards, so you’ll likely need structural upgrades. Foundation reinforcement typically costs $5,000-$15,000, while proper insulation and drywall for walls runs $5,000-$10,000. Roof insulation or replacement adds another $5,000-$20,000, and treating the concrete slab floor properly costs $3,000-$8,000.

Utility installation represents another significant expense. Adding full plumbing systems where none existed can cost $10,000-$20,000, while electrical upgrades typically run $5,000-$15,000. Don’t forget HVAC systems at $5,000-$10,000 – a necessity for comfortable year-round living.

The parking question requires careful consideration too. Converting your garage means losing parking spaces, and some jurisdictions require you to create replacement parking elsewhere on your property. Factor in potential driveway reconfiguration costs if this applies to your situation.

Basement conversions bring their own unique challenges, with moisture control being the most critical. Below-grade spaces often need waterproofing ($5,000-$15,000), drainage systems ($3,000-$8,000), and ongoing dehumidification ($1,000-$3,000) to create healthy living environments.

Ceiling height can be another basement conversion obstacle. California building code requires 7’6″ minimum ceiling height for habitable spaces. If your basement doesn’t meet this requirement, you might need to lower the floor – a substantial undertaking costing $15,000-$30,000. Some jurisdictions offer limited exceptions, but this varies widely.

A basic garage conversion in San Jose with modest finishes might cost around $100,000, while a high-end change with premium materials, custom cabinetry, and high-efficiency systems could reach $200,000 or more. Even at the upper end, this represents substantial savings compared to ground-up construction – making conversions the budget champion of ADU options.

Beyond Construction: Financing, ROI & Hidden Costs

The true Bay Area ADU cost extends far beyond the construction price tag. Smart homeowners take a holistic view, considering how they’ll pay for the project, what returns they can expect, and which sneaky expenses might be lurking around the corner.

Let’s talk money first. Financing an ADU doesn’t have to mean emptying your savings account. Most Bay Area homeowners tap into their property’s equity through home equity loans or HELOCs with interest rates typically ranging from 5-8%. These flexible options let you draw funds as needed throughout your build.

“We originally planned to use savings for our ADU, but realized a HELOC gave us breathing room for unexpected costs—and there were plenty!” shares Oakland homeowner Maria Chen, who completed her garage conversion in 2023.

If you prefer a more structured approach, construction loans (6-9% interest) are specifically designed for building projects, while cash-out refinancing (5-7%) replaces your existing mortgage but might offer better overall terms. Some forward-thinking lenders now offer ADU-specific loan products custom to this growing market.

Don’t overlook potential help from the government either. In certain Bay Area jurisdictions, grants up to $40,000 are available for qualifying homeowners, particularly those creating affordable housing units.

Now for the exciting part—what you’ll get back from your investment. In the Bay Area’s tight housing market, ADUs deliver impressive returns through multiple channels. A well-designed studio or one-bedroom typically commands $2,000-$2,500 monthly rent, while two-bedroom units can fetch $3,000 or more. That translates to annual income between $24,000 and $48,000 before expenses.

Property values also get a significant boost. Most Bay Area homes see a 20-30% increase after adding an ADU—on a typical $1.5 million property, that’s an additional $300,000 to $450,000 in equity. When you calculate cap rates (the ratio of net operating income to property value), ADUs often achieve 8-10%, far outperforming most other real estate investments in the region.

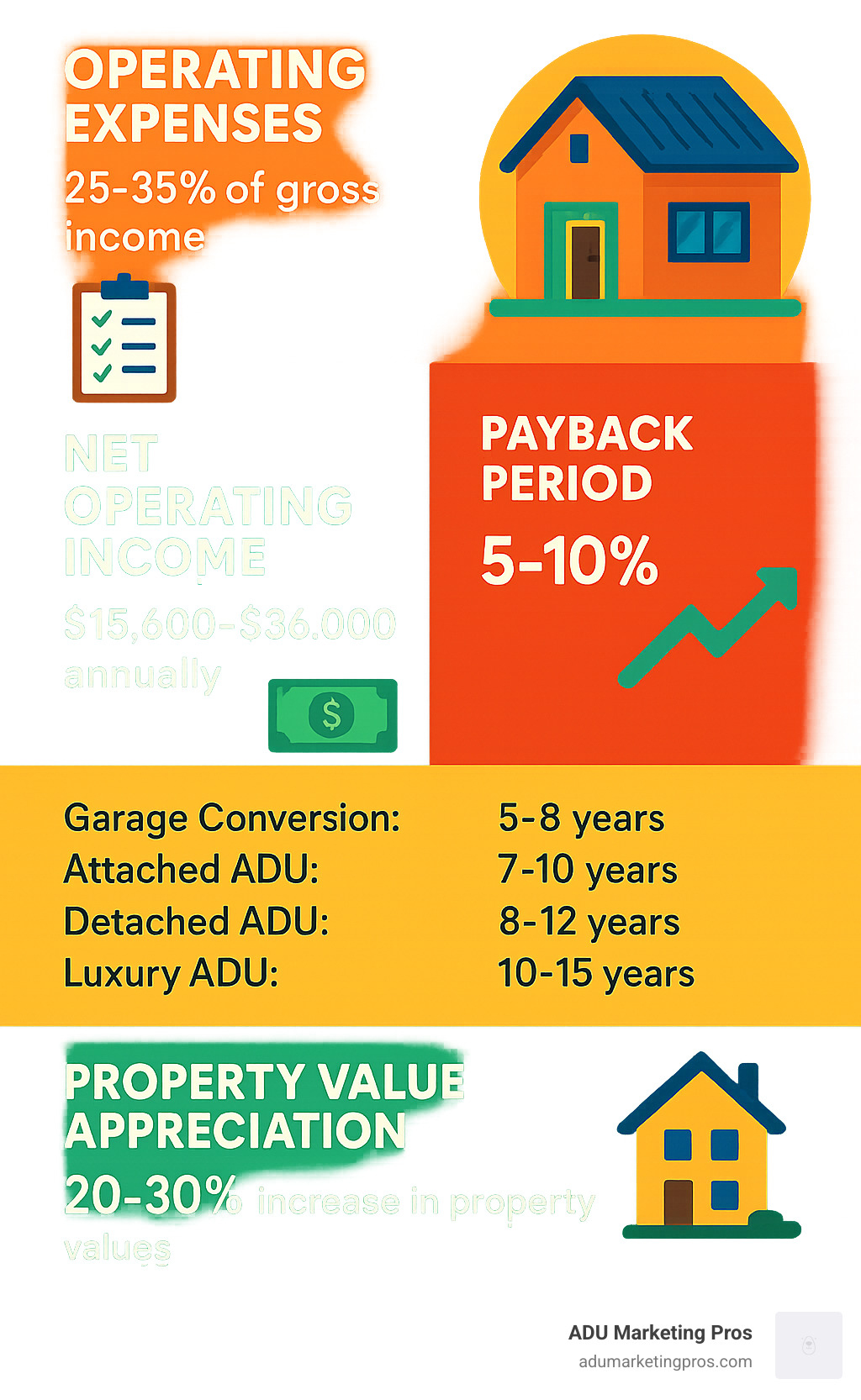

The payback period varies by project type. Garage conversions typically recoup their costs through rental income in 5-8 years, while detached new construction might take 8-12 years. Higher-end luxury ADUs with premium finishes could extend to 10-15 years—still an impressive timeline compared to many investments.

But before you get too excited about those returns, let’s talk about the costs that don’t always make it into the initial estimates. Your insurance premiums will increase by $300-$800 annually to cover the additional living space. While ADUs don’t trigger full property tax reassessments in California, the new structure will be assessed at current rates, affecting your tax bill.

Smart homeowners also budget for ongoing maintenance (1-2% of the ADU value annually), landscaping restoration after construction ($5,000-$15,000), and higher utility bills ($100-$300 monthly when occupied). California’s energy requirements often necessitate solar panels for new construction, adding another line item to your budget.

Then there are the truly hidden costs that catch even prepared homeowners off guard. Finding underground utilities that need relocation can add $5,000-$20,000 to your project. Poor soil conditions might require specialized foundations costing an extra $10,000-$30,000. Protected trees can necessitate expensive arborist services or even design changes. And let’s not forget the almost inevitable change orders during construction, typically adding 5-15% to the final tab.

“We finded an old clay sewer line running right through our planned ADU footprint,” recalls San Jose homeowner David Park. “Relocating it added $12,000 and three weeks to our project—costs we never anticipated.”

Financing Options Every Bay Area Owner Should Know

Navigating financing options is crucial for managing your Bay Area ADU cost effectively. Each approach has distinct advantages depending on your financial situation and goals.

Home Equity Lines of Credit (HELOCs) currently offer variable interest rates between 6-8% and remain one of the most popular choices for ADU projects. Their flexibility is perfect for construction’s unpredictable nature—you draw only what you need when you need it, and many offer interest-only payment options during the initial period.

“The HELOC was perfect for our ADU because construction had so many starts and stops,” explains Berkeley homeowner James Wilson. “We only paid interest on what we’d actually drawn, which saved us thousands during delays with the city permits.”

HELOCs typically feature a 10-year draw period followed by a 20-year repayment term, making them ideal for homeowners with substantial equity and strong credit scores. The main downside? Variable rates mean your payments could increase if interest rates rise.

Construction loans (currently 6-9% interest) are specifically designed for building projects and often convert to permanent financing once construction is complete. These loans disburse funds according to a predetermined schedule as construction milestones are reached. While they involve a more complex application process and higher closing costs, they’re well-suited for ground-up ADU projects with longer timelines. Most feature interest-only payments during construction, then convert to a standard 15-30 year mortgage.

If you’re already considering refinancing your primary mortgage, cash-out refinancing (currently 5-7% fixed rates) lets you tap equity while potentially securing a better overall interest rate. This option replaces your existing mortgage with a new, larger one, providing the difference in cash for your ADU project. The main advantage is having a single monthly payment, though it does reset the term of your entire mortgage and involves closing costs.

Don’t overlook government programs and incentives either. The CalHFA ADU Grant Program offers up to $40,000 in certain jurisdictions, while cities like San Jose and Oakland have launched their own low-interest loan initiatives. Energy efficiency rebates can also offset costs for green building features. These programs are particularly valuable for income-qualified homeowners or those committed to creating affordable housing units.

Several specialty ADU lenders have also emerged in recent years, offering rates between 5-8% with streamlined processes specifically for accessory dwelling projects. Some will even consider future rental income in their underwriting decisions, though geographic limitations may apply.

For deeper insights into financing structures and current rates, visit our detailed guides on ADU Financing Options and ADU Loan Rates.

When evaluating financing options, look beyond just the interest rate. Consider the draw schedule (how and when funds become available), potential prepayment penalties, closing costs, credit requirements, and tax implications of different loan types. A conversation with both a loan officer and tax professional can help clarify which approach best suits your specific situation.

Return on Investment & Payback Period

Understanding the return on investment helps put the Bay Area ADU cost in perspective. In our region’s unique housing market, ADUs deliver financial benefits through multiple channels that can transform what seems like a steep investment into a remarkably sound financial decision.

Let’s talk rental income first. A well-designed studio or one-bedroom ADU in the Bay Area typically generates $2,000-$2,500 monthly ($24,000-$30,000 annually), while two-bedroom units command $3,000-$4,000 monthly ($36,000-$48,000 annually). In tourist-friendly areas or near tech campuses, vacation or short-term rentals can boost those figures by 30-50%, though with additional management requirements.

“Our Sunnyvale ADU has been rented continuously since completion,” shares homeowner Lisa Tanaka. “The $2,800 monthly income covers our construction loan and still puts about $500 in our pocket each month after expenses.”

When analyzing cash flow, expect operating expenses to consume about 25-35% of your gross rental income. These include the incremental increase in property taxes, additional insurance coverage, regular maintenance, utilities (if you’re covering them), and property management fees if you’re not handling tenant relations yourself. After these expenses, most Bay Area ADU owners enjoy net operating income between $15,600 and $36,000 annually.

This income translates to impressive capitalization rates (cap rates) of 5-10%—significantly outperforming the 2-4% cap rates typical for single-family homes in the region. In simpler terms, your investment returns are substantially higher with an ADU than with most other Bay Area real estate opportunities.

The payback period—how long it takes to recoup your initial investment through rental income—varies by project type. Garage conversions typically reach the break-even point in 5-8 years, while attached ADUs take 7-10 years. Detached new construction, with its higher upfront costs, generally requires 8-12 years to pay for itself through rental income alone. Luxury high-end ADUs with premium finishes might extend to 10-15 years, though they often command premium rents to offset this longer timeline.

Beyond rental income, ADUs deliver substantial property value appreciation. Most Bay Area homes see a 20-30% increase in market value after adding an ADU. For a $1.5 million property (around the Bay Area median), that translates to $300,000-$450,000 in added equity—often exceeding the construction cost itself. This appreciation tends to be particularly strong in properties located within high-demand school districts or near major employment centers.

The tax benefits shouldn’t be overlooked either. Rental ADUs can be depreciated over 27.5 years, creating valuable tax deductions. Under California’s Proposition 13, ADUs are typically assessed at current market rates but don’t trigger reassessment of the entire property, limiting the tax impact. Additionally, many expenses related to rental properties—maintenance, insurance, property management, and even mortgage interest—may be deductible as business expenses, though you should always consult with a tax professional about your specific situation.

According to research on average costs when building a new ADU, these financial benefits extend well beyond direct rental income to create a compelling overall investment case.

For many Bay Area homeowners facing retirement planning challenges or seeking to generate passive income, ADUs represent one of the few accessible real estate investments that can deliver both strong cash flow and significant property appreciation in today’s competitive market.

Frequently Asked Questions about Bay Area ADU Costs

How long does a Bay Area ADU take from permit to move-in?

When planning your ADU journey, timing is everything. Most Bay Area homeowners complete their projects in 6-12 months, though this timeline can vary based on your location, project complexity, and construction method.

Your ADU trip typically unfolds in three distinct phases:

The design phase usually takes 1-3 months. You’ll spend the first few weeks in initial consultations and concept development, followed by 1-2 months of design development and engineering work. Most homeowners need 2-4 weeks for revisions before finalizing plans.

The permitting phase is often the most unpredictable part of the timeline, lasting anywhere from 2-6 months. After submitting your plans (1-2 weeks), you’ll enter the review period, which varies dramatically by city – some Bay Area municipalities process permits in a month, while others might take 3+ months. If revisions are needed, add another 2-8 weeks before receiving final approval.

Once approved, the construction phase typically runs 4-6 months. Your contractor will spend 2-4 weeks on site preparation, followed by 2-3 weeks on foundation work. Framing takes 2-4 weeks, then mechanical, electrical, and plumbing rough-ins require 3-4 weeks. Interior finishes like insulation, drywall, flooring, and fixtures consume the final 6-9 weeks, with final inspections taking 2-3 weeks.

If you’re in a hurry, prefabricated ADUs can significantly compress this timeline. With permits in hand and foundation prepared, the on-site assembly often wraps up in just 2-3 months – a considerable time savings compared to traditional construction.

What’s the cheapest ADU type I can build?

If budget is your primary concern, not all ADUs are created equal when it comes to Bay Area ADU costs.

The most affordable option is typically a Junior ADU (JADU), ranging from $60,000-$150,000. These units are created within your existing home’s footprint, maxing out at 500 square feet. They must include a small kitchen and can share a bathroom with the main house. Since JADUs leverage your existing structure and utilities, they’re the gentlest on your wallet.

Garage conversions come in second at $80,000-$200,000. These projects give you a head start with existing foundation, walls, and roof. While you’ll likely need electrical upgrades and new plumbing and insulation, you’ll save substantially compared to ground-up construction. Just be mindful of potential challenges with below-grade garages or low ceiling heights.

Basement conversions typically run $100,000-$250,000. Like garage conversions, they use existing structure but often require significant waterproofing and egress additions. Plumbing can be particularly costly if your basement sits below the sewer line.

Prefab/modular ADUs ($100,000-$300,000) offer savings through factory efficiency but still require foundation work and utility connections. The limited customization actually helps keep costs predictable.

Attached ADUs ($150,000-$300,000) share at least one wall with your main house, saving on foundation and possibly utility connections. They’re more expensive than conversions but more affordable than fully detached units.

Detached ADUs ($200,000-$400,000) represent the premium option. While they require complete new construction from foundation to roof, they offer maximum privacy and design freedom.

Whatever type you choose, you can trim costs by using standard-sized windows and doors, stock cabinets, simple roof designs, and thoughtful plumbing layouts. Sometimes spending a bit more upfront on quality materials can save money on long-term maintenance.

How much will a 500 sq ft ADU cost in 2025?

A 500 square foot ADU represents the sweet spot for many Bay Area homeowners – large enough to function as a comfortable rental unit while small enough to keep costs manageable and often qualify for reduced impact fees.

For 2025, here’s what you can expect to pay for a 500 square foot ADU in the Bay Area:

Detached new construction will typically run $150,000-$250,000, averaging $300-$500 per square foot. This gives you complete design freedom but comes with the highest price tag.

Attached ADUs cost approximately $125,000-$225,000 ($250-$450 per square foot), offering savings by sharing a wall with your existing home.

Garage conversions remain the budget-friendly option at $100,000-$175,000 ($200-$350 per square foot), leveraging existing structure to reduce costs.

Junior ADUs are the most affordable at $60,000-$150,000 if created within your existing home space.

Prefab/modular options typically cost $125,000-$200,000 plus site preparation and foundation work, offering a middle-ground approach.

These estimates include design and engineering, permits and fees (assuming reduced impact fees for units under 750 sq ft), standard site preparation, mid-range finishes, and basic landscaping restoration.

Your costs could increase with premium finishes (+$25,000-$50,000), difficult site conditions (+$10,000-$30,000), solar installation if required (+$8,000-$15,000), high-end appliances (+$5,000-$15,000), or smart home technology (+$5,000-$10,000).

A typical 500 square foot ADU includes one bedroom (or studio layout), one bathroom, a kitchen/living area, storage space, and potentially an outdoor deck or patio. This size works particularly well because it often qualifies for reduced impact fees, provides adequate rental space, balances construction cost with potential income, and fits on most residential lots without excessive setback issues.

Location matters tremendously in the Bay Area – the same ADU might cost 20% more in San Francisco than in the East Bay, reflecting local labor rates, permit costs, and market conditions.

Conclusion & Next Steps

So, you’ve made it through our deep dive into Bay Area ADU costs. What have we learned? Building an ADU in the Bay Area isn’t cheap—typically running between $150,000 and $475,000—but the potential returns through rental income, increased property value, and flexible living options make it a smart investment for many homeowners.

Let me share a few key insights to help you move forward with confidence:

First, invest time in planning before breaking ground. The design and permitting phases might feel tedious, but thorough planning now prevents expensive headaches later. I’ve seen too many homeowners rush this stage only to face costly mid-construction changes.

Your choice of ADU type should align with both your budget and your goals. Converting that unused garage might save you significant money ($80,000-$200,000) compared to building a detached structure ($200,000-$400,000), but will it truly meet your long-term needs? Think about how you’ll actually use the space.

Bay Area cities have wildly different requirements. San Francisco’s percentage-based fees (6-9% of construction costs) work very differently from Oakland’s progressive policies that waive fees for smaller units. Understanding these local nuances can save you thousands.

Always set aside a healthy contingency budget—I recommend 10-20% beyond your estimated costs. The Bay Area’s challenging building environment means surprises are practically guaranteed, from utility relocations to soil issues that only become apparent once you start digging.

Be strategic about financing. Whether you opt for a HELOC, construction loan, cash-out refinancing, or local grant program, the right financing approach can significantly impact your bottom line and monthly cash flow.

Design with the future in mind. The most successful ADUs I’ve seen incorporate flexible layouts that can adapt as needs change—from housing family members to generating rental income or even serving as your own space down the road.

For construction and architecture firms navigating this complex market, we at ADU Marketing Pros understand your unique challenges. Our specialized digital marketing solutions help Bay Area builders and designers connect with qualified homeowners who are ready to invest in these valuable additions. From targeted SEO strategies to conversion-optimized websites, we help you showcase your expertise in this growing niche.

As the housing landscape continues to evolve, ADUs remain one of the smartest investments for homeowners and one of the most promising opportunities for construction professionals. With proper planning, realistic budgeting, and partnerships with experienced professionals, you can successfully steer the complexities of ADU development.

For more detailed information about construction costs and planning your ADU project, visit our comprehensive guide on ADU Construction Cost.