Why Home Equity ADU Financing Makes Sense Right Now

In a financial landscape marked by rising interest rates and persistent housing shortages, home equity ADU financing has emerged as one of the most strategic and intelligent ways to fund an accessory dwelling unit. For millions of homeowners who are “house-rich but cash-poor,” the value locked within their property represents a powerful financial resource waiting to be unleashed. This guide will explore why now, more than ever, tapping into your home’s equity is the key to building your ADU.

Quick Answer: Top 3 Home Equity ADU Options

- Home Equity Loan: Best for homeowners who have a fixed project budget and want predictable, stable monthly payments. You receive a single lump sum, and with current rates often under 9%, it’s a secure choice in a volatile market.

- Home Equity Line of Credit (HELOC): Ideal for projects with an uncertain timeline or budget. This flexible credit line allows you to draw funds as needed during construction, paying interest only on what you use. It’s perfect for managing cash flow during a phased build.

- Cash-Out Refinance: A strategic option if you can also lower the interest rate on your primary mortgage. This replaces your existing mortgage with a new, larger one, giving you the difference in cash. It simplifies your debt into one monthly payment but requires careful consideration of closing costs and your current mortgage rate.

Key Benefits of Home Equity ADU Financing:

- Lower Interest Rates: Home equity products offer rates significantly lower than personal loans (12%+) and credit cards (21%+), saving you thousands over the life of the loan.

- Massive Equity Available: U.S. homeowners are sitting on nearly $30 trillion in tappable equity, providing a vast pool of capital for home improvements.

- Potential Tax Advantages: The interest paid on home equity debt used to build or substantially improve your home (which an ADU qualifies as) may be tax-deductible.

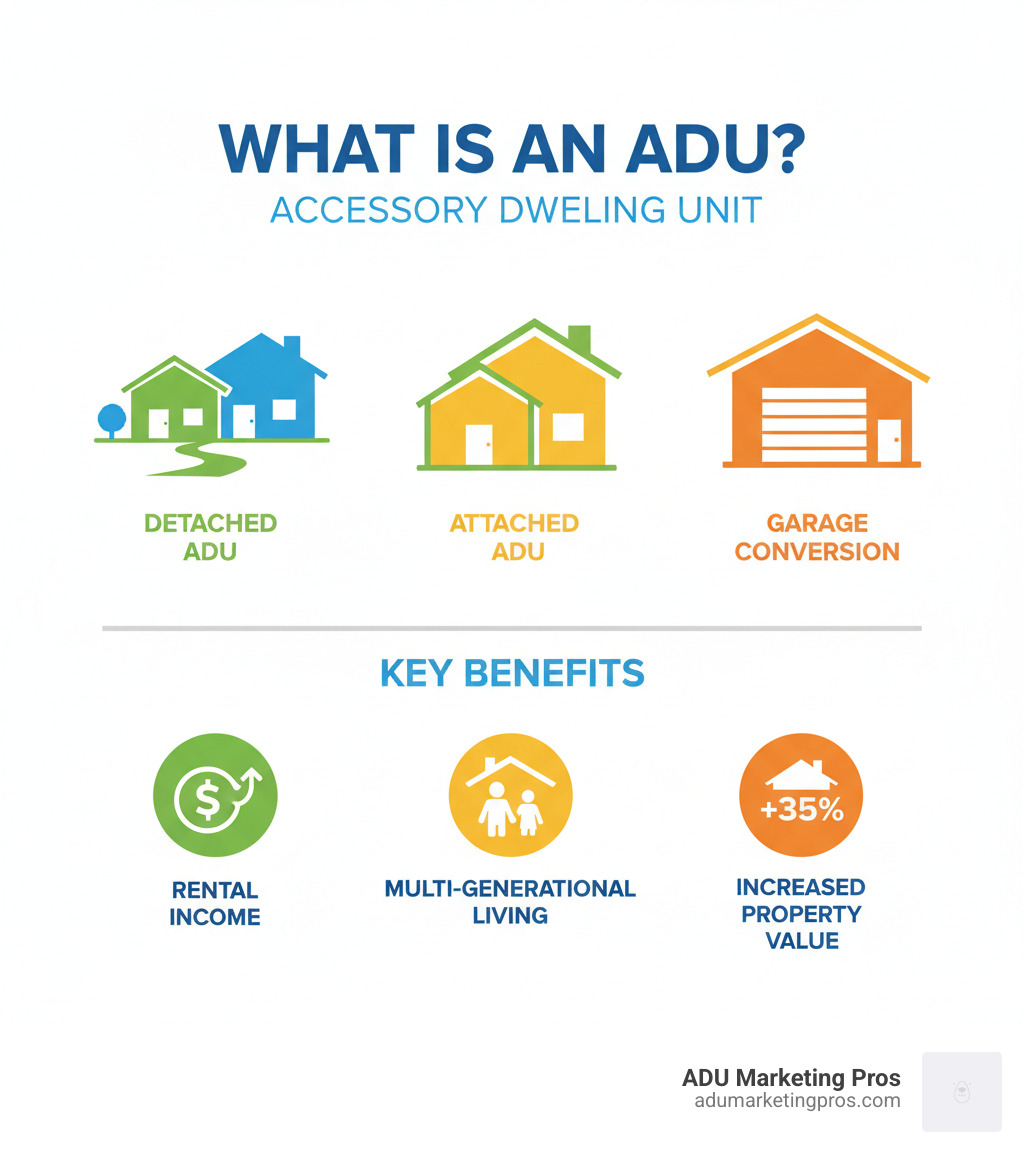

- Significant Value Creation: An ADU doesn’t just cost money; it creates value. Studies consistently show that adding an ADU can increase a property’s market value by 35% or more.

Accessory Dwelling Units (ADUs)—also known as granny flats, in-law suites, or backyard cottages—are fully independent living spaces built on the same lot as a primary single-family home. They can provide a home for family members, generate substantial rental income, or offer a flexible space for a home office or studio.

The primary hurdle for most homeowners is the cost, which typically ranges from $100,000 to over $300,000. This is where your home’s value becomes your greatest asset. With home equity at historic highs, using it to finance your ADU is far more affordable and financially sound than relying on high-interest, unsecured debt. This guide will walk you through exactly how to leverage your home equity for ADU financing, which option is best for your unique situation, and the critical details to consider along the way.

What is an ADU and Why is Home Equity a Smart Funding Choice?

An Accessory Dwelling Unit (ADU) is a secondary, self-contained home on your property. To qualify as a true ADU, it must include its own kitchen, bathroom, and sleeping/living area. Often called granny flats, in-law suites, or backyard cottages, they represent a versatile solution to the modern challenges of housing affordability and changing family structures.

ADUs come in several forms:

- Detached ADU: A standalone structure, often built in the backyard. This offers the most privacy for both the main home residents and the ADU occupants.

- Attached ADU: An addition built onto the primary home, sharing at least one wall.

- Garage Conversion: Transforming an existing garage into a livable dwelling. This is often one of the most cost-effective options.

- Interior Conversion: Carving out a space within the primary home, such as an attic or basement, and converting it into a separate unit.

- Junior ADU (JADU): A smaller unit (under 500 sq. ft.) created within the walls of the main house, which may share a bathroom with the primary residence.

The benefits are compelling. ADUs can house aging parents, allowing them to live independently while remaining close to family. They can give adult children an affordable place to live while they save for their own home. For investors, they can generate significant ADU rental income to boost cash flow and pay down a mortgage faster. In the age of remote work, an ADU can also serve as the ultimate home office, providing a quiet, dedicated workspace separate from the main house.

This is where home equity ADU financing becomes a game-changer.

Your home equity is the portion of your property you truly own—the difference between its current market value and the amount you still owe on your mortgage. Think of it as a savings account that has grown alongside your home’s value. For example:

- Your Home’s Current Market Value: $800,000

- Your Remaining Mortgage Balance: -$250,000

- Your Total Home Equity: $550,000

You can borrow against this equity to fund your ADU project. The financial logic is undeniable. While a personal loan might carry a 12% interest rate and a credit card over 21%, home equity ADU financing rates are secured by your property, bringing them down to a much more manageable sub-9% range. This difference means thousands of dollars saved annually, with that money going directly into your property’s value instead of a lender’s pocket.

Furthermore, you are not just spending money; you are making a strategic investment in your primary asset. National studies and real estate appraisals have shown that homes with ADUs can be valued approximately 35% higher than comparable homes without them. You are converting dormant equity into a feature that dramatically increases your property’s worth and can generate a new, reliable income stream. This transforms home equity from a static number on a page into a dynamic tool for enhancing your lifestyle and securing your financial future. For a broader look at funding strategies, our guide on ADU financing options provides a comprehensive comparison.

Your Guide to Home Equity ADU Financing Methods

When you decide to fund your ADU with home equity, you’ll encounter three primary methods. Each functions differently, and the optimal choice hinges on your project’s specifics, your financial comfort level, and your long-term goals. For a complete overview of all funding avenues, see our guide on From Loans to Investments: Navigating ADU Financing.

Let’s dissect the three main home equity ADU financing methods:

Home Equity Loans (Second Mortgages)

A home equity loan, often called a second mortgage, functions like a traditional loan. You borrow a specific amount of money in one lump sum and pay it back over a set period (typically 5 to 20 years) with a fixed interest rate. This predictability is its greatest strength; your monthly payment will never change, making it easy to budget for.

- Best For: Homeowners who have finalized their ADU plans, received firm quotes from a contractor, and know the exact cost of their project. The fixed rate provides peace of mind, especially in a rising-rate environment.

- How It Works: After approval, the full loan amount is deposited into your account. You begin making principal and interest payments immediately.

- Considerations: Because you receive all the funds at once, you start paying interest on the entire amount from day one, even if you haven’t paid your contractor yet. If costs run higher than expected, you cannot simply borrow more; you would need to apply for a new loan.

Home Equity Lines of Credit (HELOCs)

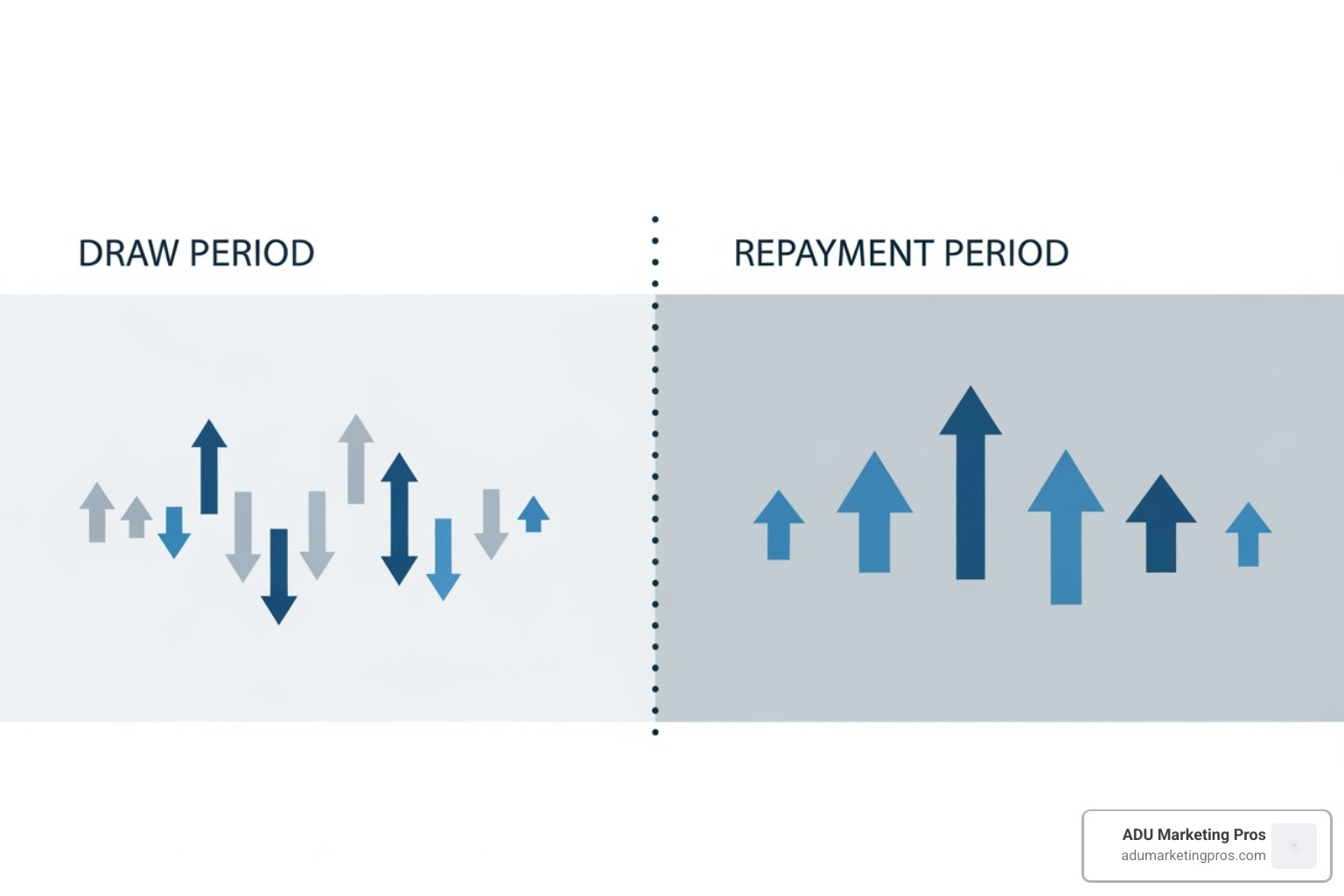

A HELOC operates more like a credit card that’s secured by your home’s equity. Instead of a lump sum, you are approved for a maximum credit limit. During a “draw period” (usually the first 10 years), you can withdraw funds as you need them, up to your limit. This flexibility is invaluable for construction projects where expenses are spread out over time.

- Best For: Phased construction projects or situations where the final cost is uncertain. It’s perfect for homeowners who want to manage cash flow by only paying for expenses as they arise.

- How It Works: You can access funds via a special checkbook, a debit card, or online transfer. During the draw period, you typically only have to make interest payments on the amount you’ve used. After the draw period ends, the HELOC converts to a “repayment period” (usually 10-20 years), where you must pay back both principal and interest, and you can no longer draw funds.

- Considerations: Most HELOCs have a variable interest rate tied to a benchmark like the Prime Rate. This means your monthly payments can fluctuate. While many HELOCs have rate caps to limit how high the interest can go, this uncertainty is a key risk to manage.

Cash-Out Refinances

A cash-out refinance involves replacing your current mortgage with a new, larger mortgage. You borrow more than what you owe on your home, and the difference is paid to you in cash, which you can then use to fund your ADU. This consolidates your housing debt into a single loan with one monthly payment.

- Best For: Homeowners who can secure a new mortgage rate that is lower than their current one. It’s also beneficial if you want to consolidate other high-interest debts (like credit cards) at the same time.

- How It Works: You apply for a new mortgage for a higher amount than your current balance. At closing, your old mortgage is paid off, and you receive the remaining cash.

- Considerations: This is a major financial decision. You will have to pay closing costs on the new loan, which can be 2-5% of the loan amount. You are also resetting your mortgage clock; if you were 10 years into a 30-year mortgage, you’ll be starting a new 30-year term. Giving up a historically low interest rate (e.g., below 4%) for a higher one often makes this option financially unwise unless the other benefits are substantial.

Here’s how these three options stack up side by side:

| Feature | Home Equity Loan (Second Mortgage) | HELOC (Home Equity Line of Credit) | Cash-Out Refinance |

|---|---|---|---|

| Fund Disbursement | Lump sum upfront | As needed (revolving credit) | Lump sum (part of new mortgage) |

| Interest Rate | Fixed | Typically Variable | Fixed (for the new mortgage) |

| Payment Structure | Fixed principal + interest from day one | Interest-only during draw period, then P+I | Principal + interest on one larger mortgage |

| Best Use Case | Fixed, known project costs | Phased projects, flexible spending | Consolidating debt, securing a lower overall rate |

| Flexibility | Low (cannot re-borrow) | High (draw, repay, and draw again) | Low (one-time cash-out) |

| Key Risks | Interest on full amount immediately | Variable rate fluctuations, payment shock after draw period | New closing costs, resetting loan term, potentially higher rate on entire mortgage balance |

Each of these home equity ADU financing methods offers a viable path forward. The best choice requires a careful analysis of your project’s timeline, budget certainty, and your personal tolerance for risk.

The Financials: Costs, Returns, and Risks of Using Home Equity for an ADU

Embarking on an ADU project is a significant financial undertaking. A successful outcome depends on a clear-eyed assessment of the costs, potential returns, and inherent risks of your home equity ADU project. Making an informed decision is paramount.

Estimating ADU Costs and Required Equity for a Home Equity ADU

Nationally, most ADU projects fall within a broad range of $100,000 to $300,000, but costs can exceed $400,000 in high-cost-of-living areas. It’s crucial to understand the components of this cost:

- Pre-Construction Costs (10-15%): This includes architectural design, structural engineering, soil reports, and city/county permit fees.

- Hard Costs (75-85%): This is the bulk of the budget, covering materials and labor for construction, from the foundation to the roof.

- Soft Costs (5-10%): This category includes utility connection fees (which can be substantial), construction insurance, and potentially a contingency fund.

Location is the single biggest variable. An 800-square-foot detached ADU in California could easily cost $350,000, while a similar project in a lower-cost state might be closer to $150,000. Garage conversions are generally less expensive than new construction, but they still require significant investment in plumbing, electrical, and structural upgrades.

To access this funding, lenders assess your Loan-to-Value (LTV) ratio. Most lenders will allow a combined LTV (CLTV) of 80% to 90%. This means your existing mortgage balance plus your new home equity loan cannot exceed that percentage of your home’s appraised value.

Example:

- Home’s Appraised Value: $900,000

- Lender’s Max LTV: 85% (0.85 x $900,000 = $765,000)

- Current Mortgage Balance: $400,000

- Maximum Tappable Equity: $765,000 – $400,000 = $365,000

In this scenario, you could borrow up to $365,000 for your ADU project. To explore ways to supplement this, consider looking into local ADU Funding & Grants.

The ROI: How an ADU Boosts Property Value and Generates Income

An ADU is an investment that pays you back in multiple ways. The return on investment (ROI) is both financial and lifestyle-based.

Financial ROI:

- Property Value Appreciation: The most significant return comes from the instant equity boost. A comprehensive study found that homes with ADUs were valued, on average, 35% higher than those without. On a $900,000 home, a $300,000 ADU investment could increase the property’s value to over $1.2 million, creating immediate equity.

- Rental Income: An ADU can become a powerful income-generating asset. In markets like San Diego or the Bay Area, monthly rents for a one-bedroom ADU can range from $1,900 to over $2,800. This income can often cover the monthly payment on your home equity loan, property taxes, insurance, and still produce positive cash flow. Many homeowners see a cash-on-cash ROI of 5-10% annually from rental income alone. For a deeper analysis, see our guide on ADU Return on Investment.

Lifestyle ROI:

Beyond the numbers, ADUs provide invaluable flexibility. They can keep families together through multi-generational living, provide a safe and affordable housing option for a loved one, or offer the perfect work-life separation with a dedicated home office.

Understanding the Risks and Tax Implications of a Home Equity ADU

Leveraging your home’s equity is not without risk. The most critical one is that your home serves as collateral. If you are unable to make the payments on your home equity loan or HELOC for any reason, the lender has the right to foreclose on your property. This underscores the importance of conservative budgeting and ensuring you do not over-leverage by taking on more debt than you can comfortably manage, even if your income changes.

On the tax front, there are significant considerations:

- Interest Deductibility: According to the IRS, interest on a home equity loan or HELOC may be tax-deductible if the funds are used to \”buy, build, or substantially improve\” the taxpayer’s home that secures the loan. An ADU project typically falls under this definition. This is a major advantage over personal loans, where interest is not deductible. Consult IRS Publication 936 and a tax professional for guidance specific to your situation.

- Rental Income Taxes: If you rent out your ADU, the income you receive is taxable. However, you can also deduct a wide range of expenses associated with the rental, including a portion of your property taxes, mortgage interest, insurance, repairs, and depreciation. Proper record-keeping is essential to maximize these deductions. For more details, see our guide on ADU Rental Income Taxes.

Finally, it’s wise to understand how the lending industry views these units by reviewing official resources like Fannie Mae’s ADU guidelines.

How to Secure Your Loan: A Step-by-Step Process

Securing home equity ADU financing is a structured process. By approaching it methodically, you can navigate the steps with confidence and position yourself for success.

Step 1: Assess Your Financial Position and Project Scope

Before you even speak to a lender, you need a clear picture of your own finances and project goals. This is the foundational work that will streamline the entire process.

- Calculate Your Home Equity: Get a rough estimate of your home’s market value using online tools (like Zillow or Redfin) or by looking at recent sales of similar homes in your neighborhood. Subtract your current mortgage balance to find your total equity. Remember, you can typically only borrow against 80-90% of this value.

- Check Your Credit Score: Lenders reserve their best rates for borrowers with strong credit. A score of 720 or higher is ideal, but many lenders will approve loans for scores of 670+. You can get your credit report for free from AnnualCreditReport.com.

- Calculate Your Debt-to-Income (DTI) Ratio: Your DTI is your total monthly debt payments (including your current mortgage, car loans, credit cards) divided by your gross monthly income. Most lenders look for a DTI of 43% or lower after factoring in the new ADU loan payment.

- Create a Realistic ADU Budget: This is non-negotiable. Get detailed quotes from at least three reputable contractors. Your budget must include a 10-15% contingency fund. Construction projects rarely go exactly as planned, and this fund will cover unexpected costs without derailing your finances.

Step 2: Research Lenders and Compare Loan Options

Don’t accept the first offer you receive. The lending market is competitive, and shopping around can save you thousands.

- Cast a Wide Net: Get quotes from different types of institutions: your current bank, local credit unions (which often have great rates and customer service), and reputable online lenders.

- Look Beyond the Interest Rate: Compare the Annual Percentage Rate (APR), which includes fees, to get a truer cost of the loan. Ask about origination fees, appraisal fees, and any prepayment penalties.

- Ask the Right Questions: For a HELOC, ask about the introductory rate period, the margin, the index it’s tied to, and the lifetime interest rate cap. For a home equity loan, confirm the term and fixed rate. Our guides on ADU Loan Rates and ADU Financing Options can help you formulate your questions.

Step 3: Gather Documentation and Apply

Being prepared with your documentation will make the application process smooth and fast. Lenders need to verify your income, assets, and the viability of your project.

You’ll typically need:

- Proof of Income: Recent pay stubs (30 days), W-2s for the last two years.

- Tax Returns: Complete federal tax returns for the last two years, including all schedules.

- Asset Verification: Bank and investment account statements for the last 2-3 months.

- Debt Information: Statements for your current mortgage, car loans, student loans, and credit cards.

- Property Information: Your homeowner’s insurance policy declaration page and a recent property tax bill.

- ADU Project Documents: Lenders will want to see your signed contract with a builder, detailed building plans, and a copy of the building permit.

The lender will then order a property appraisal from a licensed appraiser to independently verify your home’s current market value.

Step 4: Explore Complementary Government Programs

Your home equity loan doesn’t have to be your only source of funding. A savvy strategy is to layer your financing with government incentives to reduce your overall borrowing costs.

Many states and cities, particularly in housing-strapped areas like California, offer programs to encourage ADU construction. These can include:

- Low-interest loans specifically for ADU construction.

- Grants that provide a set amount of money that doesn’t need to be repaid (e.g., the CalHFA ADU Grant Program offers up to $40,000).

- Fee waivers for expensive permitting and impact fees.

Check the website of your city or county’s planning department for local incentives. For California homeowners, The Casita Coalition’s ADU Finance Guide is an excellent resource for discovering and combining these programs with your primary financing.

Frequently Asked Questions about Home Equity ADU Financing

Navigating the world of ADU financing can bring up many questions. Here are clear, detailed answers to some of the most common inquiries about using home equity.

How does a home equity loan compare to a construction loan for an ADU?

This is a critical distinction. The primary difference lies in how the loan is underwritten and disbursed.

- Home Equity Loans are based on your home’s current, as-is value. The process is relatively simple: the lender appraises your home, determines your available equity, and gives you a loan. It’s straightforward and often faster.

- Construction Loans are based on the property’s future, after-completed value (ACV), including the finished ADU. This can allow you to borrow more money, especially if you have limited current equity. However, the process is far more complex. Funds are not disbursed as a lump sum but in a series of draws or installments after specific construction milestones are met and verified by an inspector. Construction loans also typically have higher interest rates and fees due to their increased complexity and risk for the lender.

The Bottom Line: If you have sufficient equity to cover your project, a home equity ADU loan or HELOC is almost always the simpler, faster, and cheaper option. If you are equity-poor but the project has a strong projected value, a construction loan may be the only path forward. For a detailed comparison, see our guide on Construction Loans for ADU.

Can I use future rental income from the ADU to qualify for a home equity loan?

For standard home equity loans and HELOCs, the answer is generally no. Lenders underwrite these loans based on your current, verifiable income and debt-to-income ratio. They do not typically consider prospective or future income from a rental unit that does not yet exist.

However, the lending landscape is evolving. Some specialized renovation loan products, and more importantly, new guidelines from government-sponsored enterprises are changing the game:

- Fannie Mae and Freddie Mac: Both have updated their guidelines to allow lenders to consider rental income from an ADU when underwriting a mortgage. For a cash-out refinance, a lender may be able to use a portion of the projected rental income (verified by an appraiser’s rent schedule) to help you qualify. This is a significant development.

To learn more about these evolving policies, it’s essential to review the official guidelines from Fannie Mae ADU Rental Income and Freddie Mac ADU Rental Income.

What are the main eligibility requirements for an ADU home equity loan?

While specific requirements vary by lender, they all look at the same core set of qualifications to assess your risk as a borrower. To secure a home equity ADU loan, you will generally need:

- Sufficient Home Equity: Lenders typically require that your total debt (current mortgage + new loan) does not exceed a combined loan-to-value (CLTV) ratio of 85% or less.

- Good to Excellent Credit Score: A FICO score of 670 or higher is usually the minimum threshold. To qualify for the most competitive rates, a score of 720+ is recommended.

- Stable and Verifiable Income: You must provide proof of consistent income through pay stubs, W-2s, and tax returns to show you can comfortably afford the new loan payment.

- Low Debt-to-Income (DTI) Ratio: Your total monthly debt payments, including the new home equity loan, should ideally be 43% or lower than your gross monthly income.

- Positive Property Appraisal: An independent appraisal must confirm that your home’s value is sufficient to support the loan you are requesting.

How long does the home equity loan process take?

From application to funding, a home equity loan or HELOC typically takes between 30 to 45 days. The biggest variable is the property appraisal, which can take one to two weeks to schedule and complete. A cash-out refinance follows a similar timeline to a standard mortgage, usually 30 to 60 days. Being highly organized with your documentation (as outlined in Step 3) is the best way to expedite the process from your end.

Conclusion: Is a Home Equity Loan Right for Your ADU?

For the vast majority of homeowners with established equity, home equity ADU financing stands out as the most logical and financially advantageous path to building an accessory dwelling unit. The benefits are clear and compelling: you gain access to a large sum of capital at interest rates far below any unsecured alternative (often under 9% vs. 21%+ for credit cards), and the interest you pay may even be tax-deductible, further reducing your costs.

More importantly, this isn’t just a loan—it’s a strategic investment in your most valuable asset. By transforming dormant equity into a functional, value-adding feature, you can increase your property’s worth by as much as 35%. Whether you use the ADU to generate thousands in monthly rental income, house a family member, or create a dedicated workspace, you are building long-term wealth and enhancing your quality of life.

However, this path demands careful consideration. Using your home as collateral is a serious commitment. The risk of foreclosure, though remote for a well-prepared borrower, is real. Success hinges on rigorous due diligence: creating a detailed budget with a healthy contingency fund, vetting your contractor thoroughly, and being honest about your ability to manage the new monthly payment.

At ADU Marketing Pros, we are dedicated to empowering homeowners with the knowledge needed to make these transformative projects a reality. While our primary focus is on helping ADU professionals grow their businesses, we know that a thriving market begins with educated and confident homeowners. When you understand the nuances of financing, from loan types to ROI calculations, the entire ecosystem benefits.

Your home equity is a powerful tool. With a solid plan, meticulous research, and a clear understanding of the risks and rewards, it can be the key that unlocks your ADU dream. If you’re ready to explore the possibilities, seeing how others have transformed underutilized space, like in our guide on ADU garage conversions, can be a great source of inspiration.