Why the ADU vs Tiny House Debate Matters More Than Ever

When comparing ADU vs tiny house options, you’re looking at two distinct paths to compact living that serve different needs, budgets, and lifestyles.

Quick Answer: Key Differences

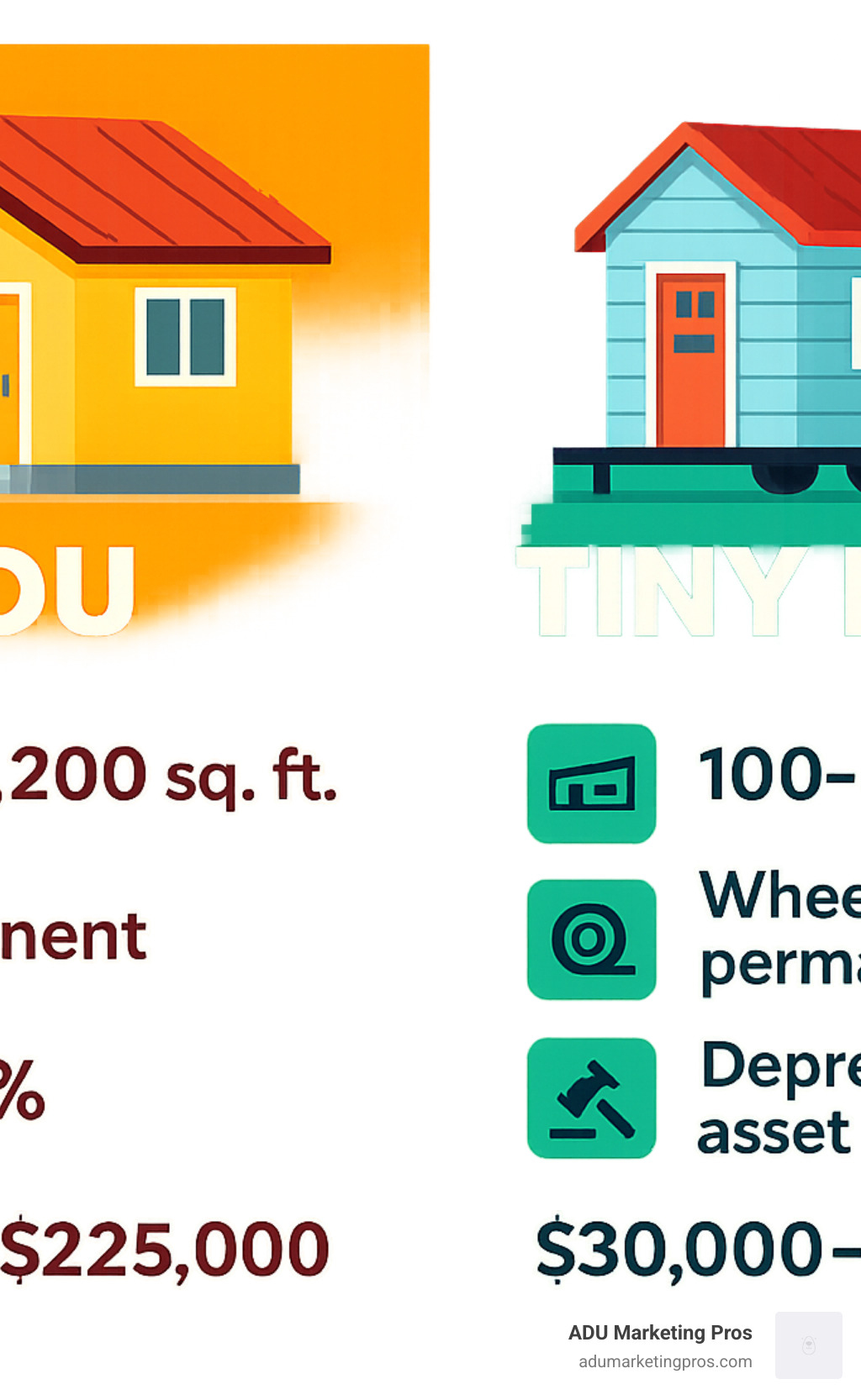

| Factor | ADU | Tiny House |

|---|---|---|

| Size | 150-1,200 sq ft | 100-400 sq ft |

| Foundation | Permanent | Wheels or permanent |

| Legal Status | Dwelling unit | Often classified as RV |

| Cost | $60,000-$225,000 | $30,000-$100,000 |

| Property Value | Increases 7-30% | No increase (depreciating asset) |

| Mobility | Fixed location | Can be moved |

The housing crisis has pushed alternative living solutions into the spotlight. With home prices at record highs and California’s housing shortage reaching critical levels, both ADUs and tiny houses offer compelling answers to different problems.

ADUs solve the investment puzzle. They’re permanent structures that add real value to your property while providing rental income or multigenerational housing options.

Tiny houses solve the mobility puzzle. They offer affordable homeownership with the freedom to relocate, appealing to minimalists and those seeking location independence.

But here’s where it gets complex: a tiny house can sometimes qualify as an ADU under certain conditions. The legal landscape varies dramatically by state and city, making the choice more nuanced than simple size comparisons.

Recent data shows ADUs can increase property values by up to 30%, while tiny home insurance costs just $600 annually compared to $500-$1,500 per six months for ADU coverage. These financial realities shape real-world decisions for homeowners and investors alike.

ADU vs Tiny House 101: Definitions, Size & Structure

When you’re weighing ADU vs tiny house options, you’re really comparing two completely different approaches to compact living. The differences go way beyond just size—they affect everything from your mortgage options to where you can legally park your new home.

Let’s start with the official definitions. The International Residential Code (IRC) Appendix Q gets pretty specific: tiny houses max out at 400 square feet of floor area (lofts don’t count toward this limit). Meanwhile, California’s ADU laws are much more generous, allowing accessory dwelling units up to 1,200 square feet, with a minimum of just 150 square feet.

But here’s the real game-changer: foundation requirements. ADUs must be permanently attached to foundations and hooked up to utilities like any traditional home. Tiny houses? They can roll down the highway on wheels or sit on a permanent foundation—your choice.

This foundation difference isn’t just about convenience. It determines whether your local building department or the DMV handles your paperwork. It affects your insurance options (HO-7 policies for tiny houses versus HO-3 for ADUs). Most importantly, it decides whether you’re building an appreciating asset or buying what’s essentially a really nice RV.

| Comparison Factor | ADU | Tiny House |

|---|---|---|

| Size Range | 150-1,200 sq ft | 100-400 sq ft |

| Foundation | Permanent required | Wheels or permanent |

| Building Codes | Full IRC compliance | IRC Appendix Q |

| Utility Connections | Required hookups | Optional/off-grid capable |

| Legal Classification | Dwelling unit | Often RV classification |

What Is an ADU?

An Accessory Dwelling Unit is basically a complete mini-home that shares a property with your main house. Think of it as your home’s younger sibling—smaller, but fully capable of independent living.

Every ADU needs its own kitchen and bathroom—that’s non-negotiable. Beyond that, you’ve got flexibility in how you build it. Attached ADUs connect directly to your main house, often as additions or converted spaces. Detached ADUs stand alone in your backyard like tiny cottages. Conversion ADUs transform existing spaces like garages, basements, or even large closets into complete living units.

The beauty of ADUs lies in their status as appreciating assets. Since they’re permanent structures, they boost your property’s assessed value and can provide steady rental income. California made them even more attractive in 2023 by eliminating owner-occupancy requirements—now you can rent out both your main house and ADU if you want.

Getting your ADU permitted involves working with your local building department, just like any home addition. More info about ADU permits can walk you through California’s specific requirements, which tend to be more ADU-friendly than most states.

What Is a Tiny House

A tiny house is a micro-dwelling of 400 square feet or less that packs all the essentials of home into an incredibly efficient space. We’re talking bedroom, bathroom, kitchen, and living area—all in a footprint smaller than most people’s garages.

Most tiny houses fall into the Tiny Houses on Wheels (THOW) category, built on trailers for maximum mobility. This RV classification opens up interesting possibilities: you can relocate for work, follow good weather, or just satisfy your wanderlust. But it also creates challenges with zoning laws and parking restrictions.

The tiny house movement appeals to people seeking minimalist lifestyles who prioritize experiences over possessions. Living in 400 square feet forces you to be intentional about everything you own. Many tiny house dwellers report feeling liberated from the burden of maintaining and filling larger spaces.

Mobility sets tiny houses apart from every other housing option. Your home can literally follow you wherever life takes you—assuming you can find legal places to park it, which admittedly can be tricky.

When a Tiny House Becomes an ADU

Here’s where the ADU vs tiny house debate gets really interesting: under the right conditions, a tiny house can legally transform into an ADU. It’s like housing shape-shifting, and it’s happening more often than you might think.

The magic happens when you place a tiny house on a permanent foundation and connect it to your main house’s utilities. Suddenly, your mobile tiny house becomes a stationary ADU that complies with zoning regulations and building codes.

San Diego offers a perfect example of this crossover. The city welcomes detached tiny homes between 150-430 square feet as official ADUs when they’re placed on concrete pads and properly connected to utilities. These units can even maintain their DMV registration while functioning as legitimate ADUs.

This hybrid approach gives you the best of both worlds: the thoughtful, efficient design of a tiny house with the legal clarity and property value benefits of an ADU. You get compact living that actually increases your home’s worth instead of just sitting in your driveway like an expensive RV.

The key requirements for this change include utility hookups for water, sewer, and electrical systems, plus meeting local setback requirements and safety codes like proper egress windows. It’s more involved than just parking a tiny house, but the payoff in terms of legal security and property value can be substantial.

The Legal & Zoning Landscape

The legal world of ADU vs tiny house projects can feel like a maze, but understanding the rules upfront saves you headaches down the road. The good news? The regulatory landscape is becoming more friendly to compact living solutions, especially in California.

Building setbacks—those required distances from property lines—affect both ADUs and tiny houses, though ADUs often get more relaxed treatment. California made a game-changing move in 2023 by eliminating owner-occupancy requirements for ADUs. This means you can now rent out your main house and your ADU without living in either one.

Here’s where things get interesting: ADUs and tiny houses live in completely different regulatory worlds. Your ADU project goes through the building department just like any home addition. But that cute tiny house on wheels? It might need DMV registration alongside building permits, depending on your local rules.

Insurance companies see this distinction clearly too. ADUs typically slide under your regular homeowner’s policy (HO-3) as permanent structures. Tiny houses often need specialized RV-style coverage (HO-1 or HO-7 policies) with different costs and coverage limits.

The regulatory split makes sense when you think about it. A permanent ADU functions like any other part of your property. A mobile tiny house operates more like a really nice RV that happens to have granite countertops.

State-by-State Snapshot (Focus on California)

California has become the golden child of ADU legislation, allowing units up to 1,200 square feet statewide while letting cities set their own specific rules. This progressive approach has sparked an ADU construction boom from San Francisco to San Diego.

The state’s approach to tiny home regulation follows comprehensive building standards guidelines that help clarify when these compact dwellings can qualify as legitimate housing units.

San Diego deserves special mention for its creative approach to the ADU vs tiny house question. The city allows tiny homes between 150-430 square feet to officially qualify as ADUs when they’re properly placed on permanent foundations and connected to utilities. It’s like having your cake and eating it too—tiny house efficiency with ADU legal status.

Oregon and Washington take different approaches that highlight how much location matters. Oregon streamlines ADU permitting to boost affordable housing, while Washington ties size limits to lot dimensions for urban density goals. These differences show why researching your local rules is absolutely critical before making your choice.

California sweetens the deal with real money. The California Housing Finance Agency offers ADU grants that reimburse pre-development costs, and many cities throw in permit fee waivers and fast-track approvals. It’s like the state is saying “please build more housing”—because they basically are.

Permits & Inspections You’ll Need

The permitting process reveals one of the biggest practical differences in ADU vs tiny house projects. ADUs require the full treatment—building permits covering structural, electrical, plumbing, and mechanical systems with the same standards as traditional homes.

Your ADU permit journey typically includes building permits with structural plans, electrical permits for service upgrades, plumbing permits for water and sewer connections, and mechanical permits for HVAC systems. It’s comprehensive, but it also means your finished ADU meets the same safety standards as any house.

The timeline reality check: expect 4-6 months for construction inspections, with total project duration reaching 9-12 months including design and permitting phases. More info about ADU design trends can help you plan more efficiently and avoid common delays.

Tiny houses face a more complicated permitting puzzle depending on their foundation type. Permanent foundation tiny houses follow similar permitting to ADUs—makes sense since they’re basically small houses. But wheeled versions might only need parking permits and utility connections in some areas, though this varies wildly by jurisdiction.

The inspection process for ADUs follows standard residential construction protocols. You’ll have foundation inspections, framing inspections, electrical rough-in, plumbing rough-in, insulation, and final inspections. It’s thorough, but it also means you’re building something that meets serious safety standards.

Cost, Financing & ROI

The financial comparison between ADU vs tiny house options involves upfront construction costs, ongoing maintenance, insurance premiums, and long-term value appreciation that can dramatically impact your return on investment.

ADUs represent appreciating assets that permanently increase property value, while tiny houses typically depreciate like vehicles when built on wheels. This fundamental difference shapes financing options, insurance costs, and resale potential.

Construction costs vary widely based on size, finishes, and local labor rates. ADUs average $300-$500 per square foot, while tiny houses range from $150-$250 per square foot for DIY builds and $250-$400 for professional construction.

Insurance costs favor tiny houses in the short term. Tiny home insurance averages $600 annually, while ADU coverage ranges from $500-$1,500 per six-month policy. However, ADUs benefit from homeowner’s insurance integration and potential rental income coverage.

Up-Front Build Costs

ADU construction typically costs between $60,000-$225,000 depending on size, location, and finish quality. A modest 364-square-foot one-bedroom ADU might start around $200,000, while a larger 1,200-square-foot two-bedroom unit can exceed $470,000 in high-cost areas.

Tiny house costs range from $30,000-$100,000+ based on construction method and customization level. DIY builders can achieve costs as low as $20,000-$50,000, while turnkey professional builds often reach $80,000-$120,000 for premium finishes.

Prefab options offer middle-ground pricing for both housing types. Prefab ADUs provide cost savings through factory construction efficiency, while prefab tiny houses benefit from standardized designs and bulk material purchasing.

The cost differential reflects different value propositions: ADUs prioritize permanent value addition and rental income potential, while tiny houses emphasize affordability and mobility. More info about ADU construction cost provides detailed breakdowns for planning purposes.

Financing Paths & Incentives

Financing options differ significantly between ADU vs tiny house projects due to their legal classifications and asset types. ADUs qualify for traditional real estate financing, while tiny houses often require alternative lending approaches.

Popular ADU financing methods include:

– Home Equity Lines of Credit (HELOCs): Leverage existing home equity

– Renovation loans: FHA 203(k) and conventional renovation mortgages

– RenoFi loans: Up to 150% loan-to-value based on after-renovation value

– Personal loans: Unsecured options for smaller projects

California’s CalHFA ADU grant program offers up to $40,000 in pre-development cost reimbursement for qualified projects. Many cities provide additional incentives like permit fee waivers and expedited processing.

Tiny house financing typically involves:

– RV loans: Terms up to 15 years for wheeled units

– Personal loans: Usually capped at 7 years with higher interest rates

– Manufacturer financing: Direct financing through tiny house builders

– Cash purchases: Many buyers save up for outright purchases

The financing landscape reflects risk assessment differences. Lenders view ADUs as secured real estate investments, while tiny houses on wheels are considered depreciating personal property similar to vehicles.

Long-Term Value & Rental Math

ADUs deliver superior long-term financial returns through property value appreciation and rental income potential. Research shows ADUs can increase home values by 7-10% for simple in-law suites and up to 30% for full-featured units.

Rental income provides ongoing cash flow. ADU rental rates vary by location but often generate $1,500-$3,500 monthly in California markets. This income stream can offset construction costs over 5-10 years while building long-term equity.

Tiny houses offer different financial benefits. Short-term rental income through platforms like Airbnb can generate $800-$1,000+ monthly, though this requires active management and favorable zoning. The lower entry cost appeals to first-time homebuyers and those seeking housing cost reduction.

The investment math favors ADUs for wealth building and tiny houses for lifestyle optimization. ADUs function as real estate investments with appreciation potential, while tiny houses provide affordable homeownership with mobility benefits.

Lifestyle Fit: Pros, Cons & Best Use-Cases

The ADU vs tiny house decision isn’t just about square footage or building codes—it’s about how you want to live your life. Think of it as choosing between planting roots or keeping your options open.

When my neighbor Sarah built an ADU for her aging mother, she finded something unexpected. Her mom loved having her own space but could still pop over for Sunday dinner. Meanwhile, her friend Jake chose a tiny house and spent last winter in Arizona, working remotely from a desert RV park. Two completely different approaches to the same housing challenge.

Privacy works differently in each option. ADUs give you that sweet spot of independence with connection—separate kitchens, separate entrances, but shared property lines. It’s like having your own apartment in your family’s neighborhood. Tiny houses offer complete privacy but might leave you feeling isolated, especially if you’re parked on someone else’s land.

The mobility factor creates the biggest lifestyle split. ADUs anchor you to a community where you can build relationships with neighbors, join local groups, and watch the corner coffee shop evolve over the years. Tiny houses let you chase perfect weather, explore new cities, or follow job opportunities without the stress of selling real estate.

Both options appeal to environmentally conscious folks, just in different ways. ADUs fight urban sprawl by adding housing without new infrastructure. Tiny houses minimize your environmental footprint through smaller energy usage and fewer possessions.

ADU Pros & Cons

The financial benefits of ADUs can be life-changing. Rental income of $1,500-$3,500 monthly helps many homeowners afford their mortgages or build retirement savings. Plus, that 7-30% property value increase means you’re building wealth while you sleep.

Multigenerational living has become increasingly popular, especially after the pandemic showed us how much family matters. ADUs let adult children save money while maintaining independence, or allow aging parents to stay close without cramping anyone’s style.

The larger living space makes a huge difference for daily comfort. At 150-1,200 square feet, you can actually have friends over for dinner, work from a proper home office, or store seasonal belongings without playing Tetris.

Legal clarity simplifies everything from insurance to financing. Banks understand ADUs, insurance companies have standard policies, and you won’t spend weekends researching obscure zoning laws.

But ADUs aren’t perfect. Higher upfront costs of $60,000-$225,000 put them out of reach for many people. You’re also committed to one location—great if you love your neighborhood, challenging if your job requires relocation.

The construction timeline tests your patience. Nine to twelve months from planning to completion means living with construction noise, permit delays, and budget surprises. If you decide to rent it out, you’ll become a landlord with all the tenant calls and maintenance responsibilities that entails.

More info about ADU rental market trends can help you understand income potential in your specific area.

Tiny House Pros & Cons

Lower entry costs make tiny houses accessible to people priced out of traditional homeownership. At $30,000-$100,000, you might pay cash and eliminate monthly housing payments entirely. That’s freedom many people can only dream about.

Mobility opens up possibilities that fixed housing can’t match. Hate winter? Drive south. Found your dream job in another state? Take your house with you. Want to try living in the mountains for a year? Pack up and go.

The minimalist lifestyle forces you to focus on what truly matters. When you can only keep 100 items, you choose carefully. Many tiny house owners report feeling less stressed and more intentional about their choices.

Lower maintenance means more time for living and less time for chores. Cleaning 400 square feet takes minutes, not hours. Smaller systems break down less often and cost less to repair.

But tiny house living comes with real challenges. Zoning restrictions make legal parking complicated in many areas. You might find yourself constantly moving or living in legal gray areas that create stress.

Space limitations affect everything from cooking elaborate meals to storing winter clothes. Entertaining means moving outside, and privacy becomes precious when you’re sharing 200 square feet with a partner.

Financing difficulties force many people to save up for cash purchases or accept high-interest personal loans. The depreciation means your investment loses value over time, unlike traditional real estate.

Choosing Between ADU vs Tiny House

Your personal situation usually makes the ADU vs tiny house choice pretty clear once you’re honest about your priorities.

ADUs make sense when you own property with available space and want to build wealth while solving housing needs. They’re perfect for families wanting to keep elderly parents close, adult children saving for their own homes, or homeowners seeking rental income. If you have $60,000+ available and plan to stay put for several years, ADUs offer the best financial returns.

Tiny houses appeal to people who value experiences over possessions and flexibility over stability. They work well for remote workers, retirees wanting to travel, or anyone feeling overwhelmed by traditional homeownership costs. If your budget is under $80,000 and you’re comfortable with minimalist living, tiny houses provide remarkable freedom.

Some creative homeowners find hybrid solutions by building tiny houses on permanent foundations to qualify as ADUs. This approach combines compact design efficiency with legal clarity and property value benefits.

The choice ultimately depends on whether you’re building an investment or buying a lifestyle. ADUs build wealth and community connections. Tiny houses buy freedom and flexibility. Both solve housing challenges—just different ones.

Building, Utilities & Installation Steps

The construction process differs significantly between ADU vs tiny house projects, from site preparation and foundation work to utility connections and final inspections. Understanding these steps helps set realistic timelines and budgets.

Site preparation varies by project type. ADUs require foundation excavation, utility trenching, and potential main house modifications for attached units. Tiny houses need level parking areas and utility access points, with less extensive site work for wheeled units.

Foundation types reflect the permanent versus mobile distinction. ADUs use concrete slabs, crawl spaces, or full basements depending on local codes and site conditions. Tiny houses employ trailer frames for mobility or concrete pads for permanent placement.

Utility connections represent a major cost and complexity difference. ADUs require full residential utility installations with separate meters or connections to main house systems. Tiny houses can use off-grid systems or simplified hookups depending on placement and local regulations.

Timeline expectations should account for permitting, construction, and inspection phases. ADU projects typically span 9-12 months total, with 4-6 months for actual construction. Tiny house builds range from 3-6 months for custom construction or immediate delivery for prefab units.

Step-by-Step ADU Build Roadmap

Phase 1: Planning & Feasibility (1-2 months)

– Site evaluation and utility capacity assessment

– Zoning compliance verification and setback measurements

– Design development and architectural plans

– Contractor selection and initial budgeting

Phase 2: Permitting (2-4 months)

– Building permit application and plan review

– Utility connection approvals and capacity upgrades

– Environmental reviews if required

– Permit fee payment and approval receipt

Phase 3: Construction (4-6 months)

– Site preparation and foundation installation

– Framing, roofing, and exterior completion

– Electrical, plumbing, and HVAC rough-in

– Insulation, drywall, and interior finishes

– Final fixtures, appliances, and landscaping

Phase 4: Inspections & Occupancy (1 month)

– Progressive inspections during construction

– Final building inspection and certificate of occupancy

– Utility activation and system testing

– Move-in preparation and tenant marketing if applicable

The process benefits from early professional consultation to avoid costly delays or design changes. Backyard ADU ideas can inspire design choices that maximize space and functionality.

Step-by-Step Tiny House Setup

Option 1: Custom Build Process (3-6 months)

– Design finalization and material selection

– Trailer preparation and utility rough-in

– Shell construction and weatherproofing

– Interior finishing and appliance installation

– Transportation to final location

Option 2: Prefab Purchase (1-3 months)

– Model selection and customization options

– Factory production and quality control

– Delivery scheduling and site preparation

– Final hookups and system commissioning

Installation Requirements:

– Level parking area with adequate access

– Utility connections or off-grid system setup

– Parking permits or zoning compliance verification

– Insurance activation and registration completion

Tiny house setup varies dramatically based on mobility plans. Permanent placement requires foundation work and full utility connections similar to ADUs. Mobile units need secure tie-downs and flexible utility connections for easy disconnection.

Frequently Asked Questions about ADU vs Tiny House

Let’s tackle the most common questions people ask when weighing their ADU vs tiny house options. These answers will help clear up confusion about legal requirements, financing problems, and zoning rules.

What is the smallest legal ADU in California?

California keeps things simple with a 150-square-foot minimum for ADUs. That might sound tiny, but it’s actually quite workable when you include all the essentials—kitchen, bathroom, and sleeping area.

Your city can ask for more space, but they can’t go below that state minimum. Most places stick with the 150-square-foot rule, though some add extra requirements for things like wheelchair access or parking spots.

These micro-ADUs work best as multipurpose spaces. Think home office by day, guest room by night. Smart design tricks like fold-down beds, compact appliances, and furniture that does double-duty can make even 150 square feet feel surprisingly livable.

The key is being realistic about how you’ll use the space. A 150-square-foot ADU makes an excellent studio for an artist, a cozy retreat for visiting relatives, or a private workspace for remote employees.

Can I finance a tiny house with a traditional mortgage?

Here’s where things get tricky. Traditional mortgages don’t work for tiny houses on wheels because banks see them as personal property, like a fancy RV, rather than real estate.

But if you put that same tiny house on a permanent foundation and jump through the building code hoops, you might qualify for regular home financing. The catch? It needs to meet minimum size requirements and local building standards.

Your best bets for wheeled tiny houses include RV loans (up to 15 years), personal loans for smaller amounts, or financing directly through the tiny house builder. Some credit unions are getting creative with specialized tiny house loans that offer better terms than traditional lenders.

The financing world is slowly catching up to the tiny house movement. More lenders are creating specific loan products, but your options remain limited compared to traditional home financing.

Does a tiny house on wheels count toward my lot’s ADU allowance?

Generally, no. Most zoning codes treat tiny houses on wheels like RVs, which means they don’t count toward your property’s ADU allowance. Cities typically reserve ADU designations for permanent structures with foundations and proper utility connections.

But here’s the interesting part: if you put that tiny house on a permanent foundation and hook it up to utilities, it might qualify as your lot’s official ADU. This requires going through the same permitting and inspection process as traditional ADU construction.

Some forward-thinking places like San Diego are creating special rules that let certain tiny houses function as ADUs even with wheels. This trend might spread to other California cities as the ADU vs tiny house lines continue to blur.

The bottom line? Check with your local planning department before making assumptions. Zoning rules change frequently, and what’s not allowed today might be perfectly legal next year.

Conclusion

Making the ADU vs tiny house choice really comes down to what you value most: building wealth through real estate or embracing a mobile, minimalist lifestyle.

ADUs are the clear winner if you’re thinking like an investor. They permanently boost your property value by 7-30% while generating steady rental income of $1,500-$3,500 monthly in most California markets. Yes, you’ll spend more upfront—typically $60,000-$225,000—but you’re buying an appreciating asset that builds long-term wealth. Plus, you get legal clarity, traditional financing options, and the satisfaction of solving the housing crisis one unit at a time.

Tiny houses shine when affordability and freedom matter most. For $30,000-$100,000, you can own your home outright and take it anywhere (zoning laws permitting). They’re perfect for minimalists, remote workers, and anyone who’d rather spend money on experiences than mortgage payments. The trade-off? You’ll deal with zoning headaches, limited financing, and the reality that your home depreciates like a car.

Here’s something interesting: you don’t always have to choose sides. Some clever homeowners build tiny houses on permanent foundations to qualify as ADUs, combining compact design with property value benefits. It’s like getting the best of both worlds—if your local regulations allow it.

Your next steps should be refreshingly straightforward. Start by checking your local zoning requirements and honestly evaluating your budget. Can you handle the higher costs and longer timeline of an ADU for the investment benefits? Or does the tiny house path to affordable homeownership and mobility align better with your dreams?

Both options offer real solutions to today’s housing challenges. Whether you’re building an ADU for multigenerational living or hitting the road in a tiny house, you’re choosing intentional living over the status quo.

For ADU construction and architecture firms looking to connect with homeowners navigating these compact living decisions, understanding this market’s unique needs creates opportunities for meaningful client relationships. More info about our ADU marketing solutions shows how specialized marketing can effectively reach this growing segment of homeowners ready to invest in alternative housing solutions.