Why Understanding ADU Terminology Matters for Homeowners

What does adu stand for in real estate? ADU stands for Accessory Dwelling Unit—a secondary, self-contained living space located on the same property as a single-family home. These units are also commonly known as granny flats, in-law suites, backyard cottages, or casitas. While the concept isn’t new, their modern resurgence represents one of the most significant shifts in residential real estate in decades.

Quick Definition:

- ADU = Accessory Dwelling Unit

- A separate residential unit on your property

- Must include its own kitchen, bathroom, and living space

- Has a separate entrance from the main home

- Cannot be sold separately from the primary residence

For homeowners looking to increase property value, generate substantial rental income, or accommodate family members in a private, dignified way, understanding the nuances of ADUs is essential. These units have surged in popularity, especially in high-cost states like California, Oregon, and Washington, where updated zoning laws have dismantled previous barriers to construction. This boom is a direct response to housing affordability crises, offering a practical way to increase housing density in existing neighborhoods without large-scale development.

ADUs represent a major evolution in how we view the single-family lot. For example, homes with ADUs in Portland sold for up to 11% more per square foot, and a landmark National Association of Realtors study found they can add up to 35% to a home’s value. This isn’t just about adding a room; it’s about adding a complete, income-generating or family-supporting home to your property.

Beyond the powerful financial benefits, ADUs offer flexible solutions for modern life. They are perfect for multi-generational living, allowing aging parents to live close by while maintaining independence. They can serve as a launchpad for adult children saving for their own home, a private and quiet remote work office, or a creative studio. This guide covers everything you need to know about accessory dwelling units, from their core definition to the financial and legal steps involved in building one.

Handy what does adu stand for in real estate terms:

What Does ADU Stand For in Real Estate? A Complete Definition

When we talk about what does adu stand for in real estate, we mean an Accessory Dwelling Unit. This is any legal, secondary living space on the same lot as a primary single-family home. Often called a granny flat, in-law suite, or backyard cottage, an ADU is a fully independent mini-home that shares the property’s address. To legally qualify as an ADU, the unit must be a self-sufficient living space with permanent provisions for living, sleeping, eating, cooking, and sanitation. A separate entrance is also a mandatory feature, ensuring privacy and independence from the main house.

Crucially, an ADU cannot be bought or sold separately from the primary home, nor can the lot be subdivided. It is an “accessory” to the main property, adding significant value and utility without creating a new parcel of land. This characteristic is fundamental to its legal and real estate definition, deeply impacting how it is financed, appraised, and taxed.

For a deeper dive into the concept, you can explore resources like All About Accessory Dwelling Units from the AARP, which offer comprehensive insights into their role in creating more livable communities.

The Core Characteristics of an ADU

Beyond the basic definition, several core characteristics universally define an ADU and distinguish it from other structures:

- Accessory Structure: An ADU is always secondary in use and size to the main dwelling. It complements the primary home rather than competing with or replacing it.

- Subordinate to Primary Residence: An ADU is typically smaller in square footage and scale than the primary house. Local ordinances often dictate a maximum size, either as a fixed number (e.g., 1,200 sq. ft.) or a percentage of the main home’s size.

- Permanent Foundation: ADUs are built on a permanent foundation, making them a permanent part of the real estate. This is a key distinction from mobile or tiny homes on wheels (THOWs), which are often classified as personal property or vehicles and have different zoning and financing rules.

- Utility Connections: Every ADU must connect to essential utilities like water, sewer, and electricity. These connections can be shared with the main house through a subpanel and shared meter, or they can be entirely separate, depending on local codes and homeowner preference. Separate meters can simplify billing if the unit is rented but may increase construction costs.

- Complete Living Space: A fully functional kitchen (with a sink, cooking appliance, and refrigeration), a bathroom (with a toilet, sink, and shower or tub), and dedicated living/sleeping areas are required for independent living. This is what makes it a “dwelling unit” and not just a guest room or pool house.

Understanding these characteristics helps clarify why an ADU is a unique and valuable addition. It’s truly a home within a home’s property.

What qualifies as an ADU for appraisal purposes?

For homeowners in California, understanding how an ADU is appraised is crucial for securing financing and realizing its full market value. Appraisers and lenders, following guidelines from entities like Fannie Mae, have specific criteria to determine if a structure is a true ADU versus part of a multi-unit property, which impacts financing and valuation.

According to the Fannie Mae Selling Guide, key factors for classification include:

- Independent Living Facilities: The unit must have its own kitchen, bathroom, and sleeping area.

- Separate Utilities: The existence of separate utility meters is a strong indicator of a two-unit property for appraisers, though state laws now facilitate ADUs sharing utilities with the primary home.

- Separate Mailing Address: An ADU generally shares the main home’s mailing address, sometimes with a “Unit B” or “#A” designator, but does not have a separately assigned address from the post office.

- Legal Rental Status: The unit must be legally permitted for rental. Unpermitted ADUs (sometimes called “illegal suites”) cause significant appraisal and sale issues. They cannot be counted in the gross living area, and their value contribution is minimal and risky. Lenders will often refuse to finance properties with unpermitted units due to safety and legal liabilities.

- Subordinate Size: An ADU is usually significantly smaller than the primary dwelling, reinforcing its “accessory” status.

The appraisal’s goal is to determine the property’s highest and best use and its market value. A permitted ADU’s contribution is assessed based on its legality, quality of construction, and market demand in areas like Los Angeles and the San Francisco Bay Area. For more on how lenders view ADUs, review our guide on Fannie Mae ADU Rental Income.

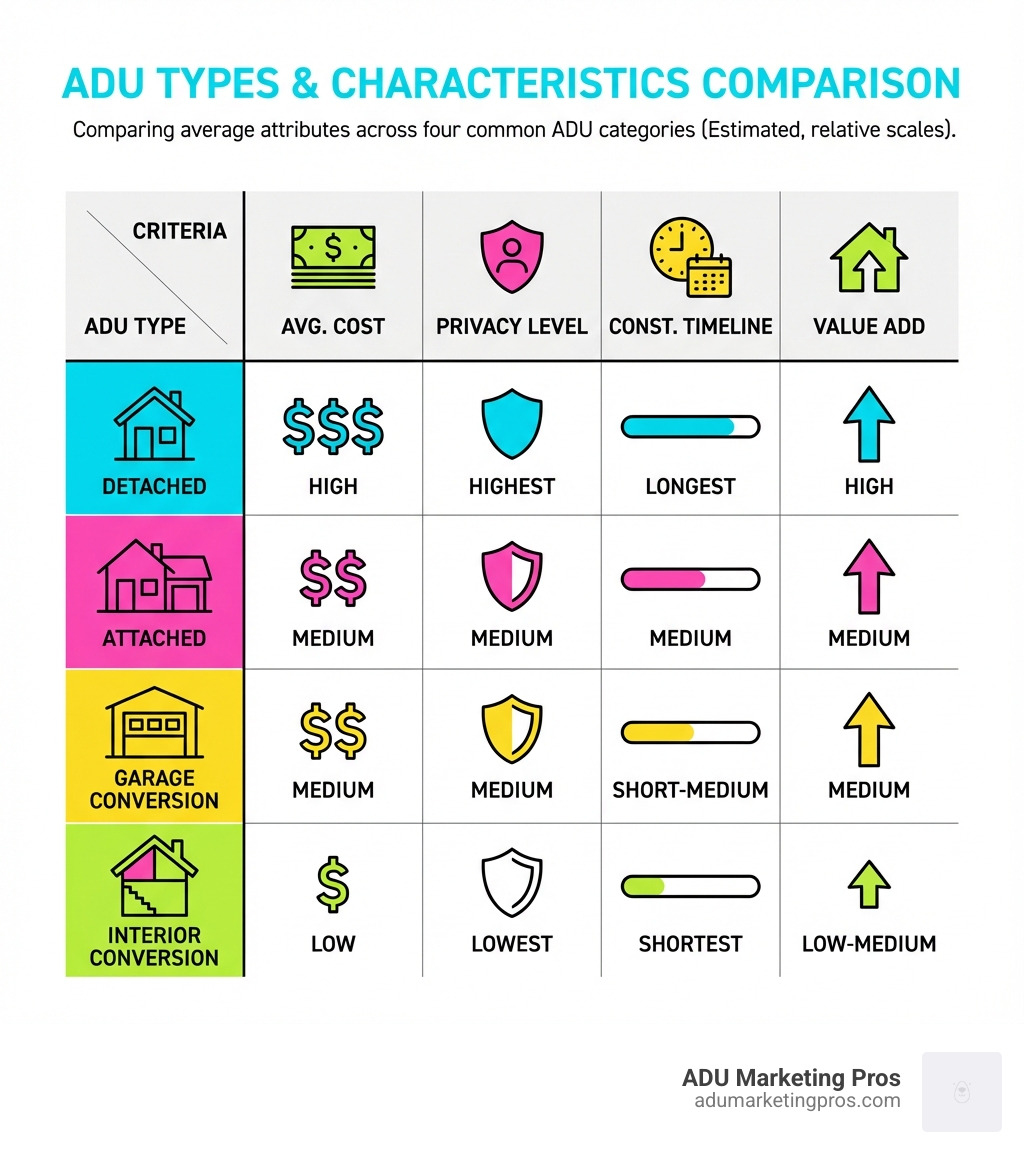

The Spectrum of ADUs: Exploring Different Types

ADUs come in several forms, each with unique benefits, costs, and construction processes. The choice often depends on your property’s layout, your budget, and your ultimate goals for the unit. Let’s break down the main categories:

For a deeper dive into aesthetic and functional choices, exploring ADU Design Trends can provide valuable inspiration for any type of unit.

Detached ADU (D-ADU)

A detached ADU, often called a backyard cottage or granny flat, is a stand-alone structure completely separate from the primary residence. It offers the highest level of privacy for both the main home occupants and the ADU residents, making it the ideal choice for generating rental income or housing non-family members. This type involves new ground-up construction, making it the most expensive option due to the need for a new foundation, framing, and running utility lines across the yard. However, the investment often yields the highest returns in both property value and rental rates, making it a popular choice in spacious suburban areas like San Jose and parts of Los Angeles. Find inspiration with various Detached ADU Plans.

Attached ADU

An attached ADU shares one or more walls with the main house but has its own separate exterior entrance. This could be a new addition built onto the side or back of the home, or a new living space constructed over an existing garage. Because it shares a wall and can often tie into the main home’s existing plumbing and electrical systems more easily, an attached ADU is typically a mid-range cost option. It offers a balance of integration and independence. A key design consideration is ensuring architectural harmony with the existing home’s style and materials. Proper soundproofing between the units is also critical to maintain privacy. Exploring ADU Exterior Design can help you visualize a seamless blend.

Conversion ADUs: Garage and Interior Spaces

Conversion ADUs are often the most cost-effective and quickest to build because they repurpose existing, underutilized structures within the property’s footprint.

- Garage Conversion ADU: Converting a garage into a living space is incredibly popular in California, where many garages are used for storage rather than parking. It repurposes an underused area and requires less structural work than new construction. Common challenges include upgrading the concrete slab to be a suitable interior floor, adding sufficient insulation, and ensuring adequate natural light through new windows and doors. The cost typically ranges from $120,000 to $200,000, making it an attractive option in dense, high-cost areas like Los Angeles and the Bay Area. Learn more on our Garage Conversion ADU page.

- Basement/Attic Conversion ADU: Changing an unused basement (often called a “daylight basement”) or a spacious attic into a living unit is also a budget-friendly approach. These conversions are excellent for maximizing a property’s assets without expanding its footprint, which is ideal for dense urban areas with small lots. Key considerations include ensuring adequate ceiling height (typically a minimum of 7 feet), providing proper egress (a window or door for escape in an emergency), and managing moisture in below-ground spaces.

Junior ADU (JADU)

The Junior ADU (JADU) is a special, smaller category unique to California law, designed as a more affordable and streamlined housing option. A JADU is no more than 500 square feet and must be created within the existing walls of a single-family home or an attached garage. What makes a JADU distinct is its reduced requirements: it can share a bathroom with the main home and only requires an “efficiency kitchen.” This includes a small sink, a cooking appliance (like a hot plate or microwave), a refrigerator, and counter space, but does not require a full gas or 220-volt stove. This allows homeowners to convert a spare bedroom with fewer construction hurdles, a key benefit in cities like San Jose and San Diego. For size regulations, see our guide on How Big Can an ADU Be in California?.

The Pros and Cons: Is Building an ADU Right for You?

Building an ADU is a major decision involving significant investment, lifestyle adjustments, and long-term planning. Like any significant real estate project, it has compelling advantages and potential challenges that every homeowner should weigh carefully.

The Advantages of Adding an ADU

Building an ADU can bring a wealth of benefits, both financial and personal, that can transform your property and financial outlook:

- Significant Rental Income Potential: An ADU can generate substantial passive income. In prime California markets like the Bay Area or West Los Angeles, monthly rents for a one-bedroom ADU can often exceed $2,500-$3,500. This income can offset or even cover your mortgage payments, pay off the construction loan, and build wealth.

- Increased Property Value: An ADU is a tangible asset that adds considerable value to your property. Studies show an ADU can increase value by as much as 35%. It makes your home more attractive to a wider range of future buyers, including those looking for multi-generational living options or built-in rental income.

- Flexible Housing Solutions: ADUs are incredibly versatile. They can serve as a private, accessible space for aging parents (“aging in place”), a home for adult children saving money, or a guesthouse for visitors. In the remote work era, a detached ADU can be the ideal dedicated home office, providing quiet separation from the main house.

- Addressing Housing Needs: In dense California cities facing housing shortages, ADUs play a crucial role. They increase the housing supply by creating gentle density in existing neighborhoods and offer more affordable rental options without requiring massive new land development.

- Potential Tax Benefits: If you rent out your ADU, you may be eligible for significant tax deductions. Expenses related to the rental portion of your property, such as a percentage of your mortgage interest, property taxes, insurance, and depreciation of the ADU structure, can often be deducted, reducing your overall tax burden.

- Sustainable Development: Building an ADU is an environmentally friendly choice. It utilizes existing land and infrastructure, promoting density and reducing urban sprawl. This leads to more walkable communities and less reliance on cars.

Potential Disadvantages and Challenges

While the benefits are plentiful, it’s important to be realistic about the challenges and responsibilities involved:

- High Upfront Construction Costs: Building an ADU is a significant investment. Costs can range from $60,000 for a simple JADU to over $400,000 for a high-end, custom detached unit in California. This includes not just hard costs (materials, labor) but also soft costs like design fees, engineering, and city permits.

- Ongoing Maintenance and Landlord Duties: As a landlord, you’ll be responsible for all repairs, tenant screening, rent collection, and general upkeep of the unit. This requires time, effort, and a budget for unexpected expenses like a broken water heater or appliance.

- Loss of Privacy and Shared Space: Renting your ADU to a tenant will naturally impact your privacy, as you’ll be sharing your backyard, driveway, or other common areas. Thoughtful design can help mitigate this, but it’s a fundamental trade-off.

- Reduced Yard Space: A detached ADU will take up a portion of your backyard, which is a direct trade-off for less outdoor recreational space for your family. This is a major consideration for homeowners who value a large yard.

- Increased Property Taxes: Adding a permitted secondary unit will trigger a reassessment of your property’s value for tax purposes. However, in California, this is typically a “blended assessment.” Only the value of the new construction is added to your existing property tax basis; your entire property is not reassessed at current market value. Still, this ongoing cost is important to factor into your budget. See our page on ADU Property Taxes for details.

- Zoning and Permitting Complexities: While California has streamlined regulations, navigating local zoning codes, building permits, and inspection processes can still be complex and time-consuming. Working with an experienced architect or design-build firm is crucial to avoid costly mistakes and delays.

Navigating the Financials and Legalities of ADUs

Building an ADU is a substantial project that requires careful planning, both financially and legally. Understanding the costs, financing options, and regulatory landscape is the first step toward a successful build. We’re here to help you understand the landscape.

How much does it cost to build an ADU?

The cost to build an ADU varies widely based on its type, size, level of finish, and location in California. A broad range is from $60,000 to over $400,000. Projects in high-cost labor markets like the Bay Area will naturally be more expensive than in other parts of the state.

Key cost factors include:

- Type of ADU: Detached new construction is most expensive, while interior conversions (JADUs, basement units) are the least expensive.

- Size and Design: Larger, custom-designed units with high-end finishes (e.g., stone countertops, premium appliances) will cost significantly more than smaller, more basic units.

- Site Conditions & Infrastructure: A flat, easily accessible lot is cheaper to build on. Extending utility lines (water, sewer, electric) to a detached unit in the backyard can be a major expense, sometimes requiring trenching across landscaped areas.

- Soft Costs: These are expenses beyond labor and materials, including architectural and engineering fees, soil reports, survey costs, and city permit and impact fees. These can add 15-25% to the total project cost.

- Labor Costs: Labor can account for 40% to 60% of the total project cost and varies significantly by region.

For example, a garage conversion may cost $120,000-$200,000, while a JADU can be as low as $25,000-$60,000 if the existing space requires minimal modification. For a more detailed breakdown, see our Cost to Build ADU resource.

How can an ADU be financed?

Homeowners in California have several effective ways to finance an ADU project, often by leveraging the equity in their property:

- Cash-Out Refinance: This involves replacing your current mortgage with a new, larger one. You take the difference between the two loan amounts in cash, which can be used to fund the ADU construction.

- Home Equity Loan (HEL): Often called a second mortgage, this is a loan for a fixed amount of money that is secured by your home’s equity. You receive the funds as a lump sum and pay it back in fixed monthly installments over a set term.

- Home Equity Line of Credit (HELOC): A HELOC is a revolving line of credit, similar to a credit card, that you can draw from as needed during the construction process. It offers flexibility, but typically has a variable interest rate.

- Construction Loan: This is a specialized, short-term loan for new construction. Funds are disbursed in stages (or “draws”) as construction milestones are completed and verified by an inspector.

- Renovation Loans (like FHA 203k): Certain government-backed loans allow you to borrow against the future value of your home after the improvements are made. Some may even allow you to use the ADU’s expected rental income to help you qualify for the loan.

- Government Grants and Programs: California offers incentives like the CalHFA ADU Grant Program, which provides up to $40,000 to low- and moderate-income homeowners to cover pre-development costs like design and permits.

For a comprehensive look at these options, visit our page on ADU Financing Options.

What are the legal requirements for building an ADU?

Navigating the legal landscape for ADUs in California has become much easier thanks to a series of state-level laws designed to remove barriers and encourage construction in cities like Los Angeles, San Diego, and San Jose.

Key legal requirements and allowances include:

- Zoning Laws: California is an ADU-friendly state where state laws supersede most restrictive local ordinances. Essentially, if you have a single-family or multi-family property, you are likely allowed to build at least one ADU.

- Setbacks: State law mandates reduced setbacks. Most ADUs can be built with just 4-foot side and rear yard setbacks, allowing them to fit on lots where it was previously impossible.

- Lot Size & Height: Minimum lot size requirements have been eliminated for ADUs. Height limits are generally up to 16 feet for detached ADUs, with some exceptions for higher limits near the primary home.

- Parking: No replacement parking is needed for a garage conversion. Furthermore, no parking is required for the ADU at all if it’s located within a half-mile of public transit.

- Permitting Process: State law mandates that local agencies must approve or deny ADU permit applications within 60 days, streamlining what used to be a lengthy and uncertain process.

- Owner-Occupancy Rules: California has prohibited local governments from requiring owner-occupancy on new ADUs until 2025, a move designed to encourage the development of rental housing.

- Impact Fees: These fees, charged by cities to pay for infrastructure, are eliminated for ADUs under 750 square feet and are proportionally reduced for larger units.

- Homeowners’ Associations (HOAs): State law now prohibits HOAs from unreasonably banning or restricting the construction of ADUs, though they can still enforce reasonable design guidelines.

Always check with your local city’s planning department for specific local ordinances and design standards. Our guide on California ADU Regulations offers more detail.

ADU vs. Two-Family Property: Understanding the Key Differences

One of the most common points of confusion for homeowners, buyers, and even real estate agents is the difference between a property with an ADU and a true two-family property like a duplex. While both configurations involve two living units on a single lot, their legal, financial, and zoning implications differ significantly.

What does ADU stand for in real estate vs. a duplex?

The core difference between a property with an ADU and a duplex lies in the concepts of “accessory” use and property zoning.

- Property with an ADU: This is legally classified as a single-family residence with an accessory unit. The ADU is secondary and subordinate to the primary home. It exists on the same legal parcel and cannot be sold separately. Its existence is an addition to the primary use.

- Two-Family Property (Duplex): This is legally classified as a multi-family residence. It consists of a structure with two primary living units, often of similar size, intended for two separate households. The entire property is zoned, financed, and appraised as a two-unit building from the outset.

Here is a table summarizing the key distinctions:

| Feature | Property with ADU | Two-Family Property (Duplex) |

|---|---|---|

| Zoning Classification | Single-Family Residential | Multi-Family Residential |

| Separate Sale | Cannot be sold separately from the main home. | Units cannot be sold separately (unless converted to condos). |

| Utility Meters | Often share meters with the main house. | Almost always have separate utility meters. |

| Mailing Address | Shares an address with the main home (e.g., 123 Main St. & 123 Main St. Unit B). | Typically have distinct addresses (e.g., 123A and 123B Main St.). |

| Financing | Qualifies for standard single-family home loans. | Requires multi-family/investment property loans. |

| Appraisal | Valued against other single-family homes with ADUs. | Valued against other duplexes and multi-family properties. |

The Fannie Mae Selling Guide provides specific criteria that lenders use to make this critical distinction.

How Appraisers and Lenders View the Distinction

For appraisers and lenders, correctly classifying a property is critical for determining its value and loan eligibility. They perform a “Highest and Best Use” analysis to determine if the property is best utilized as a single-family home with an ADU or as a two-family income property.

- Appraisal Impact: A property with a legal, permitted ADU is appraised using the sales comparison approach, where the appraiser looks for recent sales of similar single-family homes with ADUs. If comps are scarce, they may use an income approach, where the potential rent from the ADU contributes to the overall value. An unpermitted unit, however, can significantly complicate an appraisal and may not be given any value.

- Lending Guidelines: This distinction is paramount for lenders. A property with an ADU generally qualifies for more favorable single-family financing (e.g., conventional 30-year fixed loans with lower down payments). A two-family property, on the other hand, requires multi-family financing, which often comes with higher interest rates, larger down payment requirements, and stricter underwriting. Adherence to ADU Building Requirements is crucial to ensure the unit is classified correctly as an ADU.

Understanding these nuances is vital in markets like San Francisco and Palo Alto, as the classification directly impacts the property’s marketability, value, and your ability to secure financing.

Conclusion

We’ve thoroughly decoded what does adu stand for in real estate and explored the multifaceted world of Accessory Dwelling Units. From their core definition as secondary, self-contained living spaces to the diverse types available—including detached backyard cottages, attached additions, cost-effective conversions, and compact JADUs—we’ve seen how these units are fundamentally reshaping California’s residential landscape.

ADUs offer a powerful combination of compelling benefits. They can provide a steady stream of rental income, deliver a significant boost in property value, and offer unparalleled flexibility for multi-generational living or dedicated workspaces. While the process involves navigating upfront costs, financing, and local regulations, the long-term strategic advantages in wealth creation and lifestyle enhancement often far outweigh the challenges. We also clarified the crucial distinction between a property with an ADU and a two-family property, a key detail that heavily influences appraisal, financing, and overall investment strategy.

Ultimately, an ADU is more than just an extra building; it is a versatile real estate asset that enhances a property’s functionality, financial performance, and adaptability to modern life. In today’s dynamic housing market, understanding the potential of ADUs is essential for any homeowner looking to maximize their property’s value and utility.

At ADU Marketing Pros, we specialize in a single mission: helping ADU construction and architecture firms in California’s key markets—like Los Angeles, San Diego, and the Bay Area—connect with homeowners who are eager to begin this rewarding journey. We empower our clients to stand out in a crowded market and grow their businesses by focusing on what they do best: designing and building exceptional homes.

Ready to explore how an ADU can benefit your property or business? We encourage you to Explore your ADU project with our educational resources to take the next confident step.