The Rise of ADUs and Fannie Mae’s Role in Accessible Housing

Fannie Mae ADU financing represents a critical pathway for homeowners looking to add significant value, generate passive income, or create flexible, independent living spaces on their property. As the housing affordability crisis deepens across the country, interest in Accessory Dwelling Units (ADUs) has surged. Understanding the specific financing rules set forth by a major secondary mortgage market player like Fannie Mae is no longer optional—it’s essential for success.

ADUs offer a potent, ground-level solution to the national housing shortage. They promote gentle density in existing neighborhoods without altering community character, providing vital housing stock for renters, aging parents, or adult children. In fact, a staggering 61% of homeowners cite multigenerational housing as their primary motivation for building an ADU. Beyond the social benefits, the financial incentives are compelling; a well-designed and legally permitted ADU can increase a property’s value by up to 35% while creating a new stream of rental income.

Fannie Mae has established a clear, albeit strict, framework for financing these projects. These guidelines differ significantly from those of other government-sponsored enterprises like Freddie Mac, as well as from local bank portfolio loans. For ADU construction professionals, architects, and designers, mastering these financial nuances is a powerful competitive advantage. Financing complications are one of the most common reasons homeowners abandon otherwise viable ADU projects. By understanding the rules, you can guide clients toward feasible designs and prevent costly roadblocks.

This guide breaks down the key requirements for securing a Fannie Mae-backed loan for a property with an ADU.

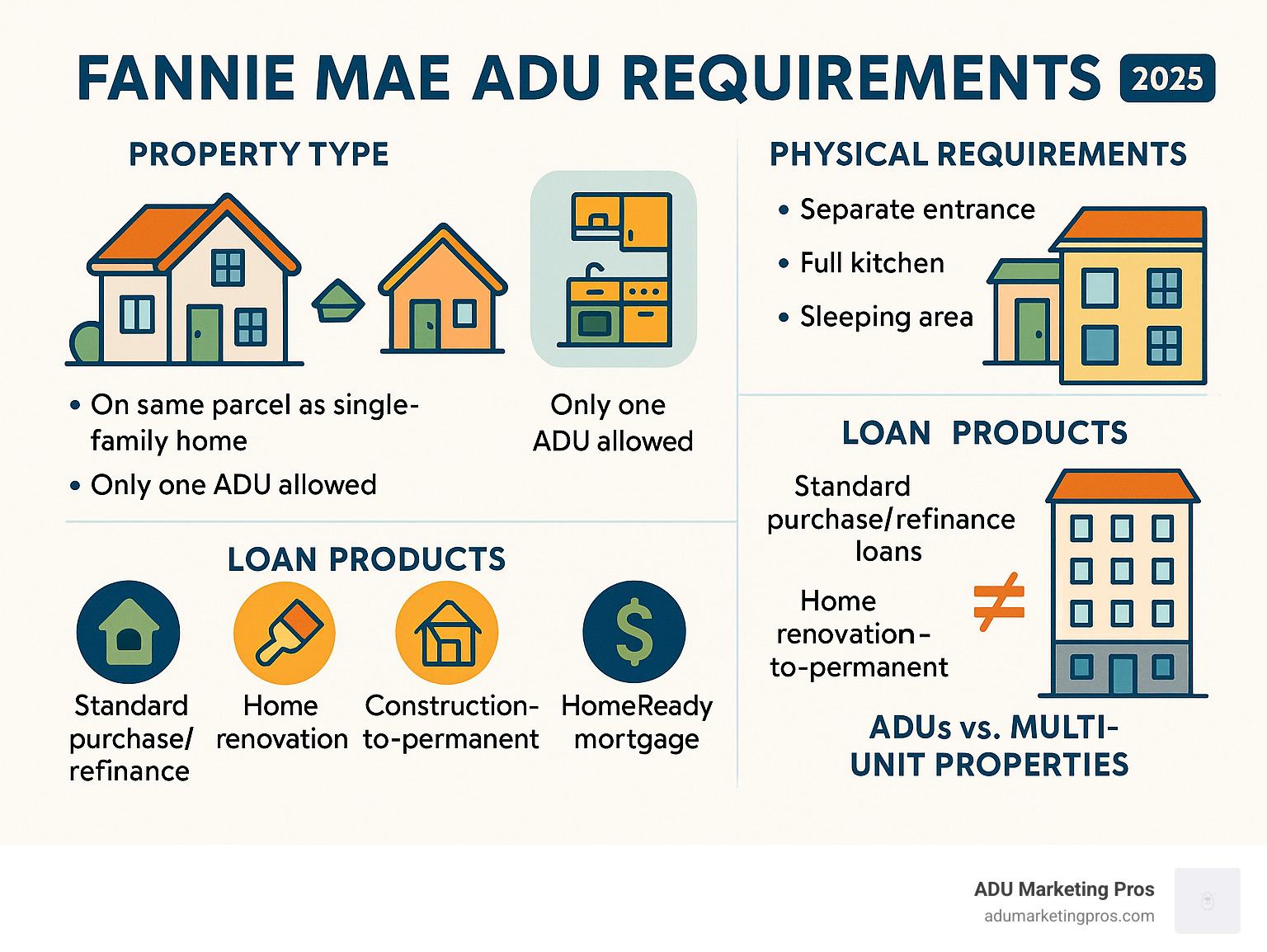

Key Fannie Mae ADU Requirements:

- Property Type: The ADU must be located on the same parcel as a primary single-family, one-unit home. Properties that are already 2-4 unit buildings are not eligible for ADU financing under these rules.

- Unit Count: Only one ADU is permitted per property. If a property has a main house and two additional units, it is classified as a three-unit property and falls under different underwriting guidelines.

- Physical Characteristics: The unit must function as an independent living space, which means it requires its own separate entrance, a full kitchen, a complete bathroom, and a dedicated sleeping area.

- Income Qualification: In most cases, borrowers must qualify for the mortgage based on their own income, without considering potential rental income from the ADU. The primary exception to this rule is the HomeReady® mortgage program.

Available Loan Products:

- Standard purchase and refinance loans for properties with existing ADUs.

- HomeStyle® Renovation loans to finance the construction of a new ADU.

- Construction-to-Permanent financing for building a new primary home and ADU together.

- HomeReady® mortgage, a specialized product that allows the use of ADU rental income for qualification.

What is an Accessory Dwelling Unit (ADU) Under Fannie Mae Guidelines?

Understanding precisely what qualifies as a Fannie Mae ADU is the foundational first step to a successful financing application. Fannie Mae’s guidelines are highly specific, crafted to ensure the secondary unit is a legitimate, independent living space. This detailed definition protects the borrower, the lender, and the integrity of the single-family mortgage market.

Defining a Fannie Mae ADU

A Fannie Mae ADU is a secondary housing unit situated on the same legal parcel as a primary single-family home. It can take many forms—a detached backyard cottage, a new apartment built above a garage, or a converted basement—but its core function must be that of a complete, separate home. Fannie Mae’s definition hinges on three key principles:

- Location: The ADU must share a lot with a one-unit, single-family home. It cannot be added to a property that is already a 2-4 unit dwelling. This rule is in place to maintain a clear distinction between a single-family home with an accessory feature and a true multi-unit investment property, which has different risk profiles and financing requirements.

- Quantity: Only one ADU is permitted per parcel. A property with a primary residence and two or more additional units is classified as a multi-unit property and is ineligible for standard ADU financing through Fannie Mae.

- Subordination: The ADU must be smaller and subordinate in size, scale, and architectural presence to the primary residence. Fannie Mae defers to local zoning ordinances for specific size limitations, but the appraiser must confirm that the ADU does not dominate the property and is clearly an accessory structure.

Key Physical Requirements for a Fannie Mae ADU

To qualify for financing, an ADU must meet several non-negotiable physical requirements that establish it as a self-sufficient living space. Failure to meet any of these standards will result in the unit not being recognized as an ADU, impacting its appraised value and financing eligibility.

- Separate Entrance: The unit must have its own independent entrance from the exterior. This allows occupants to enter and exit without passing through the primary dwelling. A connecting door between the main house and the ADU is permissible for convenience, but the separate, private entrance is mandatory.

- Full Kitchen: This is a critical and frequently misunderstood requirement. The kitchen must be a permanent installation and include, at a minimum: cabinets, a countertop, a sink with running hot and cold water, and a stove (or a 220-volt outlet and permanent hookup for one). Portable appliances like microwaves and hotplates are not sufficient and will disqualify the unit from being classified as an ADU.

- Complete Bathroom: The ADU must contain a full bathroom, which includes a toilet, a sink, and a shower or bathtub.

- Sleeping Area: There must be a dedicated space for sleeping, such as a bedroom or a studio-style layout with a designated sleeping area.

Meeting these requirements is essential for financing approval. For a deeper dive into budgeting and funding your project, you can explore various ADU financing options.

Can a Manufactured Home Be an ADU?

Yes, a manufactured home can serve as an ADU under Fannie Mae guidelines, but only under specific and strict conditions. A HUD Code manufactured home is eligible if it is legally classified and taxed as real property.

This complex transition from personal property (like a vehicle) to real property (like a house) requires:

- Permanent Foundation: The home must be permanently affixed to a foundation system that complies with both the manufacturer’s specifications and local building codes. For guidance, see HUD’s Permanent Foundations Guide for Manufactured Housing.

- De-Titling: The vehicle title for the manufactured home must be legally surrendered and retired, a process known as “de-titling.” This legally merges the home with the land, making it real property. State laws and procedures for this vary significantly.

- Primary Residence Restriction: The primary dwelling on the property cannot also be a manufactured home. The main house must be a traditional site-built or modular home.

- Verification and Documentation: Lenders will require clear photos of the HUD Data Plate and Certification Labels to verify the home’s compliance. The mortgage must cover both the primary home and the manufactured ADU as a single piece of real estate.

For complete details on these nuanced rules, it is essential to refer to Fannie Mae’s detailed property eligibility rules.

Navigating Fannie Mae ADU Loan Qualification and Eligibility

Securing a Fannie Mae ADU loan requires navigating a unique set of qualification criteria that differ from standard home mortgages. Understanding these rules on borrower income, property restrictions, and available loan products is the key to a smooth and successful approval process.

Borrower Qualification and Property Restrictions

A crucial point that often surprises homeowners is that you must typically qualify for the entire mortgage without using any potential rental income from the ADU. Your debt-to-income (DTI) ratio—the percentage of your gross monthly income that goes toward paying your debts—must be within the lender’s acceptable limits based on your existing salary, wages, and other income sources alone. While the ADU’s value is included in the property’s overall appraisal and contributes to the loan-to-value (LTV) calculation, its income-generating potential is generally excluded from the initial qualification analysis. This conservative approach is designed to mitigate risk for the lender.

For example, if a borrower has a $10,000 monthly income and $5,000 in total monthly debt payments (including the new proposed mortgage), their DTI is 50%. They must qualify at this level, even if they expect to receive $1,500 in monthly rent from the new ADU.

Fannie Mae also enforces strict property-level rules:

- One ADU Limit: Only one accessory dwelling unit is allowed per property.

- Single-Family Only: The property must be a one-unit, single-family home. Properties with 2-4 existing units are considered multi-family and are ineligible for ADU-specific financing programs.

- No Manufactured Primary Home: If the primary residence is a manufactured home, adding an ADU (whether site-built or manufactured) is generally not permitted under these guidelines.

Fannie Mae vs. Freddie Mac: Key Differences

While both are government-sponsored enterprises, Fannie Mae and Freddie Mac have distinct ADU financing rules. The best choice depends entirely on your property type, financial situation, and project goals.

| Feature | Fannie Mae ADU Guidelines | Freddie Mac ADU Guidelines |

|---|---|---|

| Rental Income Use | Not allowed for qualification (except with HomeReady® loan) | Allowed for qualification on 1-unit properties |

| Eligible Property Types | 1-unit properties only (single-family homes) | 1-unit, 2-unit, and 3-unit properties |

| Number of ADUs | One ADU allowed | One ADU allowed |

| Non-Conforming Units | Restrictive; requires lender confirmation and market comparables showing acceptance | More flexible with unpermitted ADUs if the market accepts them and they are common |

| Manufactured Homes | Can be an ADU if primary home is site-built | More restrictive rules on manufactured homes as ADUs |

In short, Freddie Mac generally offers more flexibility for using rental income and for properties that are already 2-3 units. Fannie Mae provides a more structured, though stricter, framework that is ideal for standard single-family homes, especially when leveraging the HomeReady® program.

Eligible Loan Products for Purchase, Renovation, or Construction

Fannie Mae allows several of its standard loan products to be used for properties with ADUs, treating the ADU as a valuable feature of a single-family home.

- Standard Purchase/Refinance Loans: These are the most straightforward options, used when buying a home that already has a compliant ADU or when refinancing an existing mortgage on such a property.

- HomeStyle® Renovation Loans: This is a powerful tool that allows a borrower to roll the cost of ADU construction or renovation into a single mortgage. You can finance the purchase or refinance of the home and the ADU construction costs at the same time, based on the property’s as-completed value.

- Construction-to-Permanent Financing: This single-close loan is perfect for ground-up construction. It funds the building of a new primary home and an ADU simultaneously, then automatically converts to a permanent mortgage once construction is complete, saving on closing costs.

- Cash-Out Refinance: Homeowners with significant equity can refinance their existing mortgage for a higher amount and take the difference in cash to pay for ADU construction. This offers flexibility but may come with a slightly higher interest rate than a renovation loan.

Choosing the right product is essential for securing competitive ADU Loan Rates and ensuring your project is financially sound from start to finish.

How Fannie Mae Treats ADU Rental Income

Rental income is a primary driver for many homeowners undertaking an ADU project, often forming the financial backbone of the investment. However, Fannie Mae’s rules on using this income for loan qualification are notably more restrictive than most homeowners and even some loan officers anticipate.

Using Rental Income for a Fannie Mae ADU

For the vast majority of Fannie Mae ADU loans, including standard conventional and HomeStyle® Renovation loans, you cannot use any actual or potential rental income from the ADU to help you qualify for the mortgage. Your existing, documented income must be sufficient on its own to meet the lender’s debt-to-income (DTI) ratio requirements. Fannie Mae’s rationale is that a newly constructed or purchased ADU has no established rental history, making its income speculative and therefore too risky to include in underwriting calculations. While this can be a significant hurdle, Fannie Mae provides a powerful exception for a specific subset of borrowers.

HomeReady® Mortgage: A Powerful Exception

The HomeReady® mortgage program is the game-changer for borrowers who need rental income to make their numbers work. Designed to expand access to homeownership for creditworthy low-to-moderate-income borrowers, this program is the primary pathway to use ADU rental income to qualify for a Fannie Mae loan.

Key features of the HomeReady® program for ADUs include:

- Rental Income Consideration: Lenders can consider 75% of the ADU’s documented fair market rent as part of your qualifying income. The 25% reduction is a standard industry practice to account for potential vacancies and ongoing maintenance costs.

- Example: If an appraiser determines the fair market rent for your ADU is $2,000 per month, you can add $1,500 ($2,000 x 0.75) to your monthly income for qualification purposes. This can dramatically improve your DTI ratio.

- Documentation Requirements: To use this income, you must provide robust documentation. If the ADU is already rented, a copy of the executed lease agreement is required. For a new ADU, the appraiser must complete a Form 1007 (Single-Family Comparable Rent Schedule). This form analyzes comparable rental properties in the area to establish a credible fair market rent for the ADU.

- Boarder Income: The program also allows for the use of boarder income (from a roommate in the primary dwelling), which can contribute up to 30% of your total qualifying income if you can document a 9-month history of receiving this income.

These features make HomeReady® an invaluable tool for making an ADU project financially viable. You can learn more in our comprehensive guide to Fannie Mae ADU Rental Income.

Tax Implications of ADU Rental Income

Generating rental income from your ADU has significant tax implications. This income is taxable at the federal and state level. However, you can also deduct a portion of your property-related expenses to offset this income. These deductions can include direct costs (like repairs inside the ADU) and prorated indirect costs, such as:

- Property taxes

- Mortgage interest

- Homeowners insurance

- Utilities

- Depreciation for the ADU structure

Calculating these prorated expenses typically involves determining the percentage of your property’s total square footage that the ADU occupies. Furthermore, while depreciation is a powerful deduction, it can lead to “depreciation recapture” taxes when you sell the property. Given the complexity, it is highly recommended to consult a qualified tax professional to ensure you are complying with all tax laws and maximizing your legitimate deductions. For general IRS rules, see IRS Publication 527, Residential Rental Property. For more tailored information, explore our resource on ADU Rental Income Taxes.

Appraisal and Compliance: The Technical Problems

The appraisal and compliance verification process is where many ADU financing applications encounter critical technical problems. Fannie Mae has established specific, detailed requirements for how appraisers must value properties with ADUs and how lenders must verify that the property complies with local zoning and building laws. A misstep in this phase can derail the entire loan.

ADU Appraisal Requirements

An appraiser’s report is a cornerstone of the loan approval process, and Fannie Mae’s rules for ADUs are stringent to ensure an accurate and reliable valuation.

- Separate Valuation and Reporting: The ADU’s living area cannot be combined with the primary home’s Gross Living Area (GLA). This is a common and critical error. The appraiser must report the ADU’s square footage on a separate line item in the appraisal report’s sales comparison grid. The value of the ADU is then determined as a separate line-item adjustment.

- Comparable Sales (Comps): Appraisers must prioritize finding comparable sales of properties that also have ADUs. This is the most reliable method for determining the ADU’s market value. In markets where ADUs are new and comps are scarce, the appraiser is permitted to use older sales, sales from competing neighborhoods, or even paired sales analysis (comparing a home that sold with an ADU to a similar one that sold without). However, they must provide a detailed narrative explaining their methodology and justifying their value conclusion.

- Marketability and Contribution Analysis: The appraisal must include commentary confirming that the ADU is a marketable feature in the local area and that it contributes positively to the property’s overall value. The report should analyze local trends and demand for ADUs to support this conclusion. This analysis is crucial for understanding your potential ADU Return on Investment.

For more on the technical requirements, appraisers must follow the guidelines in Fannie Mae’s Selling Guide, specifically section B4-1.3-05, Improvements Section of the Appraisal Report.

Zoning, Permits, and Legal Nonconforming Status

Zoning compliance is a major underwriting factor. While a fully permitted and compliant ADU is the gold standard, Fannie Mae provides pathways for properties with more complicated legal statuses.

- Illegal or Non-Permitted ADUs: These are not an automatic deal-breaker, but they introduce significant hurdles. The lender must confirm that the property’s insurance coverage is not jeopardized by the unpermitted unit. Crucially, the appraiser must demonstrate that such non-compliant units are typical for the market and do not negatively impact value. This requires finding at least two comparable sales with the same non-compliant use to prove market acceptance. This is often a very high bar to clear.

- Legal Nonconforming Status: An ADU that was built legally under previous zoning laws but does not meet current codes may be eligible if its “grandfathered” status is properly documented by the local zoning authority. The lender will require official documentation confirming this status.

Title insurance companies will closely scrutinize the ADU’s legal status. Any ambiguity can lead to exceptions on the title policy, which can prevent the loan from closing. Clear documentation is essential.

Common Mistakes for Lenders and Appraisers

Even seasoned professionals can make errors when dealing with the unique rules for ADU financing. These common pitfalls can lead to delays or denials:

- Misclassifying the Property: Incorrectly labeling a single-family home with an ADU as a two-unit property. This is the most frequent error and leads to applying the wrong underwriting standards, often resulting in a denial.

- Combining Square Footage: Improperly including the ADU’s square footage in the primary home’s GLA. This inflates the main home’s value per square foot and misrepresents the property, a major red flag for underwriters.

- Ignoring Zoning Issues: Failing to properly document and analyze the ADU’s legal or non-conforming status, leading to last-minute title or compliance problems.

- Inadequate Comparables: Using comps without ADUs and applying a simple “cost-to-build” adjustment instead of performing a thorough market analysis to determine the ADU’s contributory value.

- Misapplying Income Rules: Incorrectly attempting to use ADU rental income for qualification on a standard, non-HomeReady® loan, leading to an incorrect initial approval that is later overturned by underwriting.

Frequently Asked Questions about Fannie Mae ADU Rules

Here are detailed answers to some of the most common questions that homeowners, builders, and loan officers have about navigating Fannie Mae ADU financing.

What documentation is needed to prove an ADU is eligible?

Proper documentation is the foundation of a smooth loan process. Lenders will require a comprehensive package to verify the ADU’s compliance and value. Key documents include:

- Appraisal Report: A detailed report (Form 1004) that thoroughly describes the ADU, analyzes its marketability, and reports its living area separately from the main house. For rental income on a HomeReady® loan, a Form 1007 (Comparable Rent Schedule) is also required.

- Property Photos: Clear, high-resolution interior and exterior photos of the ADU are mandatory. These must highlight its independent living facilities, including the separate entrance, full kitchen (showing permanent stove/hookup), and bathroom.

- Zoning and Permit Evidence: Official documentation from the local municipality confirming the ADU’s legal status. This could be a final certificate of occupancy, building permits, or a letter from the zoning office confirming its legal nonconforming (“grandfathered”) status.

- Lease Agreement: This is required only for borrowers using the HomeReady® program to qualify with rental income from an existing, occupied ADU.

- HUD Documentation (for Manufactured ADUs): Photos of the HUD Data Plate and Certification Labels, along with proof of de-titling and permanent foundation.

Can I use a Fannie Mae loan to build a new ADU on my property?

Yes, absolutely. Fannie Mae offers excellent options for financing new ADU construction, so you are not limited to buying properties with pre-existing ADUs.

- The HomeStyle® Renovation loan is a popular choice that allows you to finance the purchase or refinance of your home and the cost of ADU construction in a single loan, based on the as-completed value.

- Construction-to-Permanent financing is ideal for building a new primary home and ADU simultaneously. This single-close loan covers the construction phase and then automatically converts to a permanent mortgage upon completion, saving time and money.

- Cash-out refinancing allows homeowners with significant equity to tap into it to fund their ADU project. While this offers great flexibility in how you manage the funds, it may come with a slightly higher interest rate compared to a renovation loan.

In all construction scenarios, the planned ADU must be designed to meet all of Fannie Mae’s physical and eligibility requirements upon completion.

What happens if my ADU doesn’t meet all of Fannie Mae’s kitchen requirements?

Fannie Mae’s kitchen requirements are strict, specific, and non-negotiable. An ADU must have cabinets, a countertop, a sink with running water, and a stove or a permanent hookup for one (e.g., a 220v outlet). A unit with only a microwave, hotplate, or other portable cooking equipment will not qualify as an ADU.

If a unit fails to meet this standard, it will not be recognized as an ADU for financing purposes. An appraiser will likely classify it as an ancillary structure, guest suite, or bonus room. This has two major negative consequences: 1) It will have a different and likely much lower appraised value than a true ADU, and 2) Any potential rental income from it cannot be used for mortgage qualification, even with a HomeReady® loan. It is crucial to design your ADU with a compliant kitchen from the very beginning to avoid these significant financing and valuation issues.

Are there minimum or maximum size requirements for an ADU?

Fannie Mae itself does not set specific minimum or maximum square footage requirements for an ADU. Instead, it defers to the local zoning and building codes of the municipality where the property is located. However, Fannie Mae does require that the ADU be “subordinate” in size to the primary dwelling. The appraiser must make a judgment call that the ADU is clearly an accessory structure and not a second primary home on the same lot. Therefore, you must adhere to your local laws while ensuring the final product feels like an accessory to the main house.

How does Fannie Mae view a property with a main house and a ‘guest house’ that lacks a kitchen?

This is a common scenario. A structure that has a bathroom and sleeping area but lacks a full, compliant kitchen is not considered an ADU by Fannie Mae. It would be classified as a guest house or ancillary building. While it can still add value to the property, it will be valued differently (and likely for less) than a full ADU. An appraiser would look for comparable sales with similar guest houses, not ADUs. Crucially, you cannot use the HomeReady® program to count any rental income from such a unit, as it does not meet the definition of a separate dwelling.

Conclusion: Opening Your Property’s Potential with an ADU

Navigating the world of Fannie Mae ADU financing can seem complex, but these detailed guidelines provide a clear and reliable path to unlocking the significant potential hidden in your property. An ADU is far more than just extra square footage; it is a dynamic and flexible asset. It can be a safe and independent home for aging parents, a launching pad for adult children, a private and productive home office, or a powerful source of rental income that can help pay down your mortgage and build long-term wealth.

With proven benefits like substantially increased property value and the ability to contribute a meaningful solution to local housing shortages, ADUs represent one of the smartest investments a homeowner can make today. To succeed, it’s vital to remember the key takeaways from Fannie Mae’s framework:

- Compliance is Crucial: Adherence to the specific physical requirements, especially for the full kitchen, is absolutely non-negotiable for financing and valuation.

- Financing is Accessible: A variety of powerful loan products, like the HomeStyle® Renovation loan, make new ADU construction not just possible, but financially manageable.

- Rental Income Has Strict Rules: The HomeReady® program is the primary and most powerful exception for using rental income to qualify for your mortgage. Outside of this program, you must qualify on your own.

- Technical Details Matter: A successful project hinges on a correct appraisal and verified zoning compliance. Getting these technical details right from the start prevents costly delays and denials.

For ADU builders, architects, and designers, mastering these financing rules is no longer a secondary skill—it’s a core business competency. When you can confidently guide clients through the financial maze, you build immense trust, differentiate your firm from the competition, and help turn a homeowner’s dream into a signed contract.

ADU Marketing Pros specializes in connecting expert construction and architecture firms with educated homeowners who are ready to build. We develop targeted marketing strategies that highlight your expertise in these complex areas, ensuring you attract clients who understand the value of a compliant, well-built ADU and are financially prepared to invest.

Ready to take the next step in mastering the financial side of ADUs? Dive deeper into our guide on Fannie Mae ADU rental income rules to see exactly how these regulations can be leveraged for your clients’ projects. Your property’s full potential is waiting to be unlocked.