Why Understanding ADU Tax Credits in California Matters

The term ADU tax credit California is one of the most frequent searches by homeowners exploring the possibility of adding a second unit to their property. This search, however, often leads to a significant misconception. While many hope for a direct, dollar-for-dollar credit to help offset the substantial costs of construction, the financial reality in the Golden State is more nuanced and, in many ways, more strategically beneficial in the long run. California does not offer a statewide tax credit specifically for building an Accessory Dwelling Unit (ADU).

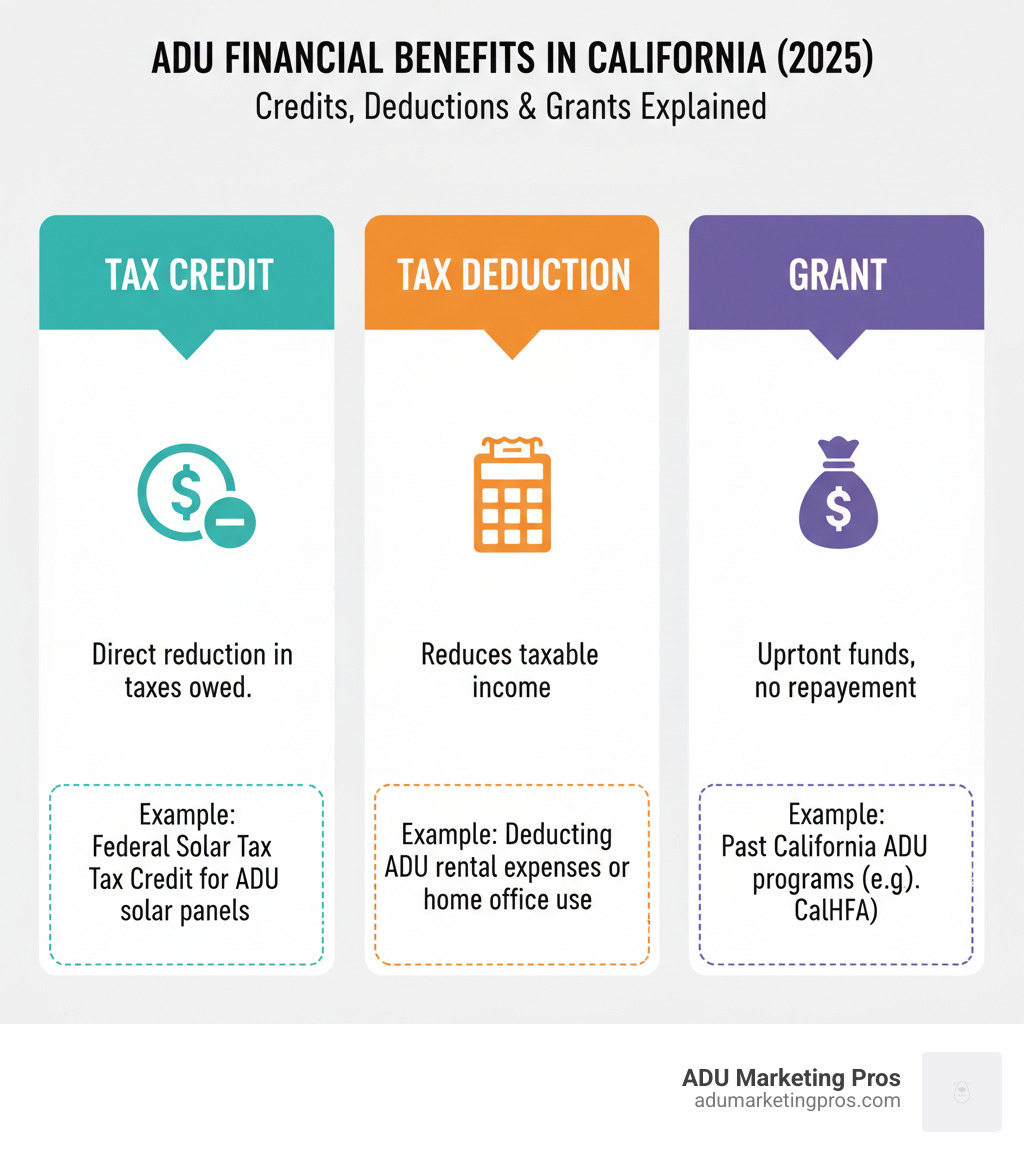

This fact can feel discouraging, but it’s only the beginning of the story. The absence of a simple construction credit is balanced by a robust framework of other financial incentives designed to make ADUs a viable and profitable investment. The confusion often stems from the interchangeable use of terms like tax credits, tax deductions, and grants. Understanding the difference is the first step toward maximizing your financial return.

Quick Answer: What You Need to Know

- No Direct State Tax Credit: California has not implemented a statewide tax credit for the general construction of an ADU. The state’s focus has been on other forms of financial relief.

- Valuable Federal Tax Credits: The federal government offers powerful tax credits for energy-efficient upgrades. Installing solar panels, for example, can make you eligible for the Residential Clean Energy Credit, which can be up to 30% of the system’s cost.

- Manageable Property Tax Increases: Your property taxes will go up, but not as much as you might fear. The increase is calculated at about 1-1.5% of the ADU’s construction cost, not the market value of your entire property.

- Powerful Tax Deductions: If you use the ADU as a rental property or a dedicated home office, you can unlock significant tax deductions for expenses, including depreciation, mortgage interest, and repairs.

- Past and Potential Future Grants: While the popular CalHFA $40,000 grant program is currently inactive due to depleted funds, the precedent for such programs exists. It’s crucial to monitor state and local agencies for future funding opportunities.

- Blended Assessment Protection: A key state law prevents your primary home’s property tax basis from being fully reassessed when you build an ADU. This is a massive, permanent financial protection that saves homeowners thousands annually.

While there’s no single construction credit to claim, a savvy homeowner can leverage the actual tax implications—from property tax rules and capital gains benefits to valuable deductions for rental or business use—to save tens of thousands of dollars over the life of their investment. This guide will demystify the financial landscape, clarifying what benefits do exist, how new laws protect you from excessive property tax hikes, and how to strategically maximize your savings whether you rent out your ADU or use it for a business.

The Reality of an ADU Tax Credit California: What Actually Exists?

Homeowners embarking on an ADU project often use the terms “tax credit,” “tax deduction,” and “grant” interchangeably, but these financial tools have vastly different impacts on your bottom line. A tax credit is the most direct benefit, offering a dollar-for-dollar reduction of your tax liability. A tax deduction is also valuable, but it works by lowering your total taxable income, with the final savings determined by your marginal tax bracket. A grant is upfront cash provided by a government agency or organization that you do not have to repay.

The bottom line is that California does not offer a direct statewide ADU tax credit California for construction. However, the state has implemented other powerful financial incentives, including crucial property tax protections and support for energy efficiency, which can be even more valuable over time.

The Myth of a Statewide ADU Tax Credit California

Let’s be unequivocally clear: there is no statewide tax credit in California simply for building an ADU. This is the most common misconception homeowners have, and it’s an understandable one. With ADU construction costs frequently ranging from $150,000 to over $400,000, the prospect of a direct credit is highly appealing. However, California legislators have strategically focused on other mechanisms to encourage ADU development.

Instead of a one-time credit, which could be complex to administer and might quickly run out of funding, lawmakers prioritized long-term affordability and protection for homeowners. A major legislative victory was California’s SB 1164, which codified the “blended assessment” method. This law prevents your primary home from being reassessed at its current, often much higher, market value when you add an ADU. Now, only the newly constructed ADU is assessed for property tax purposes. This policy provides a permanent, year-after-year saving that, for many, outweighs what a one-time tax credit could offer.

Federal Tax Credits for Energy-Efficient ADUs

While the state doesn’t offer a construction credit, the federal government provides significant incentives for making your ADU energy-efficient. These credits, revitalized and expanded by the Inflation Reduction Act of 2022, can substantially reduce your project costs. The most notable is the Residential Clean Energy Credit (IRS Form 5695).

If you install solar panels on your ADU, you can qualify for a federal tax credit of up to 30% of the total installation cost, with no dollar limit. For a $20,000 solar system, that translates to a $6,000 direct reduction in your federal tax bill. This credit also applies to battery storage systems with a capacity of 3 kWh or more.

Other energy-efficient upgrades may qualify for the Energy Efficient Home Improvement Credit. This credit covers 30% of the cost of certain improvements, up to a combined annual limit of $3,200. Qualifying upgrades include:

- High-efficiency windows and skylights (up to $600)

- Exterior doors (up to $500)

- Insulation and air sealing materials

- High-efficiency HVAC systems, heat pumps, and heat pump water heaters (up to $2,000)

An energy-efficient ADU not only provides an immediate tax benefit but also lowers long-term utility bills, increasing your profit margin if you rent it out or simply reducing your household’s overall energy footprint. For more on energy standards, see our guide on ADU building requirements.

Past and Future Financial Programs (Like the CalHFA Grant)

In the recent past, California offered a highly successful grant program that provided direct financial aid. The CalHFA ADU Grant Program provided up to $40,000 to reimburse low- and moderate-income homeowners for pre-development and non-recurring closing costs. These included architectural designs, permits, soil tests, impact fees, and property survey costs.

This program is currently inactive, as its funding was fully allocated as of late 2023. Its popularity demonstrated a clear need for such assistance. Given California’s ongoing housing crisis, it is plausible that state or local grant programs could be funded again in the future. Homeowners should proactively monitor the CalHFA website and sign up for newsletters from their local city and county housing departments. Sometimes, local jurisdictions launch their own ADU incentive programs, which can include grants, fee waivers, or low-interest loans. These grants, while not tax credits, offer direct financial aid that can substantially lower your out-of-pocket costs. Learn more about them on our Accessory Dwelling Unit Grant Program page.

Understanding Your Property Tax Bill After Building an ADU

A primary concern for homeowners considering an ADU is the impact on their property taxes. The good news is that while your taxes will increase, California’s Proposition 13 and a crucial “blended assessment” process ensure the impact is predictable and manageable.

When you complete an ADU, the County Assessor’s Office is notified via the building permits and will reassess your property. However—and this is the critical part—this reassessment only applies to the value of the new construction. Your ADU is assessed at its market value upon completion (which is typically based on the cost of construction), and this new value is simply added to your property’s existing assessed value. As a result, most homeowners see their annual property taxes increase by approximately 1% to 1.5% of the ADU’s construction cost. For a $200,000 ADU, that translates to a manageable increase of roughly $2,000 to $3,000 per year, or $167 to $250 per month.

How Blended Assessment Protects Your Primary Home’s Value

The blended assessment method is one of the most significant financial protections for California homeowners building ADUs. Thanks to state laws like SB 1164, only the new ADU is assessed at current market value. Your primary home’s assessed value remains protected under Proposition 13, which limits annual increases in assessed value to a maximum of 2%.

Let’s illustrate with an example. Imagine your home, which you bought years ago, has a current assessed value of $500,000. You build a new ADU for $250,000. The assessor will simply add the ADU’s value to your existing base value. Your new total assessed value becomes $750,000 ($500,000 + $250,000). The additional property tax is calculated only on the new $250,000 portion.

Without this protection, a full reassessment could be triggered. If your entire property is now worth $1.5 million on the open market, a full reassessment would reset your tax basis to that $1.5 million figure, potentially tripling or quadrupling your tax bill overnight. The blended assessment system prevents this catastrophic scenario and is a key reason why ADU construction is financially viable. For more details, see our guide on ADU Property Taxes.

Capital Gains Implications When You Sell

When you eventually sell your property, the cost of building the ADU provides a significant tax advantage by reducing your capital gains tax burden. The construction cost increases your property’s “tax basis,” which is the starting point for calculating profit.

For instance, if you bought your home for $500,000 and spent $250,000 building an ADU, your new adjusted tax basis is $750,000. If you later sell the property for $1,500,000, your taxable capital gain is $750,000 ($1,500,000 – $750,000), not $1,000,000.

Furthermore, if the property was your primary residence for at least two of the five years before the sale, the IRS allows you to exclude up to $250,000 (for single filers) or $500,000 (for married couples filing jointly) in capital gains. In the example above, a married couple’s $750,000 gain would be reduced to a taxable gain of just $250,000.

A critical note on rentals: If you rented out the ADU, the situation is more complex due to depreciation recapture. The depreciation deductions you claimed over the years will be “recaptured” at the time of sale, meaning they are taxed, typically at a maximum rate of 25%. This is a crucial detail to discuss with a tax professional. For general information, check out this guide from TurboTax.

Maximizing Tax Deductions with Your ADU

While a direct ADU tax credit California for construction remains unavailable, tax deductions offer a powerful and recurring financial tool to recoup your investment. If you utilize your ADU to generate rental income or as a dedicated home office for your business, you can write off a multitude of expenses, thereby reducing your overall taxable income and saving you thousands each year.

Deductions for ADU Rental Properties

Treating your ADU as a rental property transforms it into a small business in the eyes of the IRS, allowing you to deduct all ordinary and necessary expenses associated with its operation. These include:

- Mortgage Interest: A portion of your mortgage interest, prorated based on the ADU’s square footage relative to the total property.

- Property Taxes: The specific increase in your property taxes resulting from the ADU’s new assessment.

- Insurance: The portion of your homeowner’s insurance premium attributable to the ADU.

- Repairs and Maintenance: 100% of the costs for repairs and maintenance performed directly on the ADU (e.g., fixing a leaky faucet, repainting).

- Utilities: The cost of utilities (water, electricity, gas, internet) if you pay for them on behalf of the tenant.

- Professional Fees: Costs for property management, legal advice, or accounting services.

- Advertising: Expenses incurred to find and screen potential tenants.

The most significant deduction for many landlords is depreciation. The IRS allows you to deduct a portion of the ADU’s building cost (the structure’s value, not the land value) over a period of 27.5 years for residential rental properties. For a $275,000 ADU structure, this translates to a $10,000 deduction every year ($275,000 / 27.5). This is a non-cash “paper loss” that can substantially lower your taxable rental income. You’ll report this income and your expenses on Schedule E (Form 1040) and use Form 4562 for depreciation. Meticulous record-keeping is absolutely essential. Learn more about ADU Rental Income Taxes.

Deductions for an ADU Home Office

If you use your ADU exclusively and regularly as your principal place of business, it can qualify as a home office, unlocking another powerful set of deductions. The IRS’s “exclusive and regular use” test is strict—the space cannot be a hybrid guest room/office. It must be dedicated solely to your business operations.

There are two methods to claim this deduction:

- The Simplified Method: This is the easiest way. You can deduct $5 per square foot of the home office, up to a maximum of 300 square feet ($1,500 annual deduction). This is a straightforward calculation with minimal record-keeping.

- The Actual Expense Method: This method is more complex but can yield a larger deduction. You calculate the percentage of your home used for the business (e.g., a 500 sq ft ADU on a 2,500 sq ft property is 20%). You can then deduct that percentage of your home-related expenses, such as mortgage interest, insurance, utilities, and repairs. You can also claim depreciation on the business-use portion of the ADU, similar to a rental.

For added liability protection, many business owners operating from an ADU choose to form a Limited Liability Company (LLC). This legal structure creates a formal separation between your personal assets (like your primary home) and your business assets and debts, which is a prudent step for any serious enterprise. Consult a business attorney or CPA to determine if an LLC is the right choice for your situation.

Navigating the Financials: Fees, Documentation, and Professional Advice

The financial journey of building an ADU extends beyond the headline construction costs. You will also encounter a variety of fees, face rigorous documentation requirements, and need to make critical decisions that benefit from professional guidance. Strategic planning in these areas can help you navigate the landscape smoothly and maximize your savings.

Understanding and Minimizing ADU Impact Fees

Impact fees are charges levied by local governments to offset the increased demand on public infrastructure like sewers, schools, parks, and roads that new housing creates. Historically, these fees could be prohibitively expensive. Fortunately, California state law now provides significant relief for ADUs. The most important rule is that if your ADU is under 750 square feet, all impact fees are waived entirely. This was a landmark change designed to incentivize the creation of smaller, more affordable housing units.

For ADUs 750 square feet or larger, impact fees can be charged, but they must be proportional to the size of the ADU relative to the primary residence. Even with these limitations, permit fees, plan check fees, and other jurisdictional charges can still range from $5,000 to over $20,000. Each city has its own unique fee schedule, so it is imperative to check your local planning department’s website or speak with a staff member to get an accurate estimate for your area. For a detailed breakdown, see our guide on ADU Permit Cost California.

Essential Documentation for Claiming ADU Tax Benefits

Proper documentation is the bedrock of all tax benefits. Without it, you risk missing out on thousands of dollars in deductions or facing penalties during an IRS audit. From the moment you begin planning, you must keep meticulous records. Create a dedicated digital folder and a physical binder for all ADU-related paperwork.

Your documentation checklist should include:

- All Construction Costs: Every invoice and receipt for materials, labor, architectural plans, engineering, and permits. This data is not just for budgeting; it establishes your property’s tax basis, which is essential for calculating depreciation and capital gains.

- Permit and Closing Records: Keep the final, signed-off permit from your city, as this is the official proof of legal construction.

- Rental Business Records: If renting, maintain a detailed ledger of all rental income received and every expense paid (utilities, repairs, advertising, insurance, etc.). Use separate bank accounts for clarity.

- Tax Forms: Keep copies of all filed tax forms, especially Form 4562 (Depreciation and Amortization) and Schedule E (Supplemental Income and Loss).

- Energy Upgrade Invoices: If you are claiming federal energy credits, you need detailed invoices that specify the products installed and prove they meet the required efficiency standards.

Finding Reliable Professional Advice

Tax law is notoriously complex and constantly changing. Investing in professional advice is not an expense; it’s a crucial part of your project’s financial strategy.

- Tax Professionals (CPAs or Enrolled Agents): A qualified tax expert is your most valuable guide. They can help you structure your project for maximum tax advantage, navigate the complexities of depreciation and recapture, ensure you claim every available deduction and credit, and keep you compliant with IRS rules. Ask them specifically about setting up your books for a rental and the implications of depreciation on a future sale.

- Real Estate Attorneys: Invaluable for complex property matters, drafting compliant rental agreements, navigating landlord-tenant law, and establishing legal structures like an LLC to protect your personal assets.

- County Assessor’s Office: This is the definitive authority on how your property will be assessed. Their website often has detailed information, and you can call them to understand the blended assessment process for your specific property.

- Experienced ADU Builders/Consultants: While not tax advisors, reputable builders who specialize in ADUs have immense practical knowledge of local regulations, permit costs, fee structures, and the overall construction process. Learn more in our guide to ADU Building Requirements.

Frequently Asked Questions about the ADU Tax Credit California

Here are clear, straightforward answers to the most common questions homeowners have about the ADU tax credit California and the broader financial implications of building a second unit.

Is building an ADU tax deductible in California?

The cost of building an ADU is not directly deductible in the year of construction. It is considered a capital improvement, not an expense. However, the construction costs are added to your property’s tax basis. This is incredibly valuable for two reasons: 1) It reduces your taxable capital gains when you eventually sell the property, and 2) It forms the basis for annual depreciation deductions if you use the ADU as a rental property.

If you use the ADU as a rental property or a dedicated home office, you can deduct many ongoing operational expenses. For rentals, this includes a portion of your mortgage interest, property taxes, insurance, all direct repairs, and depreciation over 27.5 years (reported on Schedule E). For a qualifying home office, you can deduct a portion of home expenses based on its square footage. Additionally, specific energy-efficient upgrades like solar panels may qualify for a separate federal tax credit. For more details, read our guide on ADU Rental Income Taxes.

How much does an ADU increase property taxes in California?

Your property taxes will increase, but only based on the value of the new ADU, not your entire property. Thanks to California’s blended assessment system, your primary home’s existing assessed value is protected by Proposition 13 and is not reassessed. The annual tax increase is typically 1% to 1.5% of the ADU’s construction cost. The rate is composed of the 1% statewide base rate plus any local voter-approved bonds or special assessments. For example, a $300,000 ADU would add approximately $3,000 to $4,500 to your annual property tax bill. This predictable system prevents the sudden, massive tax hikes that would otherwise make ADUs unaffordable for many. Learn more on our ADU Property Taxes page.

Will California pay you to build an ADU?

No, the state of California does not have a program that directly pays homeowners to build ADUs. However, the state has funded grant programs in the past to help with costs. The most notable was the CalHFA ADU Grant Program, which offered up to $40,000 to reimburse homeowners for pre-development costs like permits and design fees.

This program is currently inactive, as its funds were fully depleted in late 2023. Given its success and the state’s housing goals, it’s possible that this or similar programs may be funded in the future. We strongly recommend checking your city and county websites for any local incentives. Some jurisdictions offer their own grants, low-interest loan programs, fee waivers, or provide pre-approved ADU plans to reduce design costs. Explore potential options on our ADU Funding & Grants page.

What are the tax implications if a family member lives in my ADU?

This is a common scenario with important tax consequences. The key factor is whether your family member pays fair market rent.

- If they pay fair market rent: You can treat the ADU as a standard rental property. You must report the rental income, but you are also entitled to deduct all associated expenses, including depreciation, repairs, insurance, and a portion of your property taxes and mortgage interest.

- If they live there rent-free or pay below-market rent: The IRS considers this “personal use.” You cannot claim rental losses or deduct rental expenses beyond the amount of rental income you receive. You also cannot claim a depreciation deduction. The ADU is essentially treated like an extension of your personal residence for tax purposes.

Conclusion: A Strategic Investment Beyond a Simple Credit

While the initial search for a direct ADU tax credit California leads to a simple answer—no, a statewide credit for construction doesn’t exist—the complete financial picture is far more encouraging and strategically advantageous. The absence of a single credit is more than compensated for by a suite of powerful, long-term financial benefits that make building an ADU one of the smartest investments a California homeowner can make.

The state’s blended assessment approach is a cornerstone of this strategy, protecting your primary home’s value from reassessment and limiting property tax increases to a manageable 1-1.5% of the ADU’s construction cost. This single policy saves homeowners thousands of dollars every year. If you choose to rent out your ADU or use it as a home office, you unlock a powerful engine for wealth creation through significant tax deductions for expenses and depreciation, which can dramatically lower your taxable income.

Furthermore, federal tax credits provide a direct, dollar-for-dollar reduction in your tax bill, reimbursing up to 30% of the cost of solar panels and offering thousands more for other energy-efficient upgrades. This not only lowers your upfront cost but also reduces your utility bills for years to come.

Building an ADU is a strategic financial move that works for you on multiple fronts. It can significantly increase your property value, generate a steady stream of rental income, reduce your annual income tax liability, and ultimately lower your capital gains tax burden when you decide to sell. It is a versatile tool that provides flexibility for your family, generates wealth, and contributes a much-needed housing unit to your community.

At ADU Marketing Pros, we specialize in helping ADU construction and architecture firms communicate these complex financial benefits to their clients. We understand that showcasing this expertise is critical when homeowners are making major investment decisions.

Before you break ground, we strongly recommend assembling a team of experts. Consult with tax professionals and experienced ADU builders to create a comprehensive financial plan that maximizes every available benefit and helps you avoid costly errors. The financial landscape is nuanced, but with the right professional guides, the path to a successful and profitable ADU project is clear.

Ready to explore every incentive California offers? We’ve put together a comprehensive resource to help you get the most out of your investment. Explore all California ADU incentives.