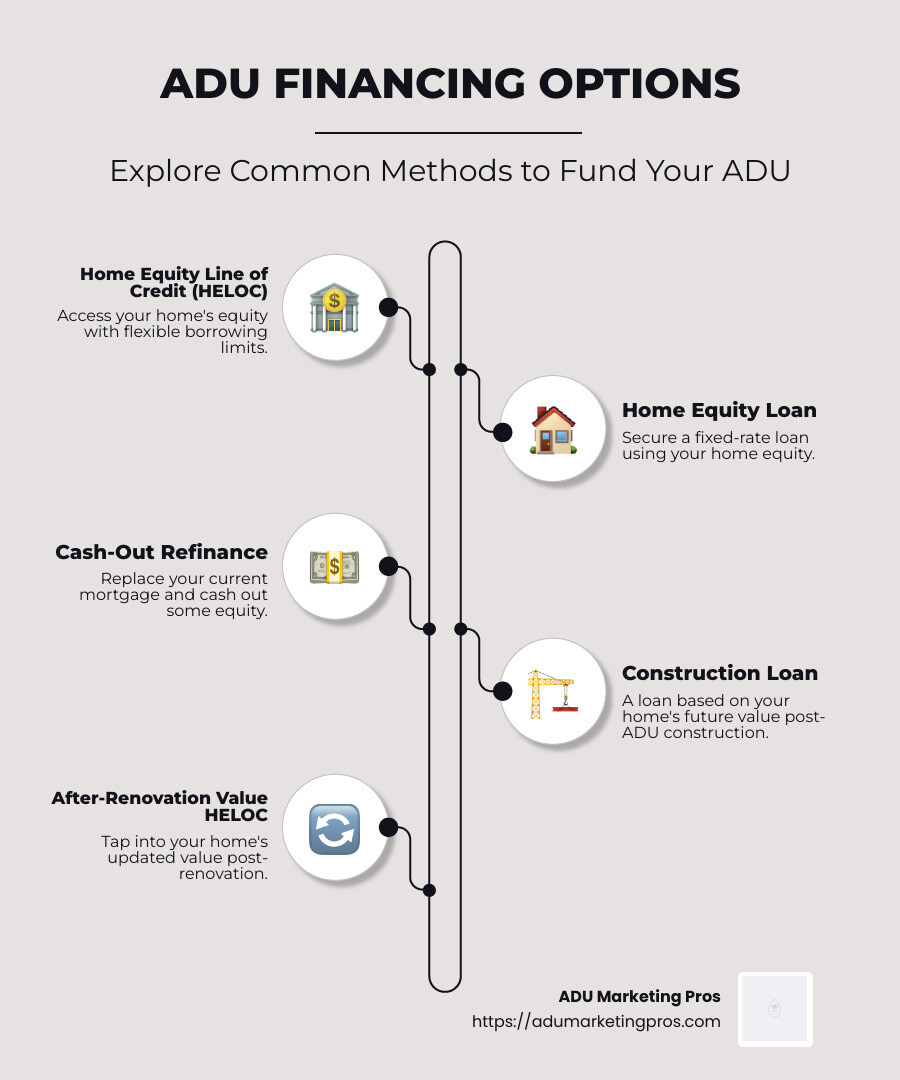

When it comes to building accessory dwelling units (ADUs), understanding the adu financing options is crucial. Whether you’re a homeowner in need of extra space or a developer looking to tap into California’s booming ADU market, here are the common financing options available:

- Home Equity Line of Credit (HELOC): Access your home’s equity with flexible borrowing limits.

- Home Equity Loan: Secure a fixed-rate loan using your home equity.

- Cash-Out Refinance: Replace your current mortgage and cash out some equity.

- Construction Loan: A loan based on your home’s future value post-ADU construction.

- RenoFi Loans and Renovation Mortgages: Innovative options consider future property value.

- After-Renovation Value HELOC: Tap into your home’s updated value post-renovation.

With California making it easier to build ADUs through policy changes, homeowners and developers face a growing demand yet also significant financing challenges. Navigating costs like site work, utility connections, and unexpected expenses can be tricky. Understanding these options can streamline your project, whether you’re targeting rental income or providing additional family space.

Understanding ADU Financing Options

When it comes to financing your Accessory Dwelling Unit (ADU), you have several options to consider. Each comes with its own set of benefits and potential drawbacks. Let’s break down the main choices:

Home Equity Line of Credit (HELOC)

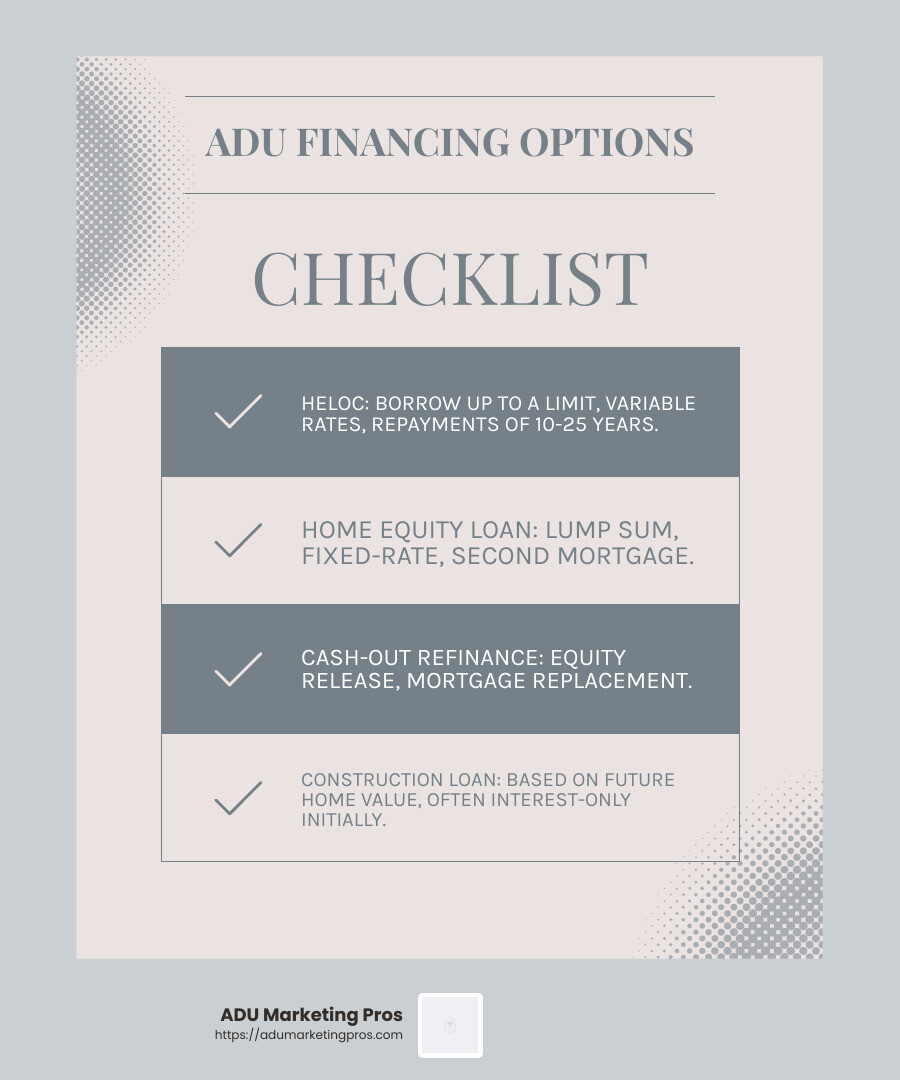

A HELOC allows you to borrow against the equity you’ve built up in your home. This is like having a credit card with your home as collateral. You can borrow up to a certain limit, and you only pay interest on the amount you actually use.

- Variable Interest Rates: HELOCs typically have variable rates, meaning your payments can change over time.

- Draw Period: This is the time when you can borrow money. It usually lasts 5-10 years.

- Repayment Period: After the draw period, you enter the repayment phase. You’ll pay back both the principal and interest, often over 10-25 years.

Home Equity Loan

A Home Equity Loan is another way to tap into your home’s equity. Unlike a HELOC, this loan gives you a lump sum upfront.

- Fixed-Rate: You get a set interest rate, so your monthly payments remain the same over the loan’s term.

- Second Mortgage: This loan is in addition to your existing mortgage, so you’ll have two separate payments.

Cash-Out Refinance

Opting for a Cash-Out Refinance means replacing your existing mortgage with a new one, usually at a higher amount.

- Equity Release: You can access the equity you’ve built up as cash, which can be used for your ADU construction.

- Mortgage Replacement: This means you might lose your current interest rate, so consider the new rate’s impact.

Construction Loan

A Construction Loan is specifically for building projects like an ADU. It’s based on your home’s estimated future value after the ADU is complete.

- Future Home Value: Lenders consider what your home will be worth post-construction, allowing you to borrow more.

- Adjustable-Rate Mortgage (ARM): Often, these loans start with lower interest rates that adjust over time. Initially, you might pay interest-only, with the principal added later.

Each of these ADU financing options has unique features that cater to different financial situations. Whether you’re looking for fixed rates, flexible borrowing, or leveraging future home value, understanding these options can help you make the best choice for your ADU project.

Next, we’ll explore custom solutions like RenoFi loans and renovation mortgages that consider your home’s future value.

ADU Financing Options: Custom Solutions

When traditional ADU financing options don’t quite fit, custom solutions like RenoFi loans, renovation mortgages, and After-Renovation Value HELOCs can offer the flexibility you need. These options consider the future value of your home, providing increased borrowing power. Let’s explore these unique solutions.

RenoFi Loan

A RenoFi Loan is a game-changer for those looking to finance an ADU. Unlike conventional loans, RenoFi considers what your home will be worth after the ADU is built. This means you can borrow based on your home’s future value, not just its current equity.

- Increased Borrowing Power: Homeowners can access up to 90% of their home’s post-renovation value, which is often 3x more than traditional loans.

- Flexible Options: Choose between a RenoFi Home Equity Loan or a Home Equity Line of Credit, depending on your needs.

This approach can be particularly beneficial for homeowners who haven’t built up much equity yet but want to maximize their borrowing potential.

Renovation Mortgage

Renovation mortgages, like the Fannie Mae HomeStyle and FHA 203(k), are designed to fund both the purchase and renovation of a property, or just the renovation if you already own the home. These loans allow you to incorporate the costs of building an ADU into your mortgage.

- Fannie Mae HomeStyle: Offers a single loan for both the purchase and renovation, with flexible terms and competitive interest rates.

- FHA 203(k): Ideal for those who want to finance renovation costs, offering low down payment options and government-backed security.

Both options are great for homeowners looking to streamline financing and potentially benefit from lower interest rates compared to separate loans.

After-Renovation Value HELOC

An After-Renovation Value HELOC is an innovative way to finance your ADU project by considering your home’s value after the renovation. This product is not widely available but is offered by some credit unions.

- Post-Renovation Value: Lenders use the estimated future value of your home to determine your borrowing limit, which can be significantly higher.

- Credit Unions: Partnering with local credit unions can offer better rates and personalized service.

This solution is perfect for homeowners who want a flexible line of credit and plan to add significant value to their property with an ADU.

These custom solutions provide homeowners with powerful tools to finance their ADU projects by focusing on future potential and offering flexible borrowing options. Next, we’ll discuss the factors that influence ADU loan interest rates, helping you understand what affects the cost of your loan.

Factors Influencing ADU Loan Interest Rates

When it comes to financing your ADU, understanding the factors that influence loan interest rates is crucial. These rates can significantly impact the overall cost of your project. Here’s what you need to know:

Credit Score

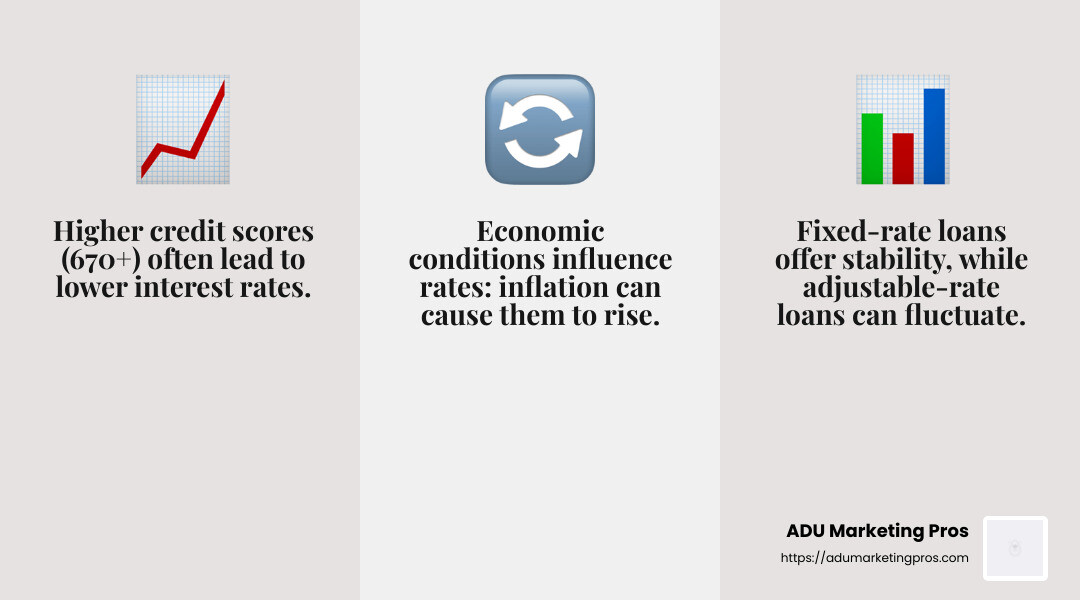

Your credit score is a key player in determining your interest rate. Lenders see it as a measure of your reliability in repaying loans. A higher credit score (typically 670 or above) can help secure lower interest rates. If your score needs improvement, consider checking for errors on your credit report, paying bills on time, and possibly opening a secured credit card to build a stronger credit history.

Loan Term & Type

The structure of your loan also plays a role. Fixed-rate loans offer stability with a consistent interest rate throughout the term, protecting you from market fluctuations. On the other hand, adjustable-rate loans might start with a lower rate but can increase over time, potentially leading to higher costs. Consider the term and type carefully to align with your financial strategy.

Market Conditions

Economic factors like inflation, recession, and housing market demand can influence interest rates. In times of economic uncertainty, rates may rise to counteract inflation, or they could drop to encourage borrowing. Keeping an eye on market trends can help you lock in a favorable rate.

Lender Policies

Different lenders have unique policies and risk assessments that affect the rates they offer. Shopping around is essential. Compare offers from multiple lenders to find the best rate for your situation. A lower rate can save you thousands over the life of your loan.

Understanding these factors can help you make informed decisions about your ADU financing. By optimizing your credit score, choosing the right loan type, monitoring market conditions, and comparing lender offers, you can secure a more favorable interest rate.

Next, we’ll tackle some of the most frequently asked questions about ADU financing options to help you steer your choices with confidence.

Frequently Asked Questions about ADU Financing Options

Building an ADU can be a fantastic investment, but financing it can feel overwhelming. Let’s tackle some common questions to help you understand the ADU financing options available.

What is the best loan to build an ADU?

Choosing the best loan depends on your financial situation and goals. Here are a few popular options:

-

Home Equity Loans: These are ideal if you have significant equity in your home. They offer a fixed interest rate and provide a lump sum upfront, making budgeting easier.

-

Cash-Out Refinancing: This replaces your existing mortgage with a new, larger one. You receive the difference as cash, which can be used to fund your ADU. It’s beneficial if you can secure a lower interest rate than your current mortgage.

-

HELOC (Home Equity Line of Credit): With a HELOC, you can borrow against your home’s equity as needed, similar to a credit card. It offers flexibility but comes with variable interest rates.

How does financing an ADU work?

Financing an ADU typically involves borrowing against the equity in your home or utilizing specific loans designed for renovations. Here’s a quick rundown:

-

Equity Borrowing: This includes home equity loans and HELOCs, where you use the value built up in your home to fund the ADU construction.

-

Construction Loans: These are short-term loans that cover the cost of building the ADU. They usually convert into a permanent mortgage once construction is complete.

-

Renovation Mortgages: Options like the FHA 203(k) allow you to finance both the purchase of a home and the cost of its rehabilitation, including ADU construction. This loan is based on the future value of the home after renovations.

What new federal policy allows you to finance an ADU?

The FHA 203(k) loan is a federal policy that supports financing for ADU construction. It allows you to borrow based on the future value of your property after the ADU is built. This can significantly increase your borrowing power. Additionally, rental income from the ADU can sometimes be factored into your loan eligibility, enhancing your financing options.

These ADU financing options offer various paths to funding your project, each with its own advantages. Understanding them can help you choose the best route to bring your ADU vision to life.

Next, we’ll explore how ADU Marketing Pros can help you craft a financing strategy custom to your needs.

Conclusion

Navigating ADU financing options can be complex, but having a solid strategy is crucial. At ADU Marketing Pros, we specialize in helping ADU construction and architecture firms not only market their services effectively but also understand the financial landscape that supports their projects.

Our expertise lies in crafting marketing strategies that highlight your firm’s strengths and expertise, enabling you to attract high-quality leads who are ready to invest in premium ADU projects. By focusing on the unique challenges and opportunities within the ADU market, we ensure that your firm stands out in a crowded field.

Financing Strategy

A successful ADU project starts with a well-thought-out financing strategy. Understanding the various financing options—such as home equity loans, HELOCs, and construction loans—allows you to align your financial planning with your construction goals. We emphasize the importance of choosing a financing option that matches your specific needs and future aspirations. Whether it’s leveraging the future value of your home or tapping into rental income potential, having a clear plan is essential.

Market Research

Staying informed about market trends and economic conditions is also vital. At ADU Marketing Pros, we conduct continuous market research to provide you with data-driven insights. This helps you adapt your financing plans to evolving regulations and consumer behaviors. By understanding these dynamics, you can make informed decisions that improve your project’s success.

In conclusion, partnering with ADU Marketing Pros means gaining not only marketing expertise but also strategic insights into the financial aspects of ADU projects. Our goal is to support your growth and ensure that your firm becomes the go-to choice for clients seeking quality and expertise.

For more information on how we can help your firm succeed, explore our services. Let’s work together to turn your ADU vision into reality.