Understanding What ADU Stands For: A Simple Definition

ADU stands for Accessory Dwelling Unit. At its core, this term refers to a secondary, self-contained home built on the same property as a primary single-family residence. But this simple definition barely scratches the surface of what an ADU represents in today’s housing landscape. It’s more than just extra space; it’s a versatile solution to complex modern challenges, from housing affordability to evolving family structures.

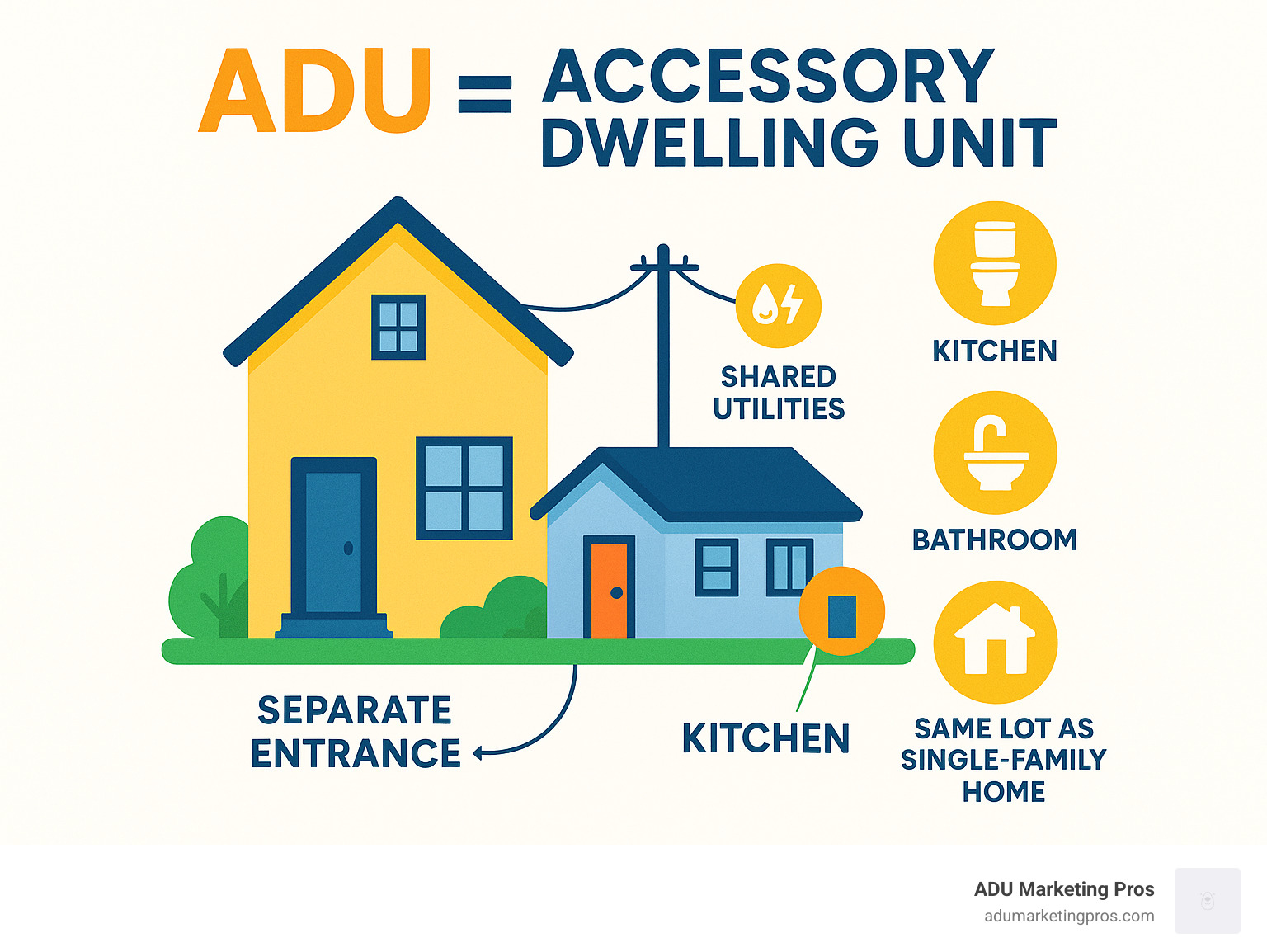

To be officially classified as an ADU, a structure must meet several key criteria:

- A Complete, Independent Living Space: It must contain everything needed for someone to live independently, including its own kitchen, bathroom, and sleeping area.

- Located on the Same Lot: It shares the property lot with a primary home.

- Separate Entrance: It must have its own entrance, separate from the main house, ensuring privacy for both occupants.

- Cannot Be Sold Separately: An ADU is legally tied to the primary residence; it cannot be sold as a separate piece of real estate like a condominium.

If you’ve heard terms like “granny flat,” “in-law suite,” or “backyard cottage,” you’re already familiar with the concept. These are simply colloquial names for different styles and uses of Accessory Dwelling Units.

The rise of the ADU isn’t a fleeting trend; it’s a direct response to significant societal shifts. Consider the data: 1-2 person households now represent 62% of all households in the United States. This demographic reality means that the traditional large, single-family home is often oversized and inefficient for the majority of the population. ADUs offer a right-sized housing option that better aligns with how people live today.

This movement has been boostd by legislative changes, particularly in states like California, which have passed sweeping pro-ADU laws to combat a severe housing shortage. These laws streamline the approval process, reduce fees, and limit restrictive local ordinances, making it easier than ever for homeowners to build. The result is a boom in construction that adds desperately needed housing stock one backyard at a time.

For homeowners, an ADU is a powerful financial tool. Beyond providing a home for family or a flexible workspace, it’s a significant investment. A well-executed ADU can increase a property’s value by 20% to 30% and generate substantial rental income. While the costs can be significant, typically ranging from $120,000 to over $400,000, the long-term financial returns are often compelling.

This article will serve as your comprehensive guide to understanding ADUs. We’ll move beyond the simple definition of what ADU stands for to explore the different types you can build, unpack the significant financial and lifestyle benefits, and honestly address the potential challenges and costs involved. Whether you’re a homeowner contemplating this journey or a professional guiding clients, understanding these units is essential in today’s real estate market.

What “ADU Stands For”: The Official Definition and Common Names

ADU stands for Accessory Dwelling Unit. While the acronym might sound like bureaucratic jargon, it describes a powerful and increasingly popular housing concept: a complete, smaller home that shares the same property as a larger, primary residence. The defining characteristic of an ADU is its self-sufficiency. To qualify as a true ADU, it must be a fully functional living space, complete with its own kitchen facilities, a bathroom, and a separate entrance.

This requirement for a kitchen is non-negotiable and is what legally distinguishes an ADU from a simple guest room, pool house, or home office. Without facilities for cooking, you have an accessory structure, but not an accessory dwelling unit. This distinction is crucial for zoning, permitting, and property valuation.

While the official term is “ADU,” these versatile structures go by many charming and descriptive names, often reflecting their intended use:

- Granny Flat: Perhaps the most well-known term, it evokes the unit’s most popular use: providing a nearby, independent home for aging parents.

- In-Law Suite: A similar concept to the granny flat, this name is commonly used for attached or interior units designed for extended family.

- Backyard Cottage: This name paints a picture of a quaint, detached unit nestled in a garden, often used as a rental or guest house.

- Casita: Spanish for “little house,” this term is prevalent in the American Southwest and describes a small, often detached, guest home.

- Carriage House / Coach House: A historical term for buildings that originally housed horse-drawn carriages with living quarters above. Today, these are often converted into stylish, standalone ADUs.

- Secondary Unit: A straightforward, functional term used by planners and builders that gets the point across without any fuss.

It’s also vital to distinguish an ADU from a tiny house on wheels (THOW). While both offer compact living, an ADU is built on a permanent foundation and is legally considered part of the real property. A THOW is legally classified as a recreational vehicle (RV), which subjects it to different rules regarding parking, utilities, and long-term residency. An ADU adds permanent, appraisable value to your property; a THOW does not. For a deeper dive into the fundamentals, The ABCs of ADUs (PDF) from AARP offers excellent foundational knowledge.

The Different Types of Accessory Dwelling Units

ADUs are not a one-size-fits-all solution. They come in several distinct forms, each with its own set of costs, benefits, and considerations.

1. Detached ADU (DADU)

A detached ADU, sometimes called a backyard cottage or DADU, is a standalone structure built from the ground up and separate from the main house.

- Cost: Typically the most expensive option, ranging from $200,000 to $400,000+, as it requires a new foundation, structure, and utility connections.

- Advantages: Offers the highest level of privacy for both the main home occupants and the ADU residents. Allows for complete design freedom.

- Disadvantages: Highest cost and requires sufficient yard space, which is sacrificed in the process.

- Best for: Maximizing rental income and providing housing for family members where privacy is a top priority.

2. Attached ADU

An attached ADU shares at least one wall with the primary residence. It is essentially a new addition to the home designed for independent living.

- Cost: Generally less expensive than a detached unit, from $150,000 to $300,000, as it can often tie into the main home’s existing foundation and utilities.

- Advantages: More cost-effective than a detached build while still offering a separate entrance and a high degree of privacy. Can be a good option for smaller lots.

- Disadvantages: Less privacy than a detached unit. Construction can be more disruptive to the main home’s occupants.

- Best for: Homeowners who want to add a unit but have limited yard space or a smaller budget.

3. Garage Conversion ADU

This popular option involves changing an existing attached or detached garage into a complete living unit.

- Cost: One of the most budget-friendly choices, typically running $120,000 to $200,000, because the foundation, walls, and roof are already in place.

- Advantages: Excellent use of an often-underused structure. Faster construction timeline and lower cost.

- Disadvantages: The homeowner loses covered parking and storage space. The long, narrow layout of a garage can present design challenges.

- Best for: Budget-conscious homeowners in areas where off-street parking is not a major concern.

4. Interior Conversion ADU

This involves converting existing space within the primary home—such as a large master suite, a basement, or an attic—into a self-contained ADU.

- Cost: Highly variable depending on the space, but often comparable to or slightly less than a garage conversion ($120,000 – $225,000).

- Advantages: Makes use of existing square footage that may be unused. Can be the least expensive option if plumbing and electrical are already nearby.

- Disadvantages: Reduces the living area of the main home. Soundproofing and creating a truly separate feel can be challenging. Basement and attic conversions require adequate ceiling height and egress windows.

- Best for: Homes with excess interior space, such as empty nesters in a large family home.

5. Junior Accessory Dwelling Unit (JADU)

A JADU is a specific category created by California law to encourage the creation of smaller, more affordable units.

- Cost: The most affordable option, often under $100,000.

- Rules: JADUs must be no larger than 500 square feet, be contained entirely within the existing walls of the primary home (including an attached garage), and have an exterior entrance. They can share a bathroom with the main house, and the kitchen must be an “efficiency kitchen” with smaller appliances and counters. In most cases, the property owner must reside in either the main house or the JADU.

- Best for: Homeowners seeking the lowest-cost entry point to create a small rental or a space for a single family member.

Key Characteristics That Define an ADU

Understanding what ADU stands for goes beyond the acronym; it’s about grasping the core principles that make these units a unique and valuable housing type.

- Accessory to Primary Home: The ADU is always subordinate to the main house. They are bought and sold together as a single property.

- Smaller Size: ADUs are inherently smaller than the primary residence. This smaller footprint leads to lower utility costs, less maintenance, and a more sustainable form of housing. New detached ADUs are typically 44% smaller per capita than standard new rental units.

- Shared Ownership: One owner or ownership entity holds the title to the entire property, including both the primary home and the ADU. This simplifies ownership compared to a duplex or condo.

- Independent Living: This is the functional heart of an ADU. With its own kitchen, bath, and entrance, it allows a resident to live a completely separate day-to-day life.

- Shared Utilities: While separate meters are sometimes possible, most ADUs tie into the main home’s water, sewer, and electrical systems. This shared infrastructure is a key factor in keeping construction costs lower than building a new single-family home on a separate lot. For a detailed look at how these principles apply in a major market, see our guide: What is an ADU? Accessory Dwelling Unit Explained.

Why Build an ADU? Unpacking the Benefits and Drawbacks

Building an ADU is a major financial and personal decision. To make an informed choice, it’s crucial to understand what an ADU stands for in a practical sense—how it can concretely impact your finances, property, and lifestyle. The decision involves weighing a powerful set of advantages against a number of very real challenges and responsibilities.

Here, we provide a balanced and honest look at both the compelling reasons to build an ADU and the potential problems you may encounter on the journey.

The Upside: What an ADU stands for in lifestyle and financial benefits

The motivations for building an ADU are diverse, but they generally fall into categories of financial gain, family support, and lifestyle flexibility. These benefits work together to make ADUs one of the most impactful home improvement projects a property owner can undertake.

1. Significant Rental Income Potential

For most homeowners, the primary driver is the potential for passive income. In high-demand housing markets like those across California, a one or two-bedroom ADU can generate $1,500 to $3,000+ per month. This consistent cash flow can be transformative, helping to cover the mortgage on the primary home, pay off the ADU construction loan, or build long-term wealth. With a typical construction payback period of 7-12 years, an ADU can become a pure profit center for decades to come. For a deeper analysis, explore our guide on ADU Rental Income.

2. Substantial Increase in Property Value

An ADU is not just an expense; it’s an investment in your property’s equity. A permitted, well-built ADU is a legal second dwelling that significantly increases the value of your home. Studies and market data consistently show that properties with ADUs are valued 20% to 35% higher than comparable homes without them. This value increase is often greater than the cost to build, meaning you can generate equity almost immediately upon completion.

3. Enabling Multigenerational Living

As housing costs continue to rise, more families are choosing to live together. ADUs provide the perfect solution, offering a way to keep family close while preserving individual privacy and autonomy. They allow adult children to save for their own homes, provide a safe and supportive environment for aging parents, or simply keep the family unit connected. This proximity fosters stronger family bonds and mutual support without the friction of sharing a single living space.

4. Supporting Aging in Place

ADUs are a cornerstone of the “aging in place” movement, allowing seniors to live independently in their own community for as long as possible. These units can be designed from the ground up with universal design principles: no-step entries, wider doorways, walk-in showers, and grab bars. This provides a safe, accessible home for aging parents, with family caregivers just steps away.

5. Best Housing Flexibility

Life is unpredictable, and an ADU provides a flexible asset that can adapt to your changing needs. Today’s rental unit can become tomorrow’s home for a boomerang child. A home office during your working years can transform into a caregiver’s residence later on. It can serve as a guest suite, an art studio, or a quiet retreat. This adaptability ensures your property continues to serve your needs for years to come, without the expense and disruption of moving.

6. Positive Environmental Impact

Building an ADU is a form of gentle, sustainable development. By creating housing within existing neighborhoods, ADUs use established infrastructure like roads, schools, and utilities. This infill development helps curb urban sprawl and reduces the carbon footprint associated with new suburban construction. Because they are smaller, they also consume fewer resources to build and require less energy to heat and cool.

The Downside: Potential Drawbacks and Challenges

While the benefits are clear, a successful ADU project requires navigating some significant challenges. It’s essential to go in with your eyes open to the costs, responsibilities, and trade-offs.

1. High Initial Construction and Soft Costs

The primary barrier for most homeowners is the upfront cost. A project can range from $120,000 for a simple conversion to over $400,000 for a custom detached unit. These “hard costs” (labor and materials) are only part of the picture. You must also budget for “soft costs” (5-15% of the total), which include architectural design fees, structural engineering, soil reports, and city permit fees. The California Department of Housing and Community Development offers resources to help homeowners understand these requirements.

2. The Challenge of Financing

Unless you have the cash on hand, securing financing for an ADU can be complex. Common financing options include:

- Home Equity Line of Credit (HELOC): A flexible line of credit based on your home’s equity, but often with variable interest rates.

- Cash-Out Refinance: You take out a new, larger mortgage on your home and receive the difference in cash to fund the project. This can secure a fixed rate but resets your entire mortgage.

- Construction or Renovation Loan: A short-term loan specifically for the build, which is then often refinanced into a traditional mortgage. These can be more complicated to secure.

3. Loss of Yard Space, Parking, or Storage

Building an ADU always involves a trade-off. A detached ADU will consume a portion of your backyard, reducing space for gardening, recreation, or pets. A garage conversion means sacrificing covered parking and valuable storage space, which can be a major inconvenience in urban areas.

4. Ongoing Maintenance and Repairs

Your property maintenance responsibilities effectively double. You are now responsible for the upkeep of two separate homes, including two roofs, two water heaters, and two sets of appliances. When a pipe bursts or an appliance fails in the ADU, it’s your responsibility to fix it promptly.

5. Becoming a Landlord

If you plan to rent your ADU, you must be prepared for the realities of being a landlord. This includes marketing the property, screening tenants, drafting legal lease agreements, collecting rent, handling tenant complaints, and understanding local landlord-tenant laws, which can be complex. It is a business, and it requires time, patience, and emotional energy.

6. Increased Property Taxes

Once your ADU is completed and permitted, the county assessor will reassess your property’s value. This will result in an increase in your annual property taxes. The good news is that only the value of the new construction is reassessed, not the entire property. This “blended assessment” results in a more modest increase than many fear, but it must be factored into your long-term financial calculations.