Why Los Angeles ADU Financing Matters for Your Property Investment

In a city grappling with a housing shortage and soaring living costs, building an accessory dwelling unit (ADU) is more than just a home improvement project—it’s a strategic financial move. Securing los angeles adu financing is the critical first step in unlocking your property’s potential to generate rental income, house family members, or simply boost its overall value. While the benefits are clear, the upfront costs—ranging from $75,000 for a simple garage conversion to over $400,000 for a custom, new-construction unit—can be a significant hurdle. Fortunately, a confluence of favorable state laws and innovative lending products has made financing an ADU in Los Angeles more accessible than ever.

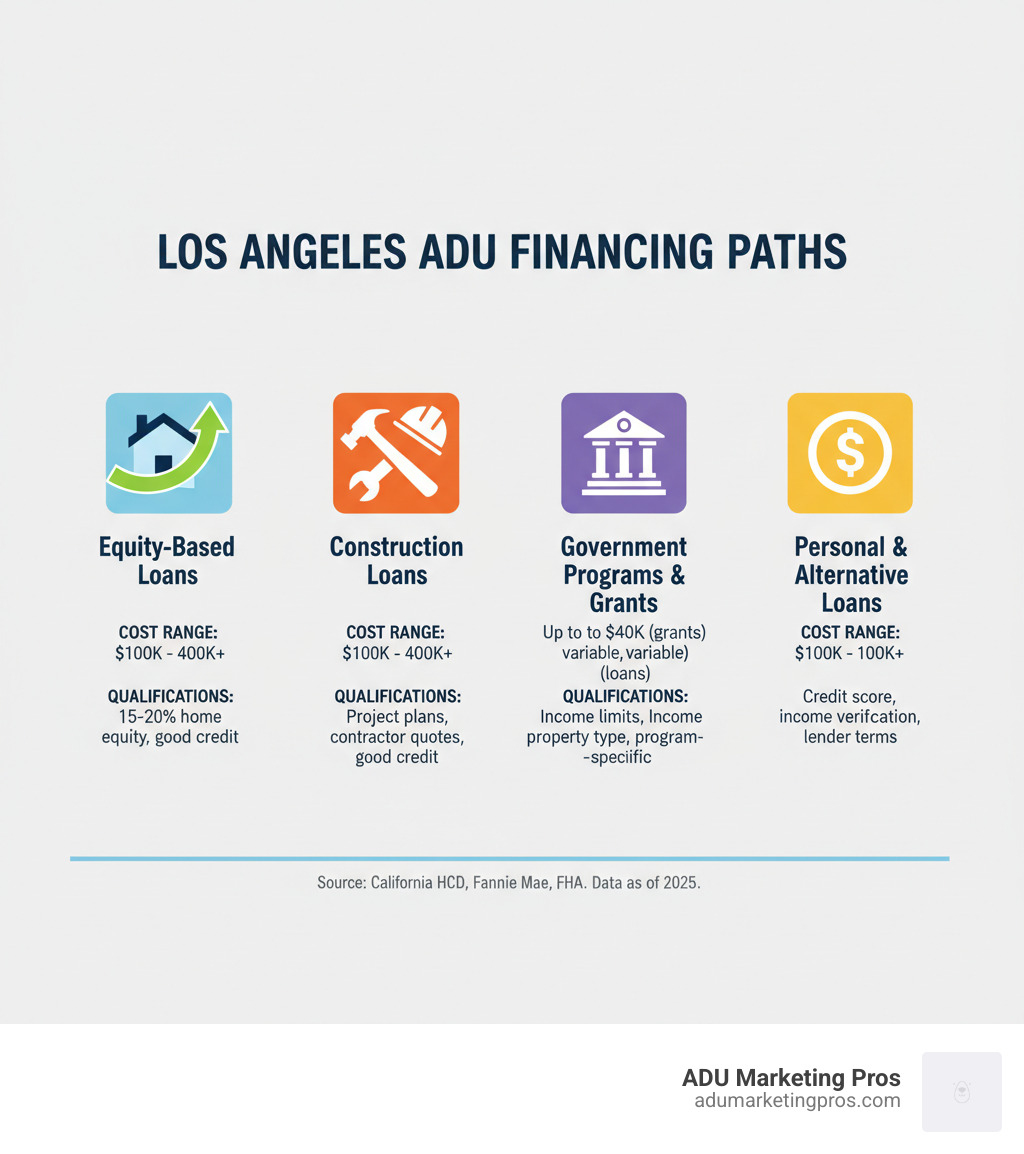

Quick Answer: Top Los Angeles ADU Financing Options

- Equity-Based Financing: Home Equity Loans (HELs), Home Equity Lines of Credit (HELOCs), or Cash-Out Refinances are the most common paths, ideal if you have at least 15-20% equity in your property.

- Construction Loans: These short-term loans are based on your ADU’s future completed value, making them perfect for larger, ground-up construction projects, even with limited current equity.

- Government-Backed Programs: FHA 203k, Fannie Mae HomeStyle, and Freddie Mac CHOICE Renovation loans bundle ADU costs into your primary mortgage, while the CalHFA program offers grants up to $40,000 for pre-development costs.

- Alternative Funding: For those who don’t qualify for traditional loans, personal loans, specialized ADU lenders, and builder financing programs offer viable alternatives.

Recent changes at both the state and federal levels have created powerful tailwinds for ADU development. Lenders are now rolling out specialized products designed for ADUs. Most notably, new FHA rules now permit lenders to count 75% of the ADU’s projected rental income toward your loan qualification, a game-changing policy that makes it significantly easier for homeowners to get approved.

This comprehensive guide will break down each major financing path available to Los Angeles homeowners. We’ll explore the nuances of equity-based loans, construction loans, government grants, and alternative funding to help you identify the best strategy for your financial situation and long-term ADU goals.

Understanding the Cost: Budgeting for Your Los Angeles ADU

Before you can secure los angeles adu financing, you must first create a detailed and realistic budget. Building an ADU is a complex construction project, and costs can vary dramatically based on the project’s size, design complexity, site conditions, and level of finishes. A thorough budget is your roadmap, preventing costly surprises and ensuring you request the right amount of funding.

Hard Costs: The Price of Construction

Hard costs refer to the physical construction of the unit. Here’s a realistic breakdown of what to expect in Los Angeles:

- Garage Conversions: Often the most budget-friendly option, a garage conversion typically costs $75,000 to $125,000. While you save on building a new foundation and structure, you must still account for significant expenses like reinforcing the existing foundation, running new utility lines (water, sewer, gas, electric), framing interior walls, and ensuring proper insulation and weatherproofing.

- New Standalone ADUs: A detached, ground-up ADU offers the most flexibility but comes with a higher price tag, generally ranging from $100,000 to over $400,000. A common rule of thumb is to budget $250 to $400 per square foot. It’s important to note that larger ADUs often have a lower cost per square foot because fixed expenses like kitchen and bathroom fixtures, permits, and utility hookups are spread over a larger area.

Soft Costs: The Price of Planning

Don’t overlook soft costs, which are the pre-development expenses required to get your project shovel-ready. These can easily add $15,000 to $30,000 or more to your total budget before a single nail is hammered. Key soft costs include:

- Architectural & Engineering Plans: Fees for designing the ADU and ensuring it’s structurally sound.

- Site Survey & Soil Reports: Required to understand your property’s topography and soil stability.

- Title 24 Energy Report: A mandatory California report detailing your ADU’s energy efficiency.

- City and County Fees: Costs for plan checks, permits, and impact fees, which can vary significantly by jurisdiction.

Key Factors That Influence Your ADU Budget

Several variables can push your costs to the lower or higher end of the spectrum:

- Site Conditions: A flat, easily accessible lot will be far cheaper to build on than a sloped hillside property that requires extensive grading or a crane for material delivery.

- Type of Construction: Prefab or modular ADUs can sometimes offer cost savings and faster build times compared to traditional stick-built methods, though customization may be limited.

- Level of Finishes: The choices you make for flooring, countertops, cabinets, appliances, and fixtures will have a major impact on the final cost. Builder-grade finishes are economical, while high-end, custom selections can add tens of thousands to the budget.

Understanding these expenses is the first step toward a successful project. For a deeper dive, see our guides on Los Angeles ADU Cost, ADU Building Costs, and ADU Cost Per Square Foot.

Tapping Into Your Home’s Value: Equity-Based Financing

For most established Los Angeles homeowners, the most straightforward and cost-effective path to los angeles adu financing is leveraging the equity in their primary residence. Home equity is the difference between your home’s current market value and the outstanding balance on your mortgage. Because these loans are secured by your property, they typically offer significantly lower interest rates and more favorable terms than unsecured loans. If you have at least 15-20% equity, this is an excellent place to begin your financing journey. You can learn more in our general guide to ADU Financing Options.

Home Equity Loans (HEL) vs. Lines of Credit (HELOC)

Home equity loans and HELOCs both use your home as collateral, but they function in fundamentally different ways. Understanding the distinction is key to choosing the right tool for your project.

A Home Equity Loan (HEL), often called a second mortgage, provides you with a single, lump-sum payment upfront. It comes with a fixed interest rate and a fixed repayment term, typically ranging from 5 to 15 years. This structure creates predictable, stable monthly payments, making it an ideal choice for homeowners who have a firm, detailed budget for their ADU and value certainty. The stability of a Home Equity Loan is a good ADU financing option for those who want to avoid the risk of fluctuating interest rates.

A Home Equity Line of Credit (HELOC) operates more like a credit card. You are approved for a maximum credit line and can draw funds as needed during a specified “draw period” (usually 10 years). You only pay interest on the amount you’ve actually used. However, HELOCs almost always come with a variable interest rate, meaning your monthly payments can rise or fall with market fluctuations. The HELOC is a revolving credit line that offers unmatched flexibility, which is perfect for ADU projects where costs are less certain or when you plan to complete the build in phases.

Key Difference: A HEL offers stability with its fixed rate and lump sum, while a HELOC provides flexibility with its draw-as-you-go structure and variable rate.

Cash-Out Refinance: A Popular Choice

A cash-out refinance is a powerful tool that replaces your existing mortgage with a new, larger one. You then receive the difference between the two loan amounts in cash, which you can use to fund your ADU. This is a very popular method for los angeles adu financing, especially if you have built up significant equity and can secure a new mortgage rate that is lower than or comparable to your current one.

The primary advantage is simplicity. You consolidate your ADU financing into a single monthly mortgage payment, often spread over a 30-year term, which can result in a lower total monthly outlay compared to a shorter-term HEL. The cash-out refi is another good ADU loan option for homeowners who prioritize a single, manageable payment.

The main drawback is that it completely resets your mortgage clock. If you were 10 years into a 30-year loan, you’d be starting over at year one, which could mean paying more in total interest over the life of the new loan. This option is generally best for those who plan to stay in their home long-term and can benefit from a favorable rate environment. Learn more about the investment side of this in our guide, From Loans to Investments: Navigating ADU Financing.

Qualifying for Equity-Based ADU Loans

To access these products, lenders will evaluate your:

- Loan-to-Value (LTV) Ratio: Most lenders require you to maintain at least 15-20% equity, meaning your total loan amount (current mortgage + new loan) cannot exceed 80-85% of your home’s appraised value.

- Credit Score: A higher credit score (typically 680+, with 720+ being ideal) will unlock the best interest rates and terms.

- Debt-to-Income (DTI) Ratio: Lenders want to see that your total monthly debt payments (including the new proposed payment) do not exceed 43-50% of your gross monthly income.

Project-Specific Funding: Construction and Renovation Loans

When your home’s current equity is limited, or you’re undertaking a large-scale project like a new, detached ADU, project-specific loans are an excellent solution for los angeles adu financing. Unlike equity loans that look at your home’s current value, these loans are based on the future appraised value of your property with the completed ADU. This “as-completed” value allows you to borrow significantly more than your current equity might permit. While the application process is more involved, they are often the only way to fund a ground-up build. Find out more in our article on Construction Loans for ADU.

How Construction Loans Work for Los Angeles ADU Financing

An ADU construction loan is a short-term (usually 12-18 months), interest-only loan designed specifically to cover building costs. The funds are not disbursed as a lump sum. Instead, they are released in stages, or “draws,” as your project reaches pre-determined construction milestones. For example, you might receive draws after the foundation is poured, the framing is complete, the roof is on, and so on. Before releasing each draw, the lender will send an inspector to verify that the work has been completed correctly. This protects both you and the lender by ensuring the project is progressing as planned and on budget.

Securing a construction loan requires extensive documentation, including detailed architectural plans, a signed contract with a vetted builder, a line-item project budget, and approved city permits. A construction loan is a bit more complicated but is purpose-built for this type of project. Once the ADU is finished and the certificate of occupancy is issued, the construction loan is typically refinanced or converted into a permanent, long-term mortgage.

Government-Backed Renovation Loans: FHA 203k & HomeStyle

Government-backed renovation loans are powerful tools that allow you to finance a home purchase or refinance your current mortgage and roll the costs of ADU construction into a single loan. They are ideal for homebuyers who want to add an ADU to a property they are purchasing or for current homeowners with limited equity.

- FHA 203k Loan: This FHA-insured program is famous for its low down payment requirements (as little as 3.5%). It combines a home loan and renovation funds into one. The “Standard 203k” is for major structural projects like a new ADU, while the “Limited 203k” is for non-structural projects up to $35,000. It is restricted to owner-occupied primary residences. See the official FHA 203k Loan details from HUD.

- Fannie Mae HomeStyle: This conventional loan is similar to the 203k, bundling purchase/refinance and renovation costs. However, it offers more flexibility, as it can be used for investment properties and second homes, not just primary residences. It also typically requires a higher credit score and down payment than an FHA loan. Explore Fannie Mae HomeStyle loans for more information.

- Freddie Mac’s CHOICE Renovation Mortgage: This is another excellent conventional loan option, particularly for first-time buyers, as it allows for the construction of an ADU with as little as a 3% down payment on a primary residence.

Can Potential Rental Income Help You Qualify?

Yes, and this is one of the most significant recent developments in ADU financing. In a major policy shift, the FHA now allows lenders to count 75% of an ADU’s projected rental income toward your total qualifying income. As FHA has changed their rules, it’s now much easier for homeowners to get approved. To do this, the lender will require an appraiser to complete a “rent schedule” (Form 1007), which provides a professional opinion of the fair market rent for the proposed ADU. This additional income can dramatically improve your debt-to-income (DTI) ratio, potentially pushing a borderline application into approval and increasing your overall borrowing power. To estimate your potential earnings, see our guide on ADU Rental Income.

Grants, Incentives, and Alternative Los Angeles ADU Financing

Beyond traditional bank loans, a variety of grants, government programs, and alternative funding sources can make your los angeles adu financing strategy more robust and affordable. These options can help cover crucial pre-development costs, fill funding gaps, or provide a path to financing for those who don’t qualify for conventional products. For a complete overview, see our guide on ADU Funding Grants.

California Government Grants and Programs

California and its local municipalities offer significant financial assistance to incentivize ADU construction and help ease the state’s housing crisis.

- CalHFA ADU Grant Program: This is the most prominent program, providing up to $40,000 to reimburse homeowners for pre-development and non-recurring closing costs. This includes expenses like architectural designs, permits, soil tests, and impact fees. The grant is designed for low-to-moderate-income homeowners and is distributed through a list of approved lenders. Funding is limited and highly competitive, so it’s crucial to monitor the official CalHFA ADU Grant Program page for availability and act quickly when a new funding round opens.

- LA ADU Accelerator Program: This innovative Los Angeles program connects homeowners building an ADU with older adults in need of stable, affordable housing. In exchange for agreeing to rent your new ADU to a Section 8 voucher holder, homeowners receive a range of supportive services, including tenant screening, landlord support, and guaranteed rent payments. Check the official site to Learn More about the LA ADU Accelerator Program and its current status and benefits.

Specialized ADU Lenders and Equity Sharing

If you lack sufficient equity or prefer not to take on more debt, consider these modern alternatives:

- Specialized ADU Lenders: A growing niche of lenders focuses exclusively on ADU projects. Companies like Renofi, Hometap, and various credit unions understand the unique challenges of ADU construction. They often offer products based on the property’s “after-renovation value,” allowing you to borrow more than traditional lenders. Their expertise can streamline the financing process significantly.

- Home Equity Sharing Agreements: Companies like Unison and Point offer an alternative to debt. They give you a lump sum of cash in exchange for a share of your home’s future appreciation. You make no monthly payments. When you sell your home (or after a set term, e.g., 10-30 years), the company gets its original investment back plus a percentage of the increase in your home’s value. This can be a great option for those who are debt-averse but it’s crucial to understand the long-term cost.

Builder and Turnkey ADU Company Financing

Many companies that design and build ADUs now offer in-house or partner financing to create a one-stop-shop experience. This can be incredibly convenient, as the builder handles both the construction and the financing application. They often work with lenders who are familiar with their process and costs, leading to a smoother approval. However, this convenience can sometimes come at a cost. It’s always wise to compare the rates and terms offered by a builder’s preferred lender with quotes you get from independent banks or mortgage brokers to ensure you’re getting a competitive deal.

How to Choose the Right ADU Financing for Your Situation

The best los angeles adu financing solution is deeply personal—it’s the one that aligns perfectly with your financial position, project scope, and risk tolerance. With a clear understanding of your own circumstances, you can confidently navigate the options and find the ideal match to bring your ADU project to life.

A Step-by-Step Guide to Securing Your Financing

- Assess Your Financial Health: Before talking to any lender, get a clear picture of your finances. Check your credit score, calculate your home’s approximate equity, and determine your debt-to-income (DTI) ratio. This will immediately tell you which loan categories you’re most likely to qualify for.

- Define Your Project and Budget: Work with a designer or builder to create a detailed project plan and a line-item budget. Distinguish between “must-haves” and “nice-to-haves” to understand where you can be flexible. This budget will determine how much you need to borrow.

- Explore Grant Opportunities First: Always investigate grants like the CalHFA program before applying for loans. Free money is the best money, and a grant can significantly reduce the total amount you need to finance.

- Shop for Lenders and Compare Offers: Do not take the first offer you receive. Get quotes from at least three different lenders, such as your local bank, a credit union, and a mortgage broker who specializes in ADUs. Compare interest rates, fees, loan terms, and closing costs. Pay close attention to the Annual Percentage Rate (APR), which reflects the true cost of borrowing.

- Prepare Your Documentation: Once you’ve chosen a lender, gather all required documents promptly. For construction or renovation loans, this will include your full project plans, builder contract, and budget. Being organized will speed up the underwriting and approval process.

Comparing Your Top Financing Options

This table provides a side-by-side comparison to help you weigh the pros and cons of the most common financing paths:

| Financing Option | Interest Rate Type | Loan Term | Pros | Cons | Best For |

|---|---|---|---|---|---|

| HELOC | Variable | Typically 10-30 yrs | Flexible borrowing (draw as needed), only pay interest on what’s used, interest-only option during draw. | Variable rates mean unpredictable payments, risk to home, less stable for fixed budgets. | Homeowners with significant equity, fluctuating project costs, or those who prefer flexibility. |

| Home Equity Loan | Fixed | Typically 5-15 yrs | Lump sum upfront, fixed payments, predictable budget. | Less flexible if costs change, interest paid on full amount immediately, shorter repayment term means higher monthly payments. | Homeowners with significant equity, clear project budget, and preference for payment stability. |

| Cash-Out Refi | Fixed | Typically 15-30 yrs | Lower interest rates (if market is good), single monthly payment, longer repayment term. | Resets mortgage term, closing costs, less ideal if current mortgage rate is very low. | Homeowners with significant equity, seeking lower rates, consolidating debt, or needing a large lump sum. |

| Construction Loan | Variable/Fixed | Short-term (1 year) | Based on “completed value,” ideal for new builds, phased disbursements. | More complex, higher interest rates during construction, requires detailed plans/contractor vetting, converts to permanent loan. | Ground-up ADU construction, homeowners with limited current equity, or those managing a multi-stage project. |

| FHA 203k / Fannie Mae HomeStyle | Fixed | 15-30 yrs | Combines purchase/refinance & renovation, low down payment, can factor future rental income. | Specific property/occupancy requirements, project start deadlines, not all lenders offer. | First-time homebuyers, those purchasing a home that needs an ADU, or homeowners with limited equity seeking government-backed support. |

Ultimately, the most critical step is to consult with a financial advisor or a lender who specializes in ADU financing. Their expertise is invaluable in navigating the complexities of each option and ensuring you make a choice that supports your financial goals for years to come. For more on interest rates, see our guide on ADU Loan Rates.

Frequently Asked Questions about Los Angeles ADU Financing

Navigating the world of los angeles adu financing can bring up many questions. Here are detailed answers to some of the most common inquiries from homeowners.

What documents do lenders typically require for an ADU construction loan?

Construction loans are more document-intensive than other loan types because the lender is financing an asset that doesn’t exist yet. To mitigate their risk, they need a comprehensive project overview. Be prepared to provide:

- Detailed Construction Plans: Full sets of architectural and structural engineering drawings.

- Signed Builder Contract: A detailed, fixed-price contract with a licensed and insured general contractor, outlining the scope of work, materials, and payment schedule.

- Project Budget and Timeline: An itemized, line-by-line breakdown of all hard and soft costs, along with a projected construction schedule.

- Building Permits: Proof of official approval from the Los Angeles Department of Building and Safety (LADBS) or your local jurisdiction.

- Personal Financials: Standard income and asset verification, including recent pay stubs, W-2s, tax returns, and bank statements.

- Good Credit History: A strong credit report and score to demonstrate your financial reliability.

Having these documents organized and ready will significantly streamline your application and approval process.

Can I finance an ADU in Los Angeles with no money down?

While a true zero-down payment scenario is rare, it’s becoming more achievable by strategically layering different programs. You can get very close to zero out-of-pocket cost by combining these strategies:

- CalHFA ADU Grant: If you qualify, use the up to $40,000 grant to cover all your pre-development soft costs and any loan closing costs.

- Low Down Payment Loans: Government-backed loans like the FHA 203k (3.5% down) or Freddie Mac’s CHOICE Renovation Mortgage (as low as 3% down) dramatically reduce the cash you need to bring to the table.

- FHA Rental Income Rule: The ability to use 75% of the ADU’s projected rental income to qualify for your loan increases your borrowing power, which can help cover a higher percentage of the project cost and reduce your required down payment.

By combining a low-down-payment loan with the CalHFA grant, many homeowners can fund their entire ADU project with minimal upfront cash.

How does building an ADU impact my property taxes?

Your property taxes will increase, but not on your entire property. Thanks to California’s Proposition 13, your primary home’s assessed value remains protected. The county assessor will perform a “blended assessment.” This means your existing home and land keep their original assessed value, and only the newly added value of the ADU is assessed at current market rates.

For example, if your ADU is assessed to have added $200,000 in value to your property, your annual property taxes would increase by approximately $2,500 (based on a ~1.25% tax rate in Los Angeles County), which is about $208 per month. This modest increase is almost always far outweighed by the rental income the ADU generates or the value it provides to your family, making the investment a sound financial decision, as detailed in our guide to ADU Return on Investment.

What happens if my ADU construction goes over budget?

Cost overruns are a real risk in any construction project. How they are handled depends on your financing. If you have a HELOC, you may have enough of a credit cushion to cover the extra costs. If you have a fixed-amount loan (like a home equity loan or construction loan), you will need to pay for the overages out-of-pocket. This is why it’s critical to include a contingency fund of 10-15% in your initial budget. Experienced builders will always include this in their estimates. Lenders for construction loans often require a contingency reserve to be funded as part of the loan itself.

Conclusion: Your Path to a Successful ADU Investment

This guide has illuminated the diverse and increasingly accessible paths available for los angeles adu financing. From leveraging your home’s equity with a HELOC or cash-out refinance to funding a new build with a construction loan or accessing government-backed programs, the right solution for your project is within reach. The landscape for ADU financing has never been more favorable for Los Angeles homeowners.

Building an ADU is a powerful, wealth-building investment. It directly confronts the local housing shortage while increasing your property’s value, creating a new and reliable stream of rental income, and providing flexible living space for family, tenants, or a dedicated home office. With transformative policy changes, like the FHA allowing future rental income to be used for loan qualification, and the availability of grants like the CalHFA program, the financial barriers to entry are lower than ever.

For builders, architects, and contractors, this surge in homeowner interest represents a significant business opportunity. The ADU market is booming, and clients need trusted experts to guide them through the complexities of design, permitting, construction, and financing. ADU Marketing Pros specializes in elevating firms in this competitive space, connecting you with qualified homeowners who are ready to build their vision.

By carefully assessing your finances, thoroughly exploring all your options, and partnering with experienced professionals, your ADU project is not just a dream, but an achievable and lucrative reality. To learn more about making your project financially viable, Find out more about California ADU incentives and take the next step toward turning your property’s potential into a tangible asset.