Why Tiny Homes Are Gaining Traction in Southern California

Tiny homes Orange County represents a powerful and growing movement for affordable, sustainable, and flexible housing in one of the nation’s most notoriously expensive real estate markets. As residents grapple with soaring living costs and a desire for a more intentional lifestyle, compact dwellings are emerging as a viable and attractive alternative. Whether you’re considering a mobile tiny home on wheels (THOW) for its adventurous spirit or a permanent accessory dwelling unit (ADU) for its investment potential, understanding the local landscape is the first step toward making your tiny dream a reality.

Quick Answer: What You Need to Know About Tiny Homes in Orange County:

- Types Available: The two main categories are Tiny Homes on Wheels (THOWs), which are legally classified as RVs, and permanent foundation homes, most often built as Accessory Dwelling Units (ADUs).

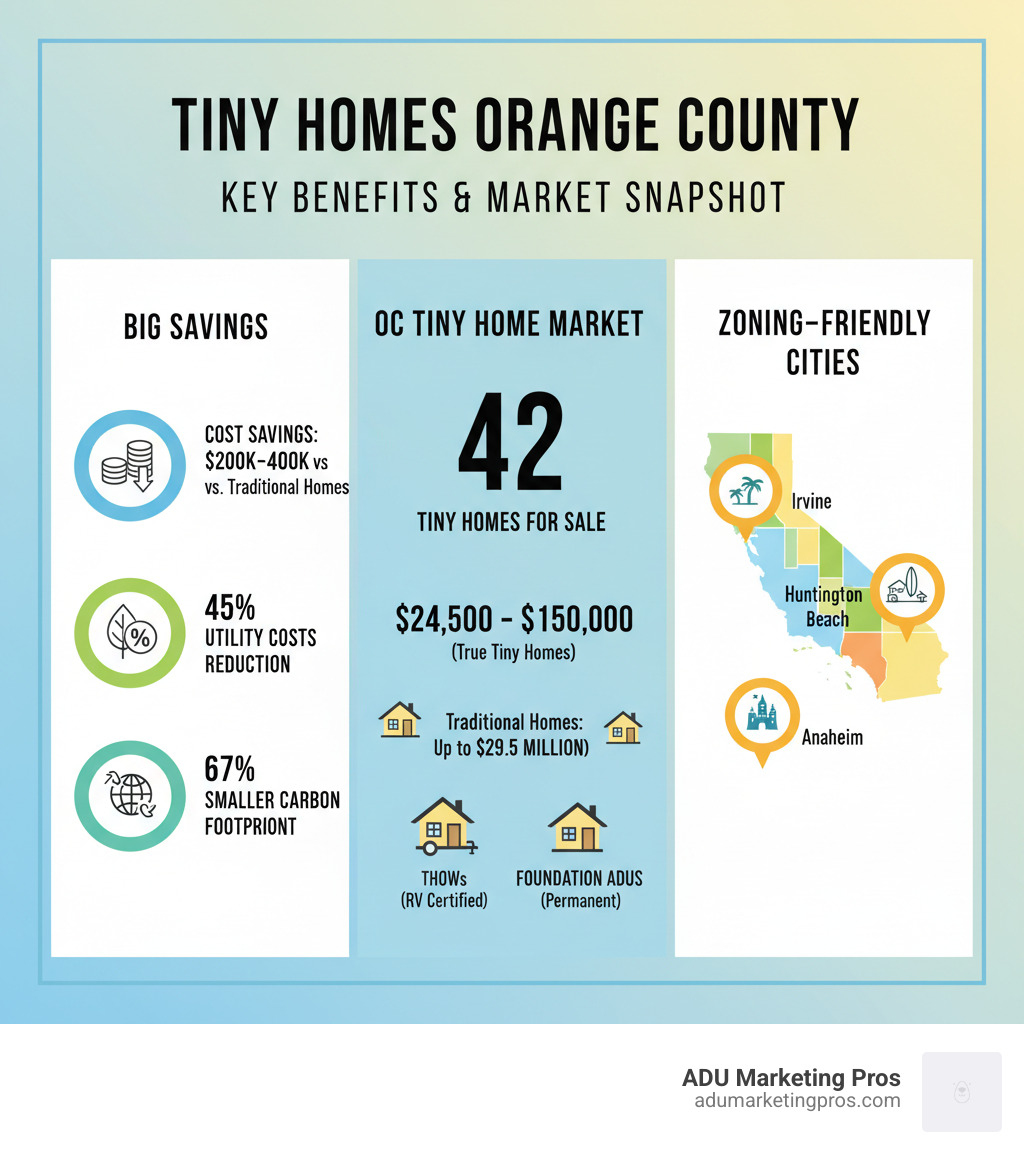

- Price Range: Varies widely from approximately $24,500 for a basic shell to over $150,000 for a high-end, custom-built unit. ADUs can cost more due to foundation and permitting.

- Zoning Rules: Highly complex and vary significantly from one city to another. THOWs face major restrictions on long-term placement, while ADUs benefit from streamlined state laws that encourage their development.

- Key Advantage: A dramatic reduction in housing costs. The average cost of a supportive housing unit in Orange County exceeded $550,000 in 2022, making tiny homes a financially liberating alternative.

- Main Challenge: Successfully navigating the maze of local city regulations and finding a legal and suitable location for the home, whether it’s land, a backyard, or a designated park.

Orange County’s acute housing crisis is the primary catalyst for this shift. With traditional home prices pushing the dream of homeownership out of reach for many, the tiny home movement offers a tangible path to financial freedom, environmental stewardship, and a more flexible way of life. This isn’t just about smaller houses; it’s about bigger lives, unburdened by crippling mortgage debt.

This comprehensive guide will walk you through everything you need to know about the tiny homes Orange County scene, from the distinct types available to the intricate zoning regulations, real-world costs, and financing avenues. The industry has matured to the point where official Orange County reports now use the term “Small-Scale Housing Units” (SSHUs) to describe these dwellings, which can range from 64-square-foot sleeping cabins to over 500-square-foot permanent homes. Builders like Pacifica Tiny Homes have already constructed over 300 units, with popular models starting at an accessible $47,900, proving that high-quality, stylish tiny living is not just a fantasy but an achievable reality in California.

The Allure of Tiny Living: Why Choose a Tiny Home in Orange County?

Choosing a tiny home in Orange County is a deliberate and empowering choice for a growing number of residents. The appeal of tiny homes Orange County extends far beyond simple cost savings to a fundamental rethinking of what a home means and the lifestyle it enables. It’s a conscious move away from the ‘bigger is better’ mentality toward a life rich in experience, not possessions.

The primary driver for most is the pursuit of financial freedom. The financial pressure of traditional housing in Orange County is immense, with median monthly mortgage payments often soaring past $5,000. A tiny home completely alters this financial equation. By drastically reducing or even eliminating mortgage debt, residents can free up thousands of dollars each month. This newfound capital can be redirected toward paying off student loans, building a robust retirement fund, traveling the world, or simply working less and living more.

This financial shift naturally fosters a minimalist lifestyle. With limited square footage, every object must earn its place. This forces a process of intentionality, cutting through the consumer clutter to focus on what is truly used, valued, and loved. Far from being a sacrifice, many tiny home dwellers report this as a profound psychological benefit. It leads to less consumption, less time spent on cleaning and organizing, and a greater sense of mental clarity and peace.

The environmental sustainability of tiny homes is another powerful and compelling factor. Their smaller size means they require significantly fewer building materials to construct, reducing their embodied carbon from the start. Once built, heating or cooling a space of under 500 square feet drastically reduces energy consumption, shrinking your carbon footprint and lowering utility bills. Many tiny homes also incorporate green technologies like solar panels, composting toilets, and rainwater harvesting systems, further minimizing their environmental impact. This aligns perfectly with California’s ambitious climate goals, making tiny living a personal choice that contributes to a more sustainable collective future.

Ultimately, the combination of financial relief, a simplified life, and a lighter environmental touch culminates in the greatest luxury of all: time. With less space to maintain and fewer possessions to manage, tiny home owners report having more time and energy for relationships, hobbies, and enjoying the incredible natural beauty and cultural richness that Orange County has to offer.

Cost of Living: Tiny vs. Traditional

The financial case for tiny homes becomes undeniable when you compare the numbers directly. A traditional Orange County homeowner can easily face monthly costs ranging from $4,650 to over $10,200 when factoring in their mortgage, utilities, property taxes, insurance, and routine maintenance.

In stark contrast, the total estimated monthly cost for tiny homes Orange County is a mere $512 to $2,100. This range depends heavily on whether you finance the home, rent a lot space for a THOW, or build a permitted ADU on a property you already own. A tiny home on wheels (THOW) avoids property tax entirely, being registered like an RV. An ADU will increase your property tax, but only by a small, manageable amount based on the value it adds. Utilities and insurance are consistently a fraction of the cost of a traditional home.

This staggering difference can amount to tens of thousands of dollars in savings annually—a life-changing sum that can be used to achieve financial security, start a business, or fund other life goals.

Here’s a quick comparison of estimated monthly expenses:

| Expense Category | Traditional Orange County Home | Tiny Home Orange County |

|---|---|---|

| Mortgage/Rent | $3,500 – $7,000+ | $362 (financing) – $1,500 (rent) |

| Utilities (Electric/Gas/Water) | $300 – $800+ | $50 – $200 |

| Property Tax | $500 – $1,500+ | $0 (THOW) – $200 (ADU) |

| Home Insurance | $150 – $400 | $50 – $150 |

| Maintenance | $200 – $500 | $50 – $150 |

| Total Estimated Monthly | $4,650 – $10,200+ | $512 – $2,100 |

These figures are estimates and will vary based on location, home size, and personal usage, but they clearly illustrate the profound financial advantages and the path to a less stressful, more flexible lifestyle that tiny living offers.

Types of Tiny Homes: Wheels vs. Foundation

When exploring tiny homes Orange County, your first and most significant decision is whether to choose a home on wheels or one on a permanent foundation. This single choice dictates where you can legally live, how your home is classified and insured, which regulations apply, and whether it functions as a mobile asset or a piece of appreciating real estate.

Tiny Homes on Wheels (THOWs)

A Tiny Home on Wheels (THOW) is a dwelling built onto a trailer chassis, designed for mobility. Legally, it is almost always classified as a Recreational Vehicle (RV). To be viable for financing and insurance, most THOWs are built to standards set by the Recreational Vehicle Industry Association (RVIA) or the National Organization of Alternative Housing (NOAH). This certification is critical; it verifies that the home meets safety standards for electrical, plumbing, and structural integrity. A certified THOW is issued a Vehicle Identification Number (VIN), just like a car or traditional RV, which is essential for registration and legal transport.

Pros of a THOW:

- Mobility: The freedom to relocate is the primary appeal. You can travel, move for a job, or simply change your scenery.

- Lower Upfront Cost: Generally cheaper to purchase than a foundation home, as there are no land or major site prep costs.

- No Property Tax: As an RV, you pay an annual vehicle registration fee instead of property tax.

Cons of a THOW:

- Placement Restrictions: This is the biggest challenge in Orange County. You cannot legally park and live in a THOW in a residential backyard. They are restricted to designated RV parks.

- Depreciation: Like a vehicle, a THOW typically depreciates in value over time.

- Financing: While RV loans are available, they often come with higher interest rates and shorter terms than a mortgage.

Tiny Homes on a Foundation (ADUs)

Tiny homes on permanent foundations are typically built as Accessory Dwelling Units (ADUs)—also known as granny flats or backyard cottages. These are secondary housing units built on a single-family residential lot. These are permanent structures connected to standard city utilities (water, sewer, electricity) and must be fully permitted and built in accordance with local and state building codes, just like a traditional house.

This permanence offers significant, long-term advantages. A legally permitted ADU is a true real estate asset. It can increase your property value, often by more than its construction cost, and provides a stable source of rental income or flexible housing for family members. While the initial investment is higher due to foundation work, utility connections, and permitting fees, an ADU builds equity and appreciates over time.

Pros of an ADU:

- Builds Equity: It is a real estate investment that appreciates in value.

- Rental Income: Can generate thousands of dollars in monthly rental income in the OC market.

- Legal Stability: Favorable state laws have made them legal and encouraged in residential zones across California.

Cons of an ADU:

- Higher Upfront Cost: Requires a larger investment for site work, permits, and construction.

- Immobility: It is a permanent structure tied to the property.

- Longer Process: The design, permitting, and construction timeline is more extensive than buying a pre-built THOW.

The choice between wheels and a foundation boils down to your long-term goals: mobility and flexibility versus stability and equity. Both paths offer an affordable, sustainable lifestyle, but they follow very different legal and financial routes in Orange County.

Navigating the Rules: Zoning and Regulations for Tiny Homes Orange County

Understanding and navigating local laws is the single most critical and often challenging step when considering tiny homes Orange County. The regulatory landscape is a complex patchwork that varies by city, but recent state-level legislation has created much clearer pathways, especially for tiny homes built on permanent foundations.

The Official View: From “Tiny Homes” to “Small-Scale Housing Units”

In official planning documents, Orange County has moved toward using the term “Small-Scale Housing Units” (SSHUs) instead of the more colloquial “tiny homes.” This deliberate shift in terminology allows for a more precise and professional discussion of various compact housing types. An Ad Hoc committee on housing affordability conducted a detailed study of SSHUs, analyzing everything from 64-square-foot emergency sleeping cabins to 528-square-foot permanent dwellings with full amenities. This official recognition is a crucial step in destigmatizing smaller homes and shaping more supportive and standardized policies across the county. For an in-depth look, the county’s official report offers valuable insight into how officials view this housing category: Orange County Small-Scale Housing Unit Report.

Zoning for THOWs: The Major Hurdle

This is where the dream of tiny living often collides with reality for Tiny Homes on Wheels. Because THOWs are legally classified as RVs, they are subject to RV regulations. In nearly all Orange County cities, this means you cannot legally park a THOW in a backyard or on a private lot and use it as a full-time residence. They are generally restricted to designated RV parks and mobile home communities, which may have their own rules, waitlists, and monthly fees.

Attempting to live in a THOW on a private residential lot is a high-risk strategy that can result in code enforcement violations, significant fines, and orders to vacate. Before investing tens of thousands of dollars in a THOW, it is imperative to contact your specific city’s planning and code enforcement departments to get a clear, written understanding of the rules for using an RV as a dwelling.

Zoning for Foundation Homes (ADUs): A Clearer Path Forward

For tiny homes built on a permanent foundation, the legal landscape is dramatically more favorable. In response to the statewide housing crisis, California has passed a suite of progressive laws, such as AB 68 and SB 9, designed to make building ADUs easier, faster, and more accessible for homeowners. These state laws streamline the approval process and, crucially, override many restrictive local ordinances that previously made ADUs difficult or impossible to build. You can find comprehensive information on the state’s official California Department of Housing and Community Development ADU page.

- Bill text for AB 68 (2019) was a landmark bill that forced cities to approve ADUs within 60 days, reduced setback requirements, and eliminated parking requirements for many projects.

- Bill text for SB 9 (2021) went even further, allowing many homeowners to split their single-family lots and potentially build up to four units where only one stood before.

While cities like Anaheim, Irvine, and Huntington Beach have embraced ADUs and have dedicated resources to guide homeowners, they still have their own specific permitting processes, fees, and design standards. For example, Irvine has pre-approved ADU plans to expedite the process, while Anaheim provides clear checklists and a homeowner-friendly portal. The key takeaway is that while the state has removed the biggest barriers, you must still work closely with your local planning department to ensure your project complies with all requirements.

The Financial Blueprint: Cost, Financing, and Finding Your Tiny Home

Embarking on a tiny home journey in Orange County requires a solid financial plan. While the costs are significantly lower than for traditional housing, it’s essential to understand the specific expenses of purchasing, building, financing, and sourcing your home to budget effectively and avoid surprises.

What is the Average Cost of Buying or Renting a Tiny Home in Orange County?

The cost of tiny homes Orange County varies dramatically based on type, size, level of finish, and whether you build it yourself or buy it turnkey. Purchase prices generally fall within a range of $24,500 for a basic, no-frills unit to over $150,000 for a high-end, custom model with luxury finishes.

- DIY Shells: For those with the skills and time, a basic tiny home shell on wheels can be purchased for $20,000 to $40,000. This provides the trailer and exterior structure, leaving you to complete the plumbing, electrical, and all interior work.

- Professionally Built THOWs: Turnkey models from established builders like Pacifica Tiny Homes or California Tiny House typically start around $47,900 for a smaller model and can easily exceed $100,000 for larger, fully-equipped units with custom features.

- Foundation-based ADUs: These represent a higher upfront investment, often ranging from $100,000 to $300,000+. This comprehensive cost includes design fees, expensive city permits, foundation work, utility connections (which can cost $10,000-$25,000 alone), and construction. However, this is a real estate investment that adds significant, appreciating value to your property.

The prohibitive cost of land in Orange County is a separate and often much larger expense if you don’t already own property. This is precisely why building an ADU on an existing residential lot is the most popular and financially sound option for tiny living in the region. Long-term residential rentals of tiny homes are extremely rare, with most listings being for short-term vacation stays or creative/commercial use.

Securing Financing for Your Tiny Home in Orange County

Financing a tiny home is not as straightforward as getting a traditional mortgage, and the options depend on the type of home.

- RV Loans: This is the most common route for certified THOWs that meet RVIA standards. Lenders like LightStream or credit unions that offer RV loans are familiar with these mobile dwellings. A good credit score is essential, and terms are typically shorter (5-15 years) than a mortgage.

- Unsecured Personal Loans: These loans can be used for any type of tiny home, including DIY projects or non-certified THOWs. However, they usually come with higher interest rates and shorter repayment terms (3-7 years) because they are not secured by collateral.

- Builder Financing: Many tiny home builders have established relationships with lenders or offer their own in-house financing to simplify the buying process. This can be a convenient one-stop-shop option, with some companies advertising monthly payments as low as $362 for their most basic models.

- Home Equity Loans/Lines of Credit (HELOC): For homeowners building an ADU, this is often the best financing option. By borrowing against the equity in your primary residence, you can secure a large loan with a low interest rate and a long repayment term, making it ideal for a major construction project.

Where to Find Tiny Homes for Sale

Knowing where to look is key to finding the right tiny homes Orange County for your needs and budget.

- Online Marketplaces: Websites like Tiny House Listings and Tiny Home Builders’ marketplace are dedicated platforms for new and used tiny homes. Broader real estate sites like Zillow or Houzeo may also occasionally list them.

- Specialized Builders: The best way to assess quality is to connect directly with builders. Companies like Pacifica Tiny Homes, California Tiny House, and Forever Tiny Homes are reputable California-based builders that offer tours of their models and work with clients on custom designs.

- Social Media & Forums: Facebook groups and online forums dedicated to the tiny house movement are great places to find private sellers, get recommendations for builders, and learn from the experiences of other owners.

- Home & Garden Shows: Events like the OC Home & Garden Show sometimes feature tiny home builders, providing an excellent opportunity to see different models in person, compare features, and speak directly with company representatives.

Always perform due diligence when selecting a builder. Check their reputation, read reviews, ask for references, and ensure they adhere to necessary certifications (like RVIA for THOWs) and local building codes (for ADUs). For builders looking to connect with qualified customers, specialized marketing is key. Learn more about marketing for tiny house builders in California to see how targeted strategies can grow your business.

The Reality Check: Challenges and Drawbacks to Consider

While the benefits of tiny homes Orange County are compelling, it’s crucial to approach this lifestyle with a clear-eyed understanding of the challenges. Tiny living is not a simple, plug-and-play solution; it requires a significant lifestyle adjustment, meticulous planning, and resilience, especially in a densely populated and highly regulated area.

Space, Storage, and the Art of Downsizing

Living in under 500 square feet is a radical departure from the typical American home. This requires a fundamental and often difficult change in your relationship with possessions. The downsizing process can be emotionally taxing and practically overwhelming. Success hinges on ruthless decluttering and the adoption of smart storage solutions and multi-functional design. Every square inch must have a purpose. This means investing in furniture like a couch that converts into a guest bed and dining table, stairs that double as drawers, and vertical storage that utilizes wall space effectively. There is simply no room for clutter or impulse purchases. This commitment to deep minimalism is a rewarding discipline for some and an unsustainable restriction for others.

Legal, Logistical, and Financial Hurdles

This is often the biggest and most frustrating hurdle for prospective tiny home owners. The regulatory landscape is a minefield that can stop a project before it starts.

- Zoning for THOWs: The simple truth is that in Orange County, a THOW is an RV, and you generally cannot live in one in a backyard full-time. They are restricted to designated RV parks, which can be difficult to find, have long waitlists, and come with their own set of rules, fees, and a less-than-permanent atmosphere.

- ADU Permitting: While state laws have streamlined the process, building a legal ADU is still a bureaucratic marathon. It involves significant permitting fees (which can run into the tens of thousands), multiple inspections, and strict compliance with local building codes, energy standards, and design guidelines. Utility hookups, in particular, can be unexpectedly complex and costly, sometimes requiring trenching across a landscaped yard.

- Insurance and Financing: Insuring a tiny home can be a puzzle. THOWs need specialized RV insurance, which can be difficult to secure for custom or DIY builds that lack official RVIA certification. ADUs must be properly added to a homeowner’s policy, and not all insurance agents are familiar with these structures, leading to confusion and potential coverage gaps. Similarly, financing can be tricky, as tiny homes don’t fit neatly into traditional mortgage or loan categories.

Social and Community Factors

The human element presents another set of real-world challenges. Dedicated tiny home communities for private owners are virtually non-existent in Orange County, which can lead to a sense of isolation compared to living in a traditional neighborhood. You are often the only tiny home on the block or in the RV park.

Furthermore, there’s the NIMBY (“Not In My Backyard”) phenomenon. Despite the housing crisis, some existing residents may harbor concerns about ADUs or tiny homes impacting property values, parking, privacy, or neighborhood character. The Orange County SSHU report specifically highlighted community engagement and overcoming negative perceptions as a key challenge. Successfully integrating a tiny home, especially an ADU, requires proactive communication with neighbors, a thoughtful design that complements the existing neighborhood aesthetic, and a commitment to being a responsible, considerate neighbor. Winning over skeptics often happens when they see a high-quality, well-designed project that enhances the property and provides needed housing.

Frequently Asked Questions about Tiny Homes in Orange County

Here are straight, no-nonsense answers to the most common questions we hear about tiny homes Orange County.

Can I legally live in a tiny house on wheels in Orange County?

Generally, no. In almost all Orange County cities, you cannot live full-time in a Tiny Home on Wheels (THOW) parked on a private residential lot (e.g., your backyard or a friend’s driveway). Because THOWs are legally classified as Recreational Vehicles (RVs), they are restricted to designated RV parks or mobile home communities for long-term occupancy. Regulations are city-specific and can change, so you must confirm with your local planning department before purchasing a THOW with the intent to live in it locally.

Is a tiny home a good investment in California?

It entirely depends on the type. A tiny home on a permanent foundation (ADU) is an excellent investment. It is a legal, permitted structure that adds square footage to your property, significantly increases your property’s market value, and can generate substantial rental income in a high-demand market like Orange County. A THOW, however, should be viewed more like a vehicle or a lifestyle asset. It provides affordable housing value but typically depreciates over time and does not build equity in the same way that real estate does.

How small is a tiny home?

While there is no single, universally accepted legal definition, a tiny home is generally considered to be a residential structure under 500 square feet. The International Residential Code (IRC) provides a formal definition in Appendix Q for tiny houses on a foundation, defining them as 400 square feet or less. However, the term is used more broadly. Orange County’s official studies have examined “Small-Scale Housing Units” (SSHUs) ranging from a 64-square-foot sleeping cabin to a 528-square-foot dwelling with a full kitchen and bathroom. The defining characteristic is not just the small size, but the efficient, intentional, and highly functional design of a compact living space.

What are the property tax implications for a tiny home?

This is a key difference between the two types. A THOW is registered with the DMV as a vehicle, so you pay an annual vehicle registration fee, not property tax. An ADU, as a permanent improvement to your property, will trigger a reassessment of your property value. However, it’s not a reassessment of the entire property. Your tax bill will increase based only on the value of the newly constructed ADU, resulting in a relatively modest and predictable increase in your annual property taxes.

How long does it take to build a tiny home?

The timeline varies greatly. A pre-designed THOW from a professional builder can often be completed in 8 to 12 weeks. A custom THOW may take 4 to 6 months from design to delivery. An ADU project is much longer due to the permitting process. The design and engineering phase can take 1-3 months, the city plan review and permitting process can take another 2-6 months (even with streamlined laws), and the on-site construction itself can take 4-8 months. A realistic total timeline for an ADU, from initial concept to move-in, is typically 9 to 18 months.

Conclusion

The tiny homes Orange County movement is more than a trend; it’s a rational and powerful response to the region’s housing affordability crisis. It offers a tangible path toward financial freedom, environmental sustainability, and a more intentional lifestyle. While traditional homes in the area come with staggering, lifelong costs, tiny homes can slash monthly housing expenses by 70% or more, fundamentally changing one’s financial future.

However, this journey demands clear-eyed planning and a deep understanding of local realities. The regulatory landscape is complex, and the distinction between a mobile Tiny Home on Wheels (THOW) and a permanent Accessory Dwelling Unit (ADU) is the most critical factor for success in Orange County. THOWs, classified as RVs, face severe placement restrictions that make them a logistical and legal challenge for stable, long-term living.

For those seeking to put down roots in Orange County, ADUs represent the most stable, valuable, and legally supported opportunity. Bolstered by progressive state laws like AB 68 and SB 9, these permanent tiny homes are a sound real estate investment. They add real, appreciating value to your property, create the potential for significant rental income, and offer flexible housing solutions for family or personal use. They are not just a lifestyle choice; they are a strategic financial asset.

The market for these homes is expanding rapidly, and for builders and architects in this space, the competition is fierce. Success requires more than just quality construction; it demands deep expertise in navigating a maze of regulations and confidently guiding clients through a complex, high-stakes process. In this environment, homeowners are looking for a trusted authority, not just the lowest bidder.

At ADU Marketing Pros, we specialize in helping construction and architecture firms cut through the noise. We build powerful marketing strategies that showcase your expertise, build unwavering trust with your ideal clients, and position your firm as the go-to leader in the Southern California ADU market.

If you’re a builder or architect ready to attract more qualified, high-value leads and scale your business in California’s booming ADU industry, we can help. Learn more about marketing for tiny house builders in California and discover how our targeted, authority-building approach can transform your business.

The tiny home movement is actively reshaping what’s possible in Southern California, offering a rare chance to own your space, live sustainably, and build the life you truly want.